[1] Pictet Asset Management, CEIC and Refinitiv

[2] Excluding Russia and Ukraine

[3] US 5-year real yield stands at 1.39 per cent, data as of 18.01.2012. Source: Pictet Asset Management, Bloomberg

[4] https://am.pictet/en/uk/global-articles/2022/pictet-asset-management/secular-outlook#overview

[5] OECD Trade in Value Added database, in 2015 final demand as a share of world value added

Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Why China's re-opening could be a blessing for emerging market bonds

The re-opening of the world's second largest economy shouldn't concern those worried about inflation.

The sudden re-opening of China's economy has caused fresh uncertainty among fixed income investors already worried about inflation and interest rate hikes.

But the country's unexpectedly rapid loosening of Covid restrictions will provide much-needed growth for the world economy. Its effect on global inflation is likely to be muted.

The upshot is that this should create a benign climate for fixed income markets, particularly emerging market bonds.

China Reopening: The Impact on Fixed Income

With China's re-opening, find out what will be the impact on fixed income from Mickael Benhaim, Head of Fixed Income Investment Strategy & Solutions at Pictet Asset Management

Source: Pictet Asset Management

Emerging markets: the beneficiaries

China’s return to the global economic stage is a momentous event. The world’s second largest economy is a significant source of output, consumption of goods, services and natural resources as well as liquidity.

As such, its recovery will flow through to the rest of the world via trade, tourism and commodities. And, significantly, it will be other emerging market economies, rather than the developed world, that will receive the biggest boost.

Take imports. Chinese demand for goods made overseas is certain to surge as consumers loosen their purse strings after having spent nearly three years buying only food and other staples.

The scale of pent-up demand is considerable. Our analysis shows household excess savings – disposable income minus consumption – reached RMB5 trillion, more than twice the 2014 levels and equivalent of 4 per cent of GDP. According to our research, much of that spending will flow to other emerging nations – such as Singapore, Thailand and Chile.

