Asset allocation: wary of Goldilocks reflation trade

2023 began with prospects for the global economy darkening The fear was that runaway inflation and higher interest rates would trigger a worldwide recession.

A year later, and investors are facing a remarkable change in the economic landscape.

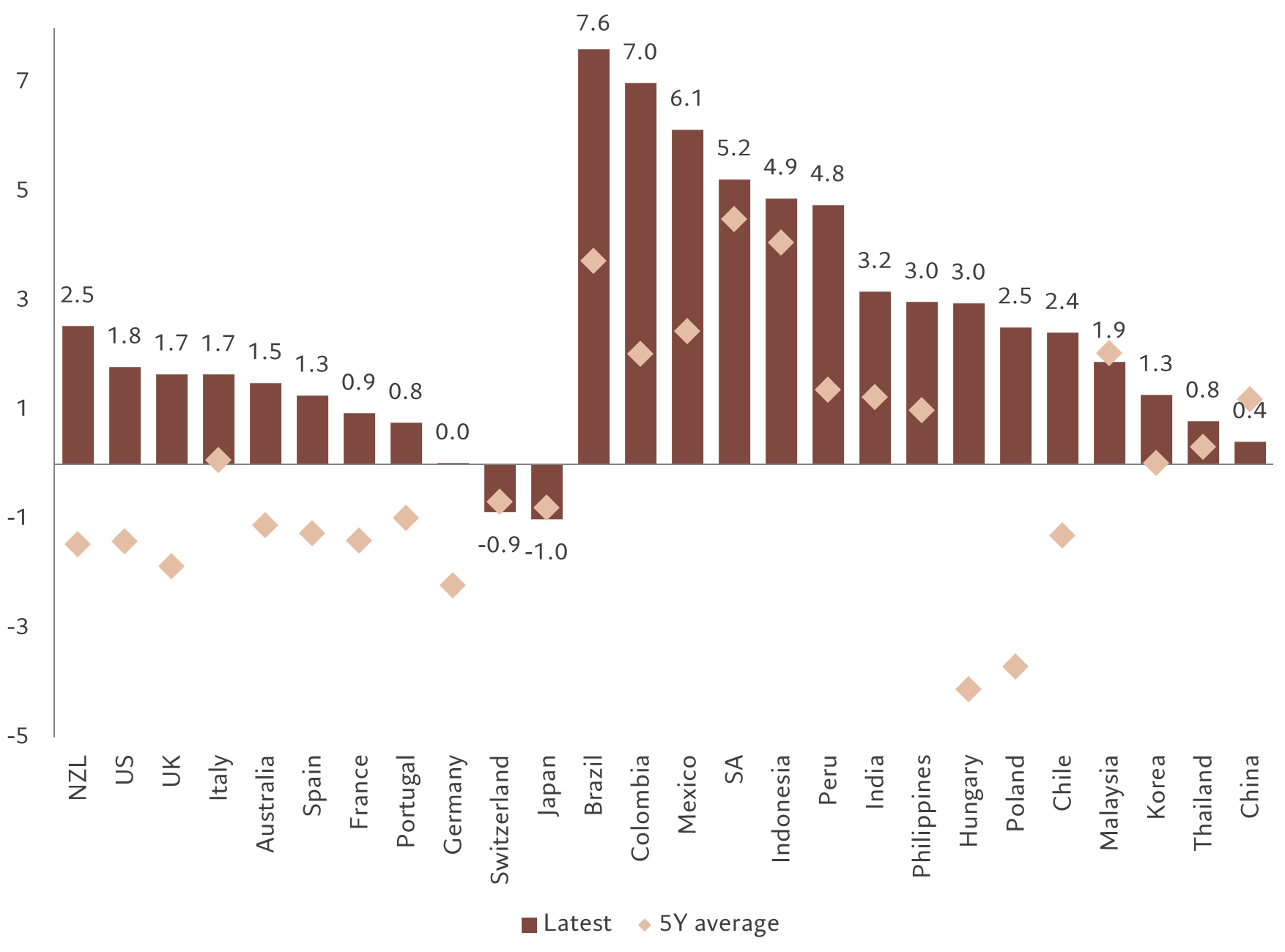

The global economy may be slowing, but it remains resilient enough to avoid a hard landing. Inflation is declining around the world, albeit with bumps, which will encourage most major central banks to terminate their tightening campaign and start cutting interest rates in the coming months.

