The 5 lessons investors should learn from 2023

Betting against the US economy was a mistake, while hopes for China's revival proved overly optimistic. Chief strategist Luca Paolini runs the rule over a tumultuous year.

1. Growth is more important than rates for equities

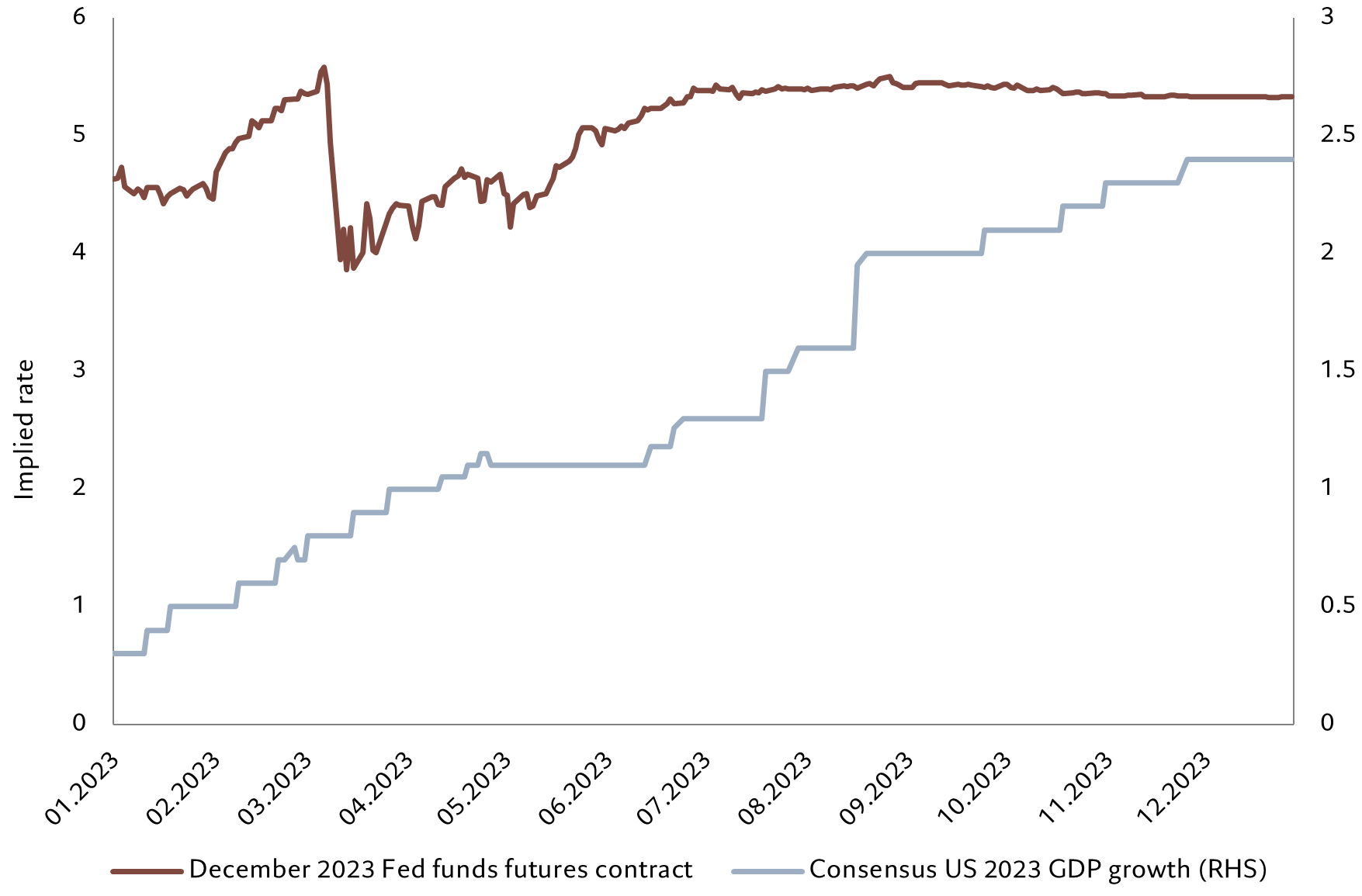

The idea that the US Federal Reserve's monetary policy is the single most important influence on equity markets has been conventional wisdom since the financial crisis of 2008. But while stocks remain sensitive to changes in market-derived interest rate expectations, the equity market rally of 2023 can’t be attributed to a dovish Fed. An important factor was stronger-than-expected US economic growth.