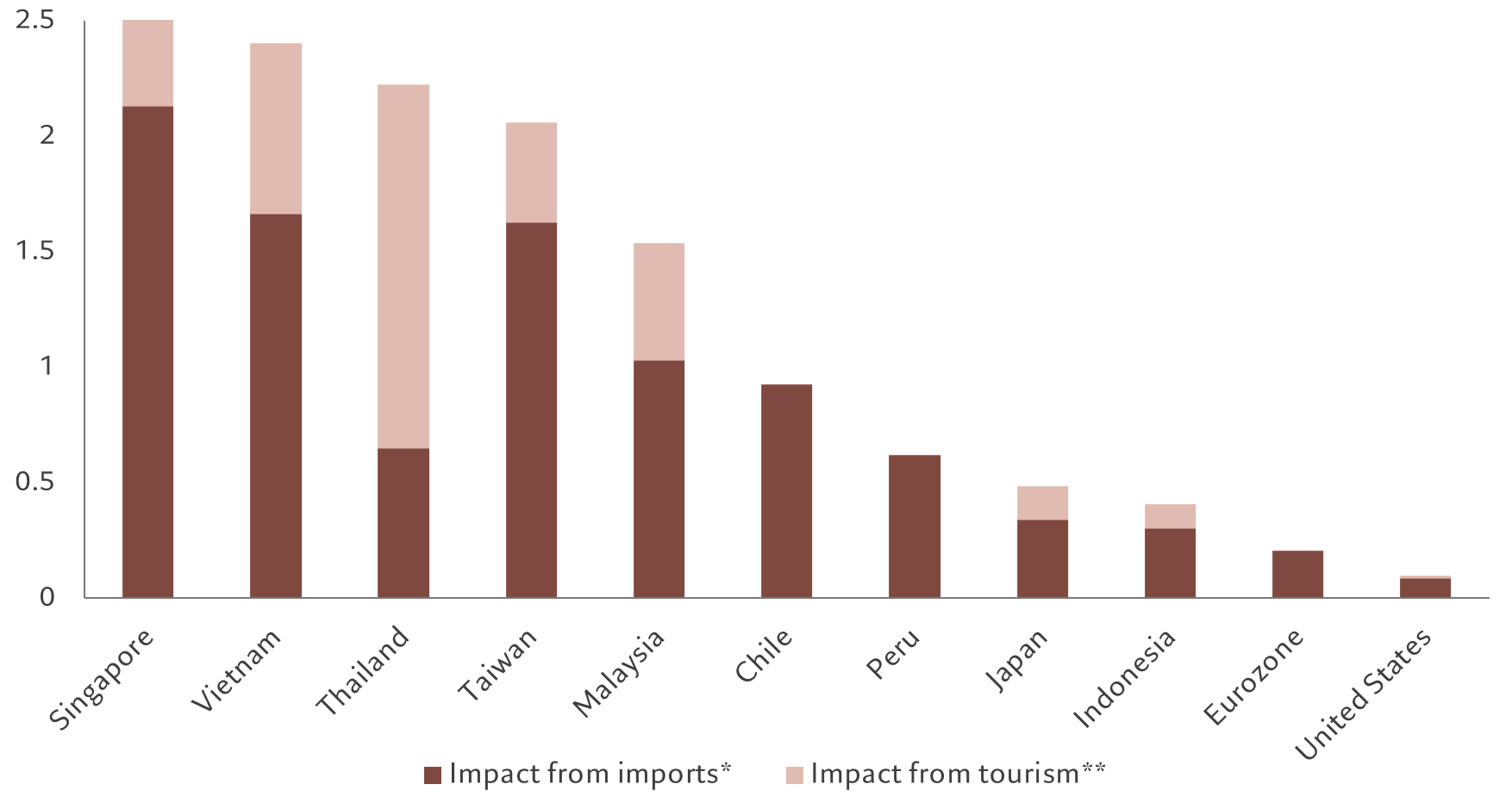

Fig. 1 - Growth boost

Re-opening impact on GDP growth (%) from rising Chinese imports* and tourism**

* Change in GDP growth from a 10 per cent increase in Chinese imports ** Change in GDP growth from a rise in tourism revenues from China, assuming tourism activity returns to half the 2019 level. Source: Pictet Asset Management, CEIC and Refinitiv. Data as of 31.01.2023

A pick-up in Chinese tourism should provide an additional economic boost to the emerging world. Thailand, for instance, expects as many as 5 million tourists from China this year and consumer spending to hit a three-year high.

Commodity exporters, especially those in Latin America, should also benefit from higher Chinese demand for their natural resources.

The developing world was already enjoying superior growth premium over their advanced peers. China’s reopening will simply widen this growth gap further.

Taking all this into account, we expect emerging economies to grow over 4 per cent this year, outpacing developed peers, which will expand by just 0.5 per cent.1