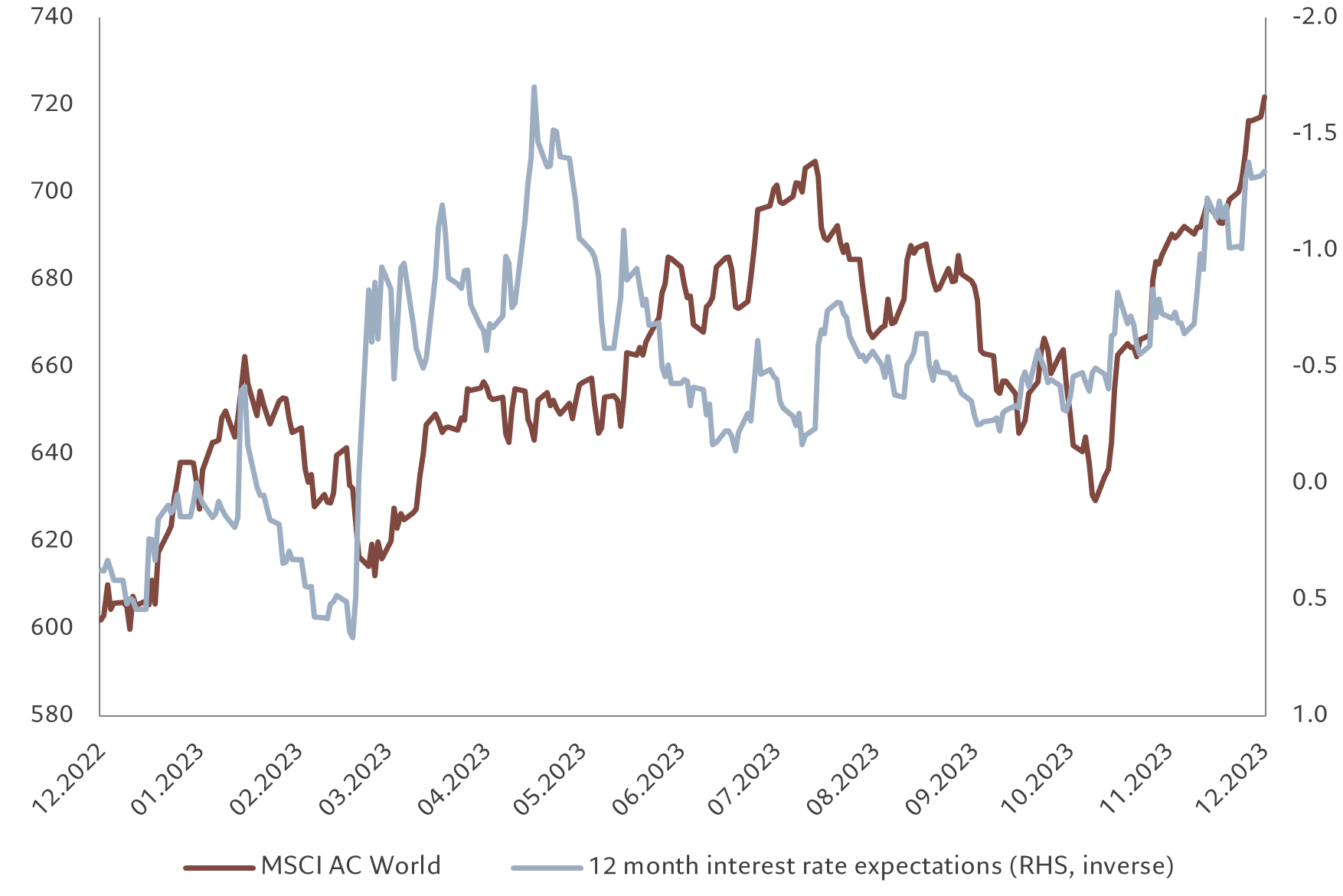

Expectations for such a Goldilocks scenario have given rise to a powerful reflation trade across asset markets in recent weeks. But we have reasons to be cautious - not least because investors appear to be getting ahead of themselves at a time when end-year market dynamics may be distorting prices.