Recall that the Fed ended up hiking four times - or 100 basis points - last year. That was a much more hawkish outcome than the consensus forecast at the beginning of the year, which pointed to just two hikes followed by two interest rate cuts late in 2023. Why did it hike so aggressively? It was a response to a much stronger economic performance from the US. US GDP growth for the year is on track to come in at 2.4 per cent compared to the 0.3 per cent gain economists were expecting 12 months ago.

On an annual basis, the US economic surprise index has been the highest in two decades, excluding the immediate aftermath of Covid-19. Of course, the decline in inflation was a boost to equities too, but that fall turned out to be less pronounced than what was envisaged a year ago. Be in no doubt, it was the unexpected resilience of the US economy that ultimately made risk assets shine in 2023.

Source: Refinitiv, Bloomberg, Pictet Asset Management. Data covering period 03.01.2023 - 29.12.2023.

2. Inflation was indeed 'transitory' – but it's too early for a victory lap

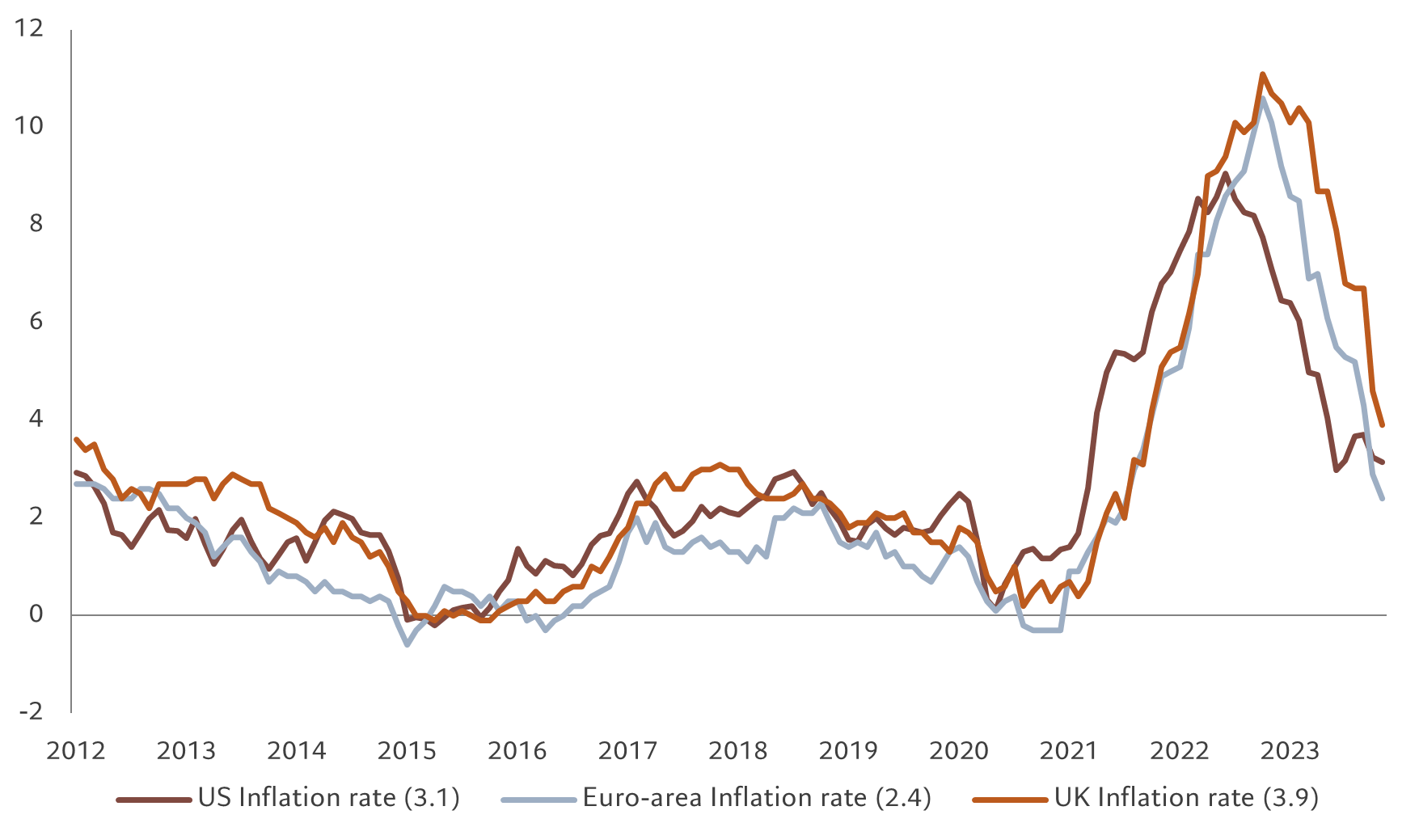

Inflation in developed economies peaked in 2022 at around 10 per cent or just slightly above, as the post-Covid surge in consumer spending coincided with supply bottlenecks in many industries.

The consensus at the beginning of 2023 was for inflation to remain higher for much longer, with central banks at the time derided for characterising inflation as “transitory”.

As it turned out, 2023 was the year that central banks re-established their anti-inflation credentials. By hiking rates further, they were rewarded with a rapid decline in inflation.

Inflation in developed economies is now declining at the same - or in some cases, faster - rate than it was rising in 2021-2022, with price inflation for goods basically flat. In the US, headline and core inflation is approaching 3 per cent year-on-year while in Europe both measures are decelerating even more steeply.

But we are not out of the woods yet. Inflation rates remain above central banks’ targets, service inflation is stickier than expected, transportation costs are on the rise and price expectations by businesses have stopped falling. And our models suggest the disinflation trend will pause or stop in the coming months.

In other words: watch this space. Inflation could yet spoil the party.

Source: Refinitiv, Pictet Asset Management. Data covering period 15.01.2012 – 15.11.2023.