Stars aligned for emerging market bonds

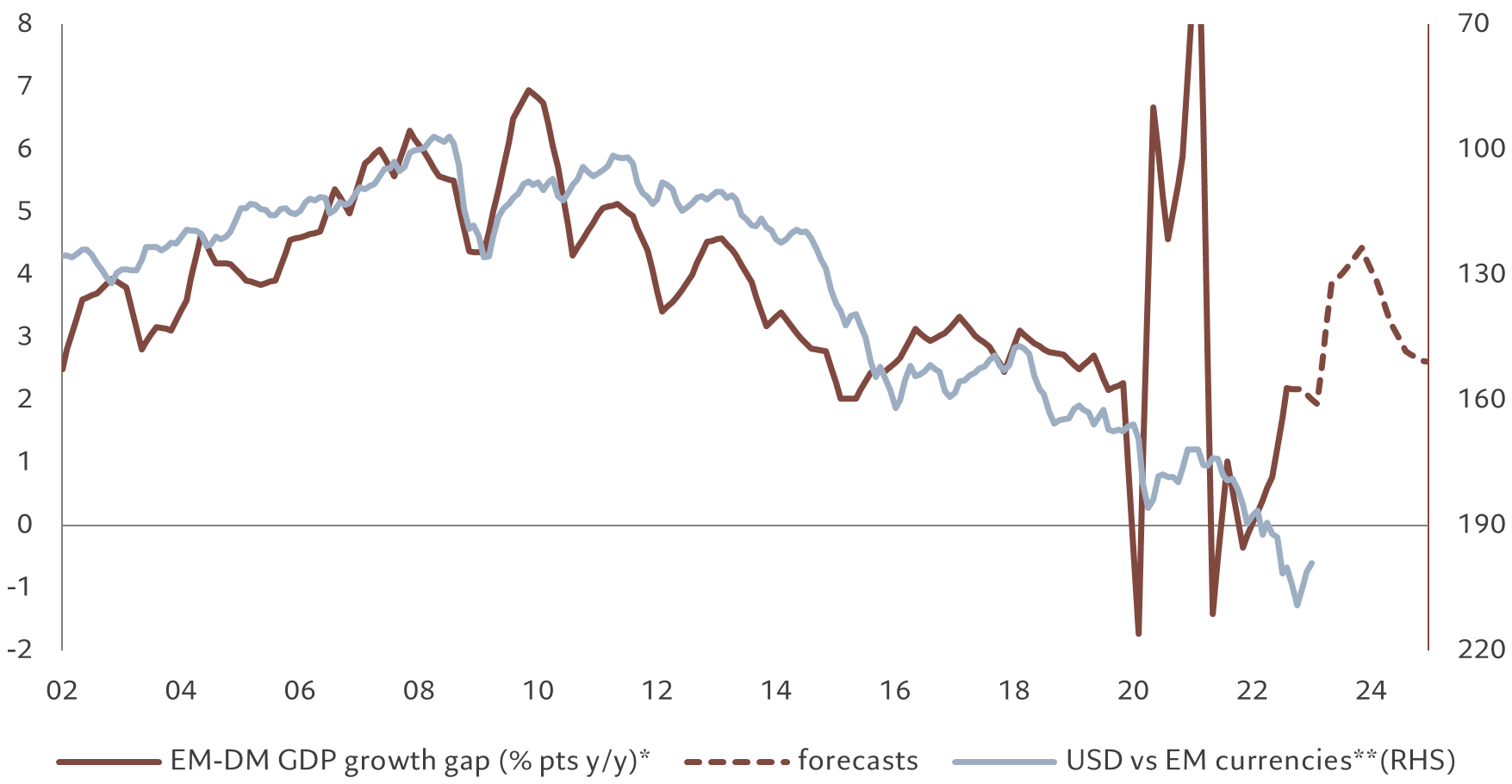

This should translate into gains for emerging market currencies. As Fig. 2 shows, emerging market currencies tend to appreciate whenever the developing world's growth gap with advanced economies expands.

According to our model, emerging market currencies could appreciate by as much as 20 per cent against the US dollar. That, in turn, should provide a considerable source of return for emerging market local currency debt.

Fig. 2 - Superior growth in emerging world

Growth gap and currency performance have strong correlation

The asset class was in any case cheap relative to its fundamentals.

Many emerging markets – especially in Asia and Latin America – already offer real yields on their local debt which are well above their five-year average and also higher than those in the US.2

Looking ahead, we expect emerging market sovereign and corporate bonds to be among the best performing fixed income asset classes in the next five years, with both local currency and dollar-based debt forecast to gain at least 7 per cent a year. We expect emerging corporate bonds to return 5.2 per cent.3

International spillovers

But China’s re-opening isn’t free of risks.

Some investors fear its economic revival threatens to place a strain on already stretched global supply chains, pushing commodity prices higher and stoking inflation. This would then force central banks worldwide to tighten the monetary reins still further, risking a spike in developed market bond yields in a repeat of 2022 when US and European economies emerged from the lockdown.

The scenario is certainly plausible. China has already surpassed the US as the biggest consumer of energy and non-energy goods on a final demand basis.4 Indeed, commodity prices such as copper and iron ore have risen 20-40 per cent over the past three months.

But we don’t believe a pick-up in Chinese demand would radically change global inflation dynamics.

To begin with, much of the world economy is in a fragile state today. Many countries in the developed world are currently flirting with recession.

What is more, it is wrong to assume China’s re-opening will play out in the same way as those of Europe and the US, when they removed Covid restrictions in early 2022. Then, wage inflation took hold primarily because of unusually tight labour markets.