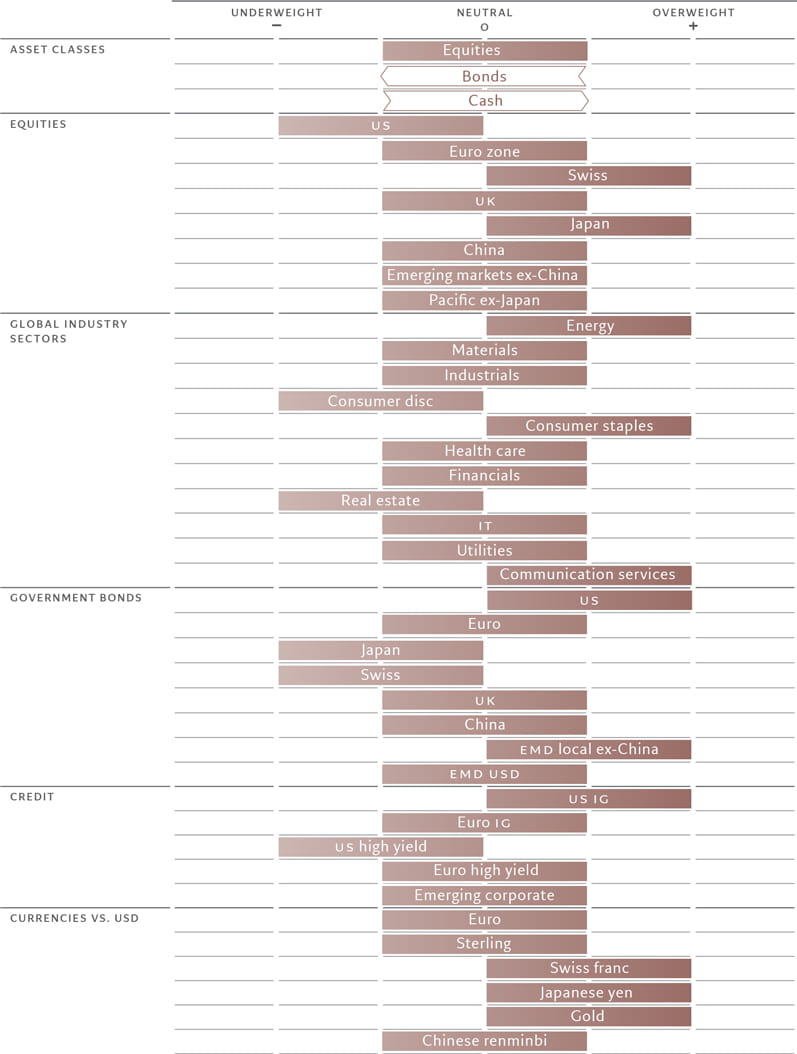

This is why we prefer to be benchmark weight in our asset allocation, downgrading bonds to neutral and upgrading cash to neutral. We remain neutral in equities.

Our analysis of the business cycle shows the US is unlikely to regain growth leadership among developed economies anytime soon. Manufacturing and housing sectors have slowed down, while leading indicators suggest capital investment will contract in the coming months in line with depressed levels of future spending intentions.

What is more, we expect US services consumption to moderate soon. This is because US consumers continue to run down savings they built during the pandemic. These have fallen to just USD337 billion in October from a USD1.8 trillion peak in mid-2021.

We expect this number will run down to zero by the end of the first quarter in 2024. At the same time, the US labour market is showing early signs of weakness. Job openings are down about 3 million from their peak in mid-2022.

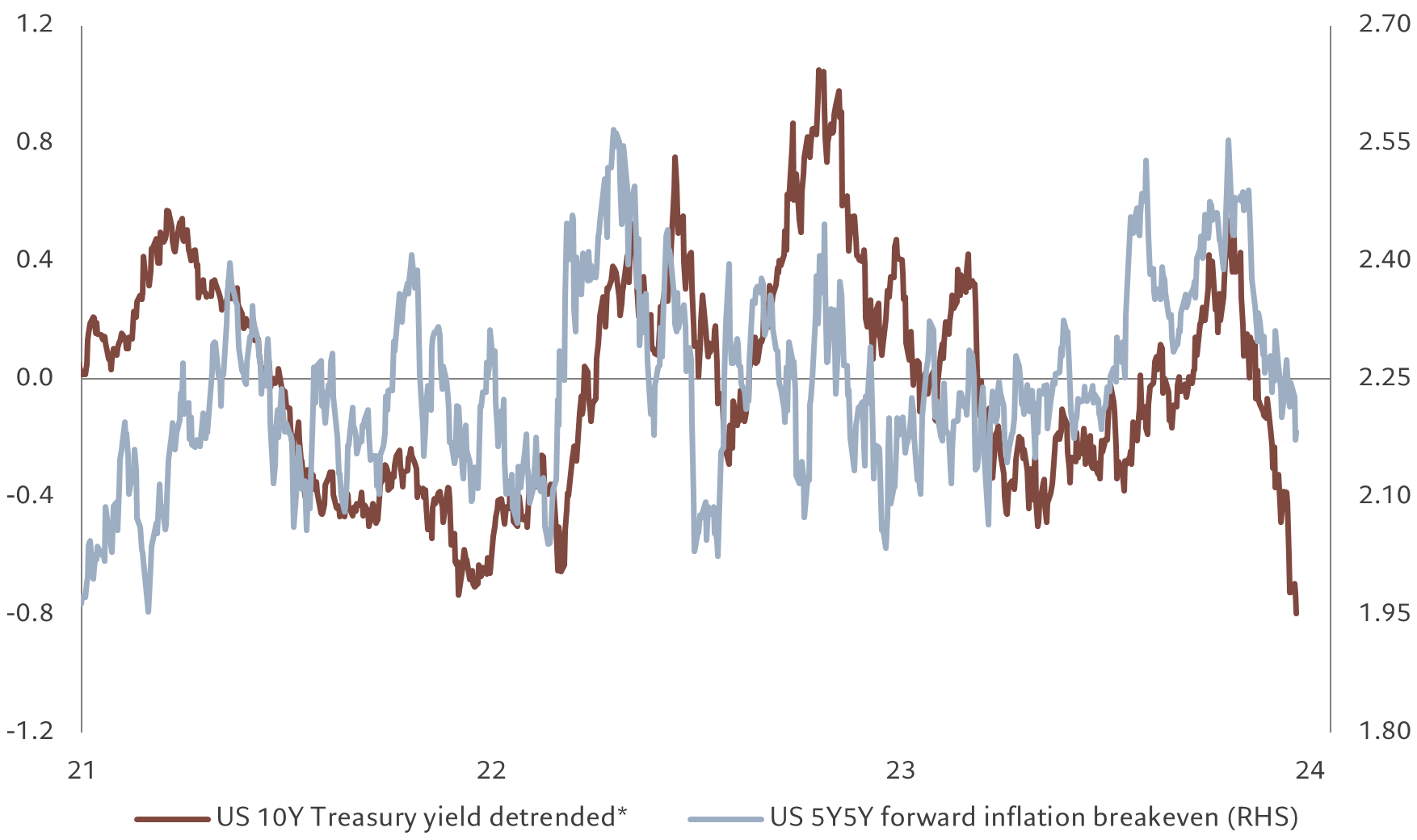

For all this, and even with inflation falling faster than previously anticipated, we don't believe the US Federal Reserve will see fit to lower real interest rates. We expect the US central bank to cut interest rates just three or four times next year, a less dovish scenario than that priced in by bond markets.

* Detrended yield removes the effects of trend from a data set to show only the differences in values from the trend, allowing cyclical patters to be identified. Source: Refinitiv, Bloomberg, Pictet Asset Management, data covering period 18.20.2020 – 20.12.2023

Our liquidity analysis supports our neutral asset allocation stance.

Global excess liquidity -- the difference between the rate of increase in money supply and nominal GDP growth – is only slightly positive.

Conditions won't necessarily become easier in the event of US interest rate cuts. In our view, while the Fed will lower the Fed funds rate over the course of 2024, it will be keen to keep real interest rates steady. Which means market expectations for easing of as much as 150 basis points, double what the Fed signalled at its recent meeting, look overstretched. Other central banks are equally unlikely to deliver aggressive interest rate cuts given the risk of reigniting inflation.

By contrast, we think China is easing too little. Monetary authorities need further interest rate cuts to counter forces from structural deleveraging which pose risks to highly indebted sectors of the economy.