3. China’s problems are secular not cyclical but there are still some bright spots

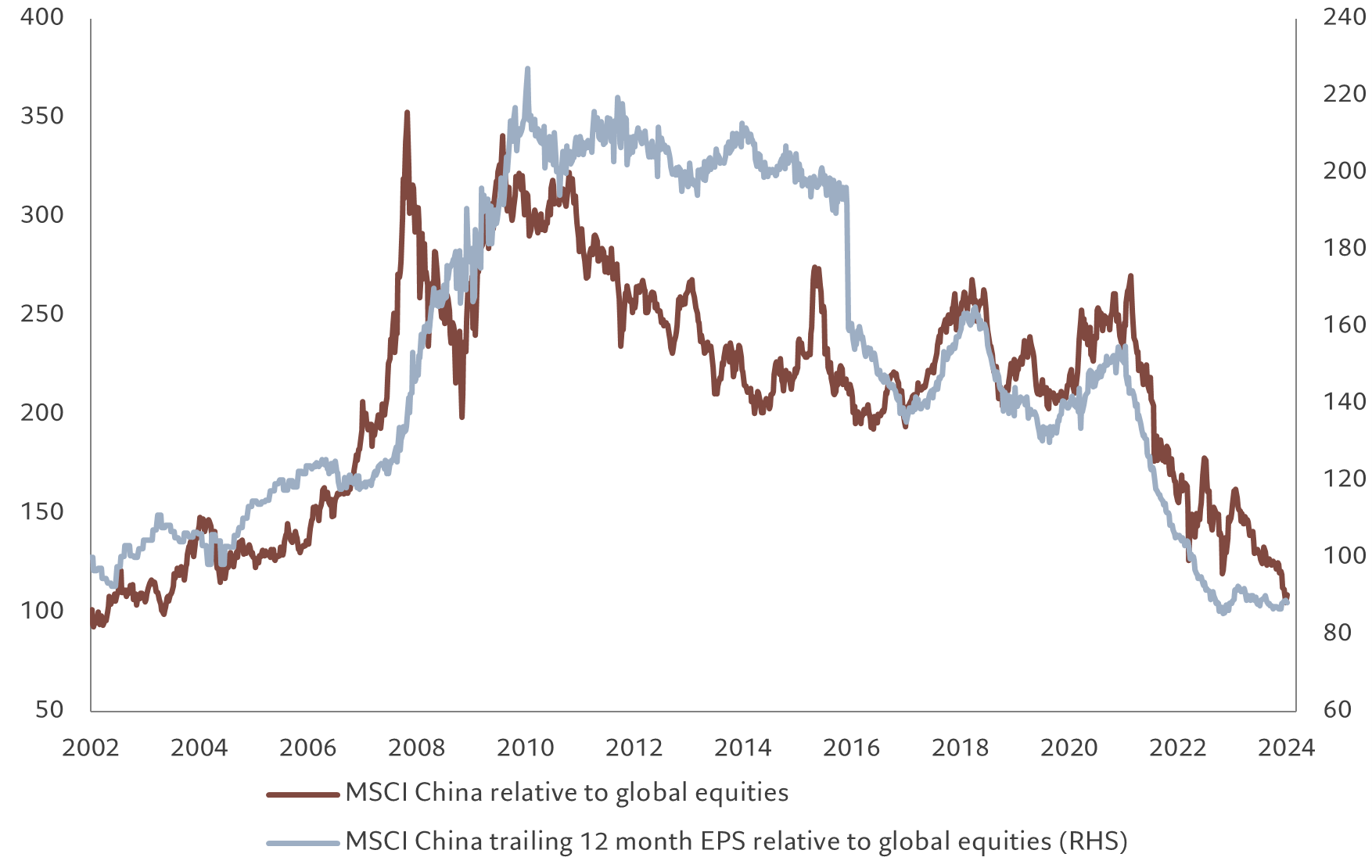

China’s post-Covid economic recovery has been underwhelming: real GDP growth for 2023 has been only around 5 per cent.

Investors in Chinese stocks have suffered accordingly. China's equities were down 11 per cent last year, trailing the MSCI World Index by 33 percentage points.

Since hitting a peak against world stocks in February 2021, Chinese equities are down a cumulative 60 per cent in US dollar terms relative to the MSCI World Index and are back at the same levels as in 2002, when China had just joined the World Trade Organisation.

Bears have strong arguments to make.

The Chinese economy suffers from a mild version of debt deflation triggered by the collapse of its property sector and the lack of an appropriate monetary and fiscal response. An erratic regulatory policy in key industries adds to the economic gloom. The International Monetary Fund forecasts that China’s annual GDP growth will gradually decline to about 3.5 percent by 2028 due to weak productivity and an ageing population.

However, there are some bright spots, not least China's technology and auto industries.

Chinese communications giant Huawei recent released a surprisingly sophisticated smartphone. Particularly impressive is that the new handset features Chinese-made components and is powered by an advanced semiconductor reportedly made by Shanghai’s Semiconductor Manufacturing International Corp. That's no small feat for a company that remains subject to crippling US sanctions.

Meanwhile China’s BYD has just overtaken US rival Tesla to become the world’s top seller of electric-vehicles. The lesson for investors. Do not write China off.

Source: Refinitiv, Pictet Asset Management. Data covering period 01.01.2002 – 02.01.2024.

