While Covid-19 exposed the fragility of globalisation, a polycrisis of climate change, rising geopolitical tensions and war on Europe’s eastern flank has increased the pressure on companies to build more agile and resilient supply chains.

But shifting elements of production into new geographies, or reshoring operations entirely, can add to the cost and complexity of meeting consumer demands. Fortunately, technology offers a solution.

Planning and procurement

When companies shift elements of a supply chain into new geographies by building a new factory or switching material suppliers, they risk baking inefficiencies into the process by viewing the project in isolation. Advanced digital modelling can mitigate this by providing risk managers with a holistic view of the developing chain.

However, the calculation becomes exponentially more complex when attempting to determine the most efficient way of organising a system made up of millions of micro-operations. Artificial intelligence is helping to solve – or at least simplify – these equations. Task or process “mining”, as the field is known, generated USD1 billion in sales in 2022, according to Gartner. It uses powerful AI to sift through a company’s “log files”, or computational records of each interaction across a supply chain, and then converts them into actionable insights that can determine better solutions. For executives deciding whether to shift operations to a new location, process mining can help calculate dynamic risks such as changing climate conditions or the threat of political disruption.

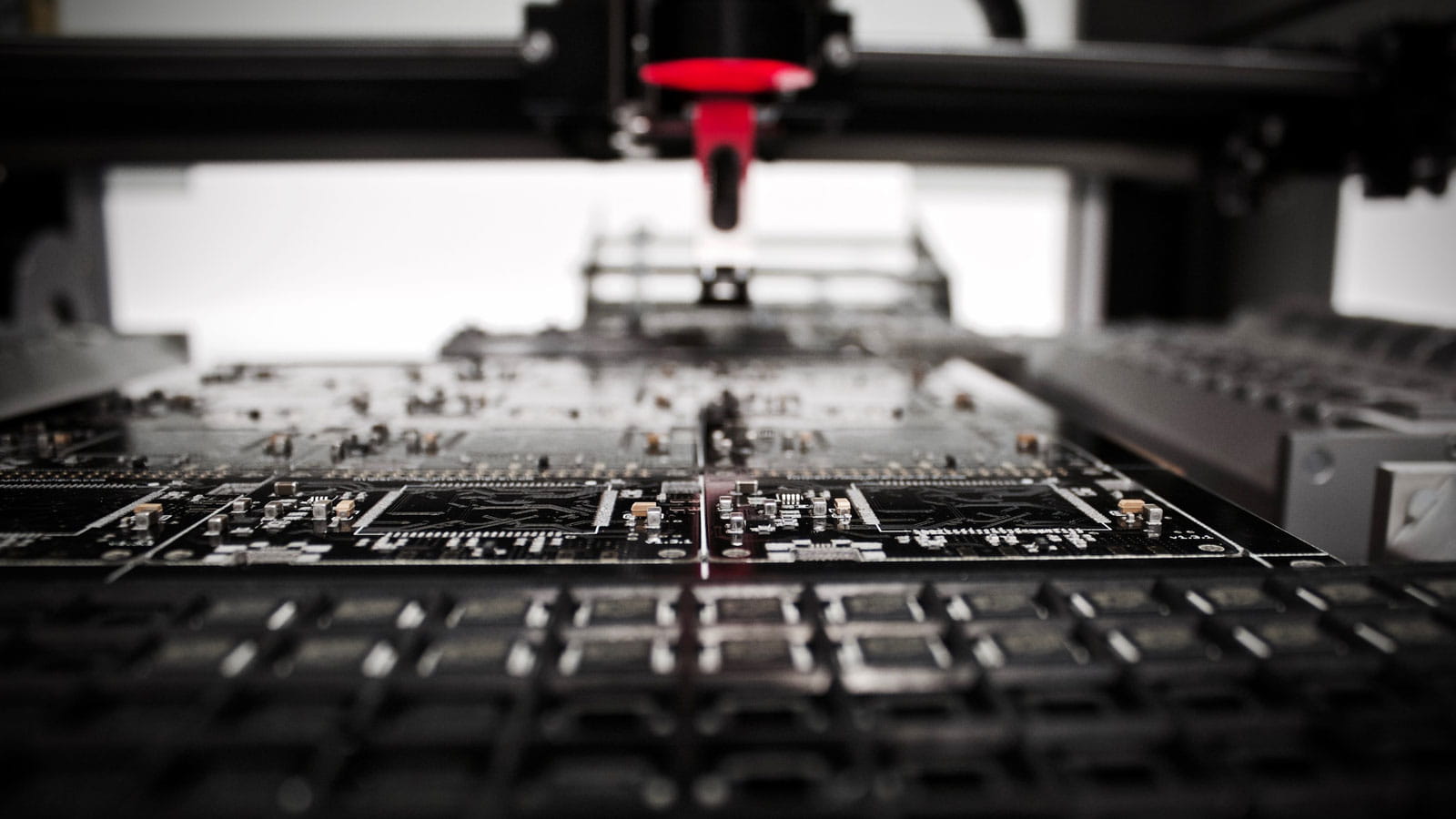

Manufacturing and making

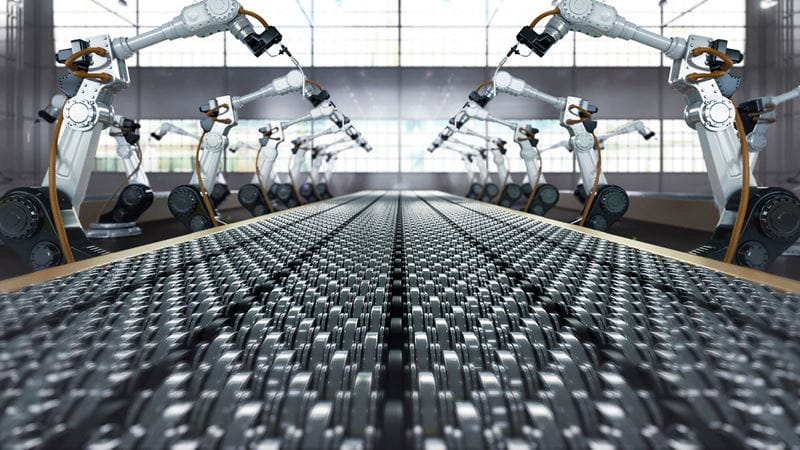

De-risking supply chains often requires shifting operations into high-wage countries. But the growing sophistication of technology can offset these costs. The application of new machine-learning models allows robots to memorise the pattern in which a human operator guides their arms and repeat it to pick up objects or hold components in place. These new skills have earned robots a promotion from the factory floor, with companies using them further down the supply chain in the inspection of products or recycling of materials.

Ironically, the biggest barrier to robot adoption is the lack of humans who know how to operate them, explains Jeff Burnstein, Head of the Association for Advancing Automation. “These machines need people to design them, install them and programme them,” he says. As robot adoption accelerates, companies will replace partners who provide cheap labour with firms that specialise in particular areas of automation, programming and maintenance, he adds.

Automated assembling

A resilient supply chain will never rely on a single partner, but even one with multiple suppliers can be derailed by a pandemic. To mitigate against global events, some of the world’s biggest companies are using 3D printing to shift manufacturing closer to the end consumer. This not only reduces the costs of shipping and storage but also allows companies to react to consumer demand rather than manufacture based on forecasts.

3D printing is still in its infancy, despite growing 18 per cent in 2022, according to Wohlers Associates. Machines remain slower and more expensive than human manufacturing, while concerns persist that companies could become dependent on material suppliers. Yet, as the technology improves, 3D printers will allow companies to shift from mass production to mass personalisation, as well as reducing risk and cost across supply chains.

Customer connections

The successful automation of manufacturing presents questions about how companies can take technology further. Autonomous mobile robots (AMRs) are already zipping around warehouses organising products into groups based on their destinations or delivery times, and now companies are setting their bots to work outside the warehouse.

In April, one AMR startup announced that its bots had completed more than 6 million miles of deliveries while, in Korea, another firm announced plans to integrate cameras and image recognition AI to create “self-driving patrol robots”. As automated shuttle buses and minivans take to the streets, the AMR industry is expected to grow to be worth around USD18 billion by 2040, according to the consultancy.

“AMRs are like self-driving cars, but for unstructured environments,” explains Amit Goel, Director of Product Management for Autonomous Machines at NVIDIA. “They don’t need fixed, pre-programmed tracks and are capable of avoiding obstacles, which makes them ideal for applications in hospitality, cleaning, roaming security and last-mile delivery.”

Faster, better, stronger

As companies accelerate the rewiring of global supply chains, new technologies provide them with ways to build more resilient systems. “Soft” technologies such as AI and digital can identify inefficiencies and forecast consumer demand with greater accuracy, while “hard” technologies such as robotics and 3D printing allow companies to concentrate manufacturing close to the end user, reducing the risk of delays and disruption.

The new generation of supply-chain design is intended to mitigate risk, first and foremost, but it will also lead to innovation in business models.

Look at the change in the elevator industry, for example. The business model used to be selling elevators at the cost of production and then making your money from long and lucrative maintenance contracts. But now, new entrants to the market are undercutting the incumbent business model by using sensors and proprietary software to pre-empt faults and get them fixed. This is the type of incremental automation that reinvents supply chains and transforms industries.

This article was produced by the Financial Times. It originally appeared on: https://pictet.ft.com/how-de-risking-the-supply-chain-could-drive-industries-to-innovate

Investment Insights

- by Anjali Bastianpillai, Senior Client Portfolio Manager, Thematic Equities, Pictet Asset Management

- Supply bottlenecks during the Covid pandemic highlighted the dangers of relying on far away countries for manufacturing. Geopolitical tensions have added more pressure on global supply chains. As a result, governments and companies are increasingly looking to shift production to their home territories or at least nearby. We believe this should fuel demand for industrial robots to staff these new factories as well as other automation equipment and software solutions.

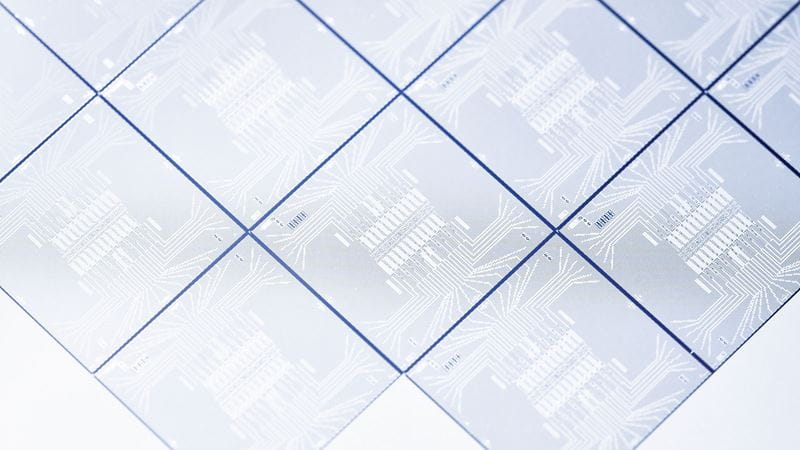

- The managers of Pictet Asset Management’s robotics strategy see re-shoring/near-shoring, artificial intelligence and automation as three of the key themes for the coming years. Indeed, this is already starting to play out. Some 41 per cent of US manufacturers are looking to increase automation, according to a recent survey by ABB Robotics. At the same time, building onshore semiconductor factories is a major focus of Washington’s USD550 billion federal infrastructure spending package, and similar incentives have been approved across several nations and economic unions. Efficient software are also essential for enhancing processes, increasing productivity, and optimising resource utilization.

- One area where we see opportunities is cobots – machines that are designed to work alongside humans. According to some estimates, the global cobot market could reach USD6.8 billion in 2029 from just USD1.2 billion in 2022, which equates to a compound annual growth rate (CAGR) of some 34 per cent. To support the automation, we also expect growth in sectors such as industrial software and semiconductors.