Asset allocation: window of optimism

For once, it has been quite a positive start to the new year – at least as far as the world economy is concerned. Slowing inflation appears to justify a pivot in monetary policy towards interest rate cuts, while growth has been resilient enough to suggest that the economy can avoid a hard landing.

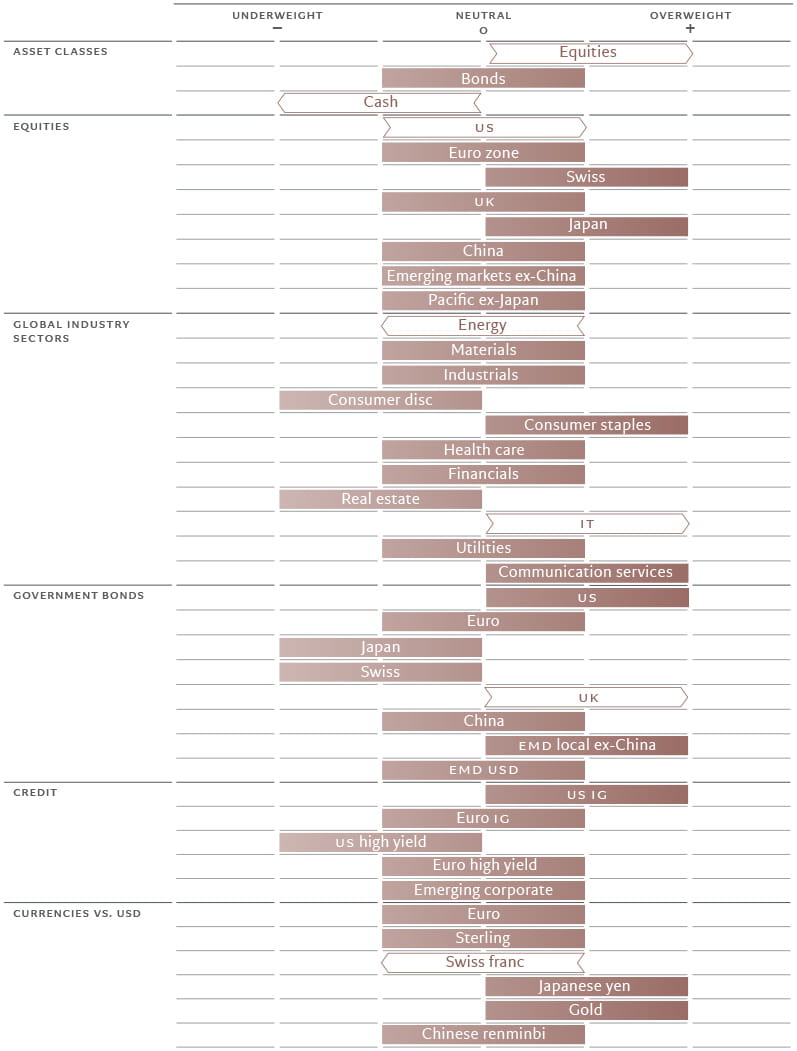

As long as this Goldilocks scenario holds, riskier assets should benefit. Therefore, we upgrade global equities to overweight, balancing this with an underweight in cash. As interest rate cuts start to come through, holding money in cash or equivalents will become increasingly unattractive. Our stance on bonds, meanwhile, remains neutral.

We view this allocation shift as a short-term move. Much like Goldilocks’s porridge won’t stay the perfect temperature for ever, we believe the global economy will eventually start to cool and bonds will regain the upper hand over equities.

Indeed, our global leading indicator of business activity points to a likely slowdown going into the second half of the year. We expect growth in developed economies to total just 0.9 per cent for 2024 – roughly half the pace of the previous year.

Japan remains the only developed market with a positive score in our macro-economic model, with strong wage growth and potential rebound in global trade providing strong tailwinds.

The US economy is also holding up relatively well so far, which should boost its equity market in the near term. But survey data is increasingly gloomy, and we expect dynamics in the consumer sector and non-residential investment to deteriorate soon, prompting the US Federal Reserve to cut rates.

Growth in the euro zone, meanwhile, will likely be anaemic, albeit stable.