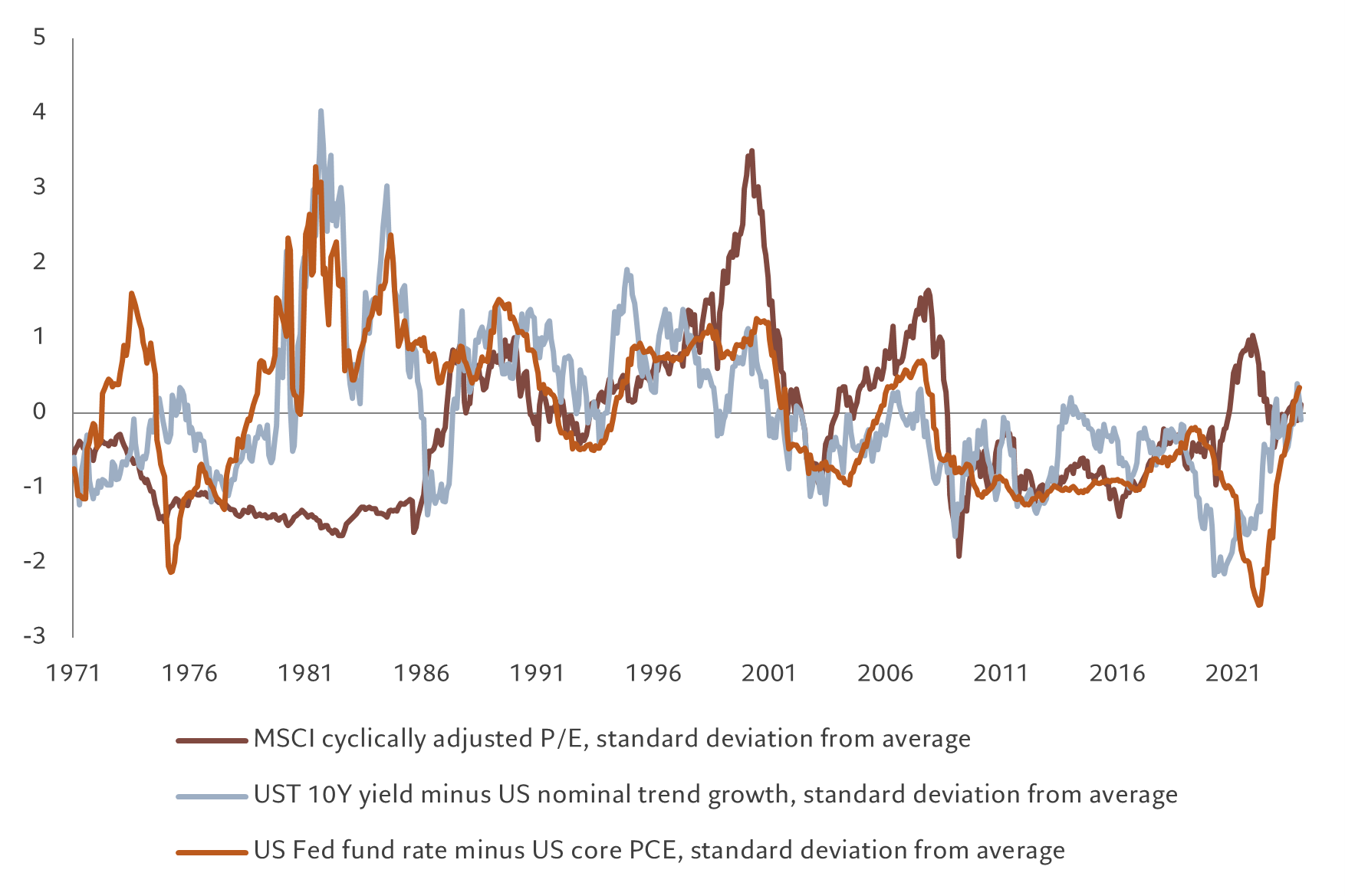

4. Valuation does matter in the long term

The unprecedented monetary and fiscal stimulus implemented in response to the Covid-19 pandemic caused an epic decline in risk premia across all asset classes. Valuations for US equities peaked in late 2020, trading at a price-earnings multiple of 23 – the level they hit in 1999 just before the tech crash. Yields on 10-year US government bonds, meanwhile, fell to a record low 0.5 per cent. Many investors thought US interest rates would be held at 0 per cent in perpetuity. But conditions soon changed. An inflation burst triggered an aggressive monetary tightening campaign that brought a swift end to financial repression and took interest rates to levels more or less in line with trend nominal GDP growth. Valuations for most asset classes duly reverted to their historical range. Global equities currently trade at some 16 times forward earnings while global government bonds now yield 3 per cent. Mean reversion is clearly still a powerful force in financial markets and valuation still matters over the long-term.

Source: Refinitiv, Pictet Asset Management. Data covering period 08.01.1971-08.12.2023.