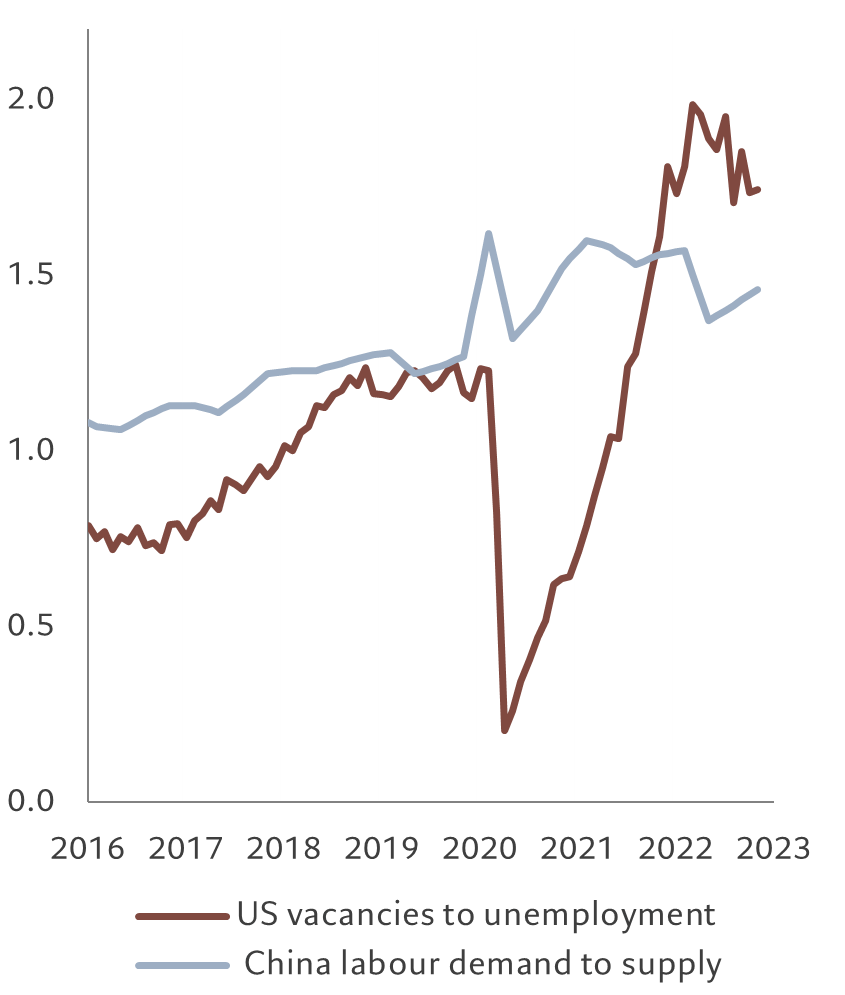

At the time of the US’s re-opening, for example, the number of job vacancies to the number of people unemployed had hit a record high of 2 to 1. So what began as higher prices for services quickly broadened out to all corners of the economy, triggering a wage-price spiral. Europe experienced similar problems. Yet China’s employment market shows no such strains. It is far from excessively tight, with the job openings to unemployment ratio holding steady at around 1.5. This suggests it is unlikely to transmit price pressures to the rest of the world.Figure 3 - Wanted: more staff

US jobs demand outstripped supply in 2022

This, in turn, means China’s impact on global inflation is not powerful enough to trigger aggressive tightening from major central banks. Instead, they will soon reach the end of their rate hike campaigns. We expect the Fed to pause its rate hikes at around the 5 per cent mark.

Markets are already beginning to price in US interest rate cuts of as much as 171 basis points over the next three years, the most aggressive easing cycle ever seen while still hiking.

This should come as a relief to developed market bonds. We should expect no major sell-offs (which the asset class experienced last year), with yields likely to hover within narrow ranges.

China’s abrupt opening is bound to cause upheaval throughout the world economy. But the benefits of its return to the global stage will outweigh the risks, boosting the prospects of emerging debt without destabilising fixed income markets in the developed world.

More on fixed income

Bonds beckon

Real yields have surged across all classes of fixed income. This is creating opportunities for investors not seen for many years.

November 2022

First steps back into credit

As renaissance dawns for the fixed income market, short-dated investment grade bonds offer a good re-entry point into credit.

January 2023

Peak intensity: decarbonising EM corporate bond portfolios

Emerging market economies are becoming less carbon intensive. This should help investors align their corporate bond portfolios with sustainable goals.

December 2022

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.