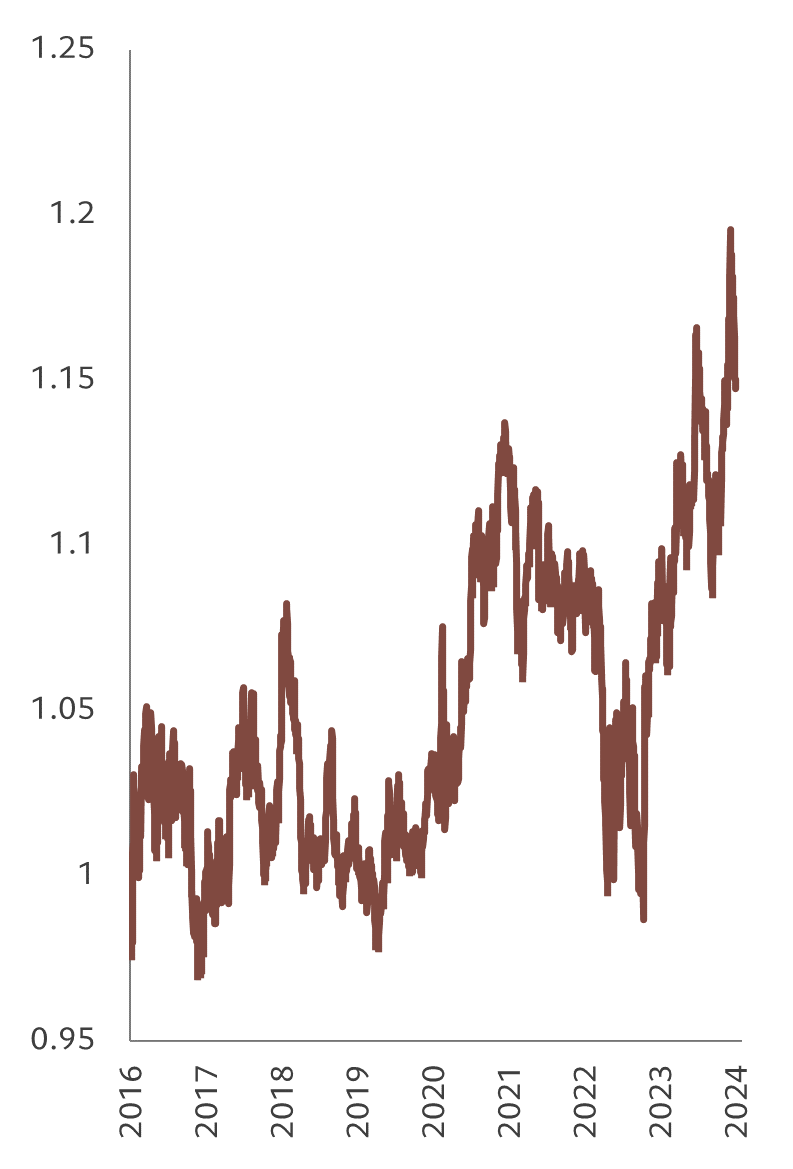

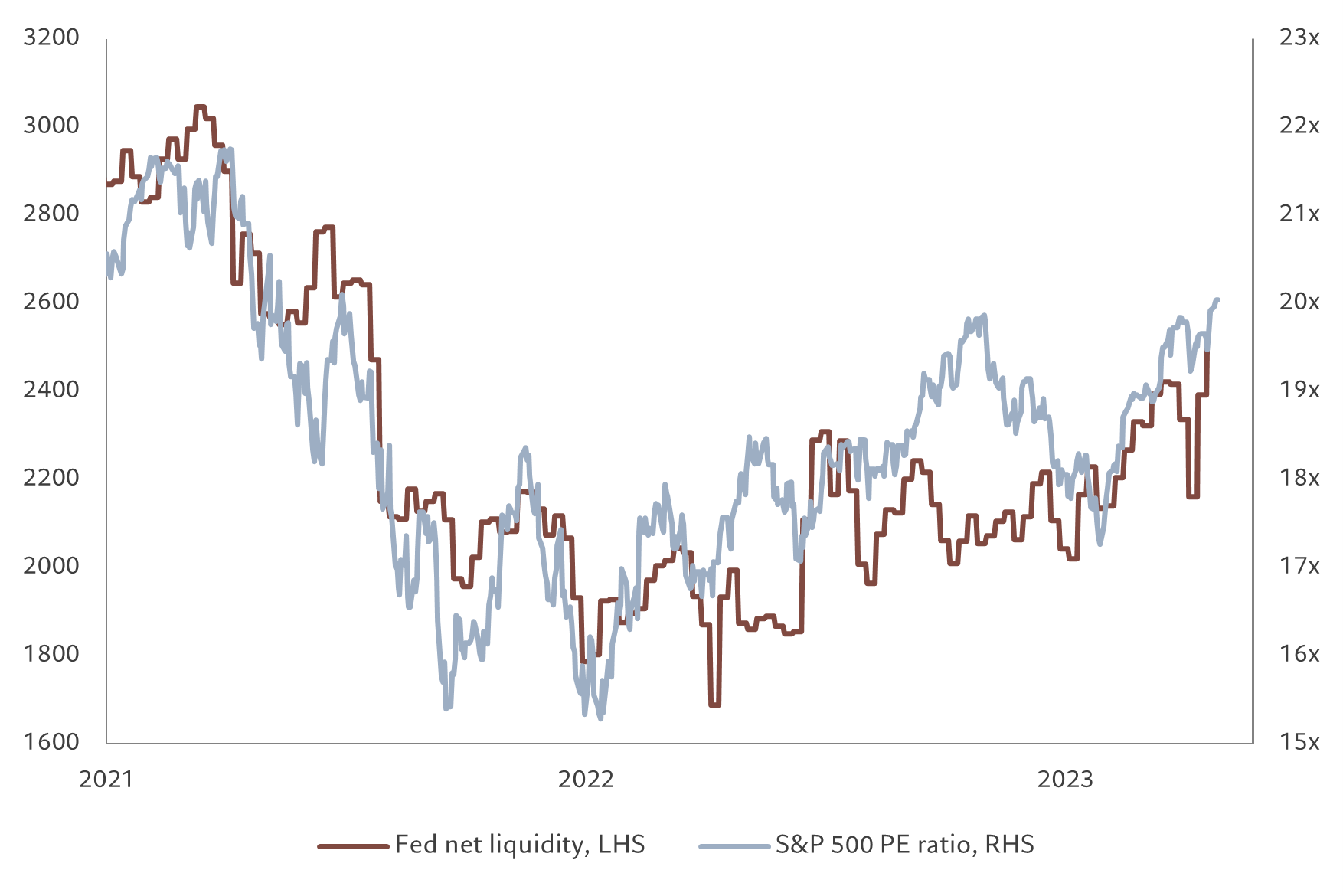

Our liquidity indicators show conditions will remain supportive for stocks, and US equities in particular, till the end of the first quarter. The Fed’s quantitative tightening programme has failed to make a dent, as it has been more than offset by financial institutions withdrawing their surplus cash parked with the central bank (see Fig. 2). This has helped risky assets outperform cash, restoring a degree of the ‘policy put’. Our analysis suggests that the increase in net liquidity – the additional amount of money the central bank provides the economy for investment and spending –is consistent with the S&P 500 grinding higher towards the 5,000 mark.

The situation is likely to change once the US Treasury shifts issuance to longer-dated bonds rather than T-bills, which we expect to occur the second quarter of 2024. This will result in a significant slowdown in the reduction of the Fed's reverse repo facility , a net drain of the liquidity in the financial system and a likely increase in risk premia.

Fed net liquidity refers to the central bank's injections or withdrawals of funds from the financial system. Source: Refinitiv DataStream, Pictet Asset Management. Data covering period 13.12.2019-23.01.2024.

At that point, the stretched equity valuations will likely start to look unsustainable. US stocks appear expensive trading on 20 times their 12-month forward earnings – a level rarely sustained outside of the dotcom bubble. Improved earnings prospects offer some comfort, especially in the tech sector (and consequently for US), but the upside is limited given the lofty expectations that are priced in - consensus earnings per share growth for the US market is above 10 per cent against our forecasts of 4 per cent.

Our tactical preference for equities is also underpinned by positive technical signals, especially strong trends in US and Japan. Sentiment indicators have normalised from euphoria territory, while investor positioning shows a balance between call and put options, or between investors betting on a market rally versus those bracing for a rout.