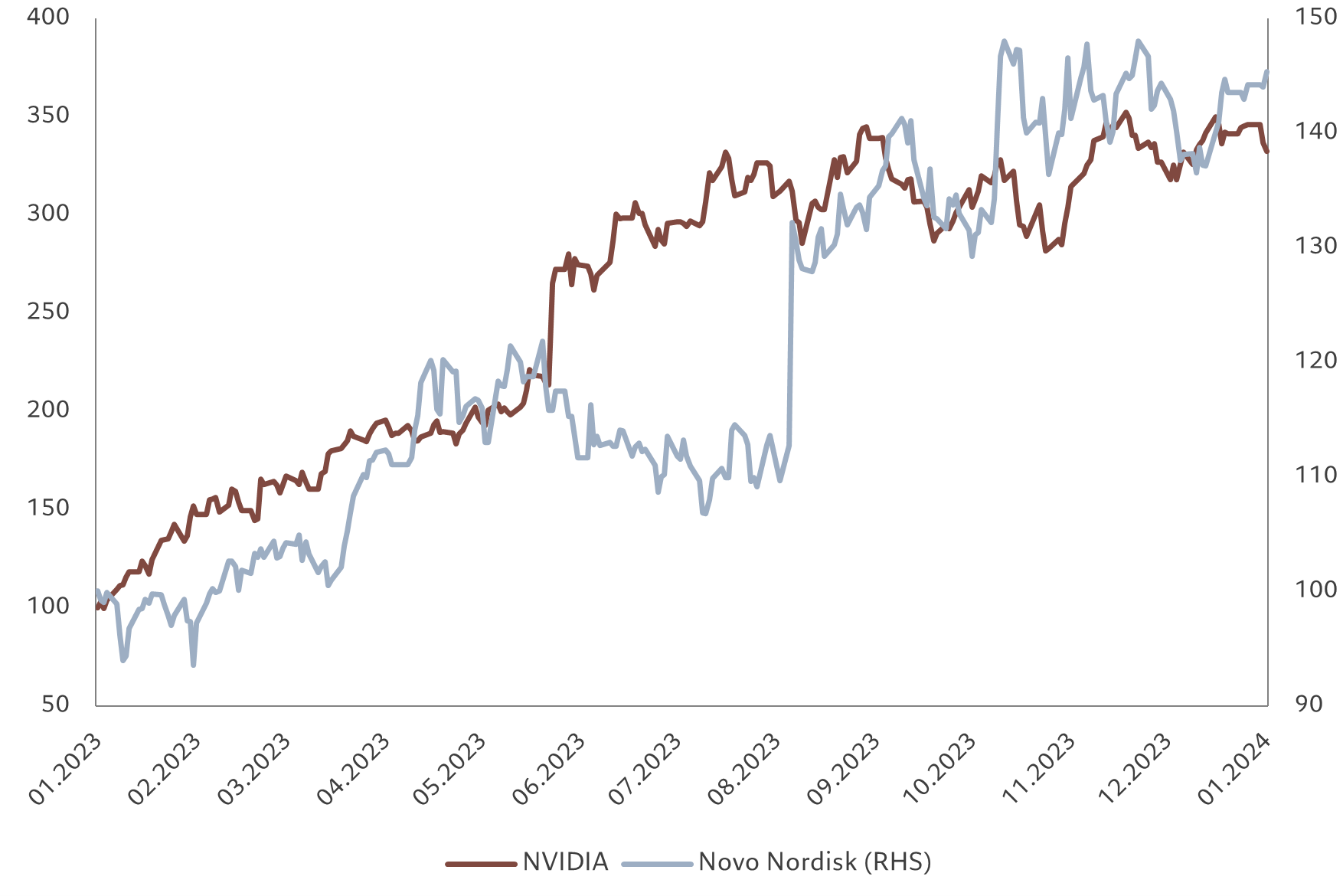

5. Themes are more important than sectors in alpha generation

Novo Nordisk shares gained 50 per cent in 2023, making it the most valuable company in Europe and accounting for nearly 3 per cent of the MSCI Europe index. A game-changer for the company was a study showing that its blockbuster obesity medicine Wegovy also reduced the risk of heart attacks and strokes. The message: investors should focus on secular themes in their strategic allocation, rather than sectors. But even within secular themes, picking the winners is critical to achieving superior returns.

Source: Refinitiv Datastream, Pictet Asset Management. Data covering period 03.01.2023-03.01.2024.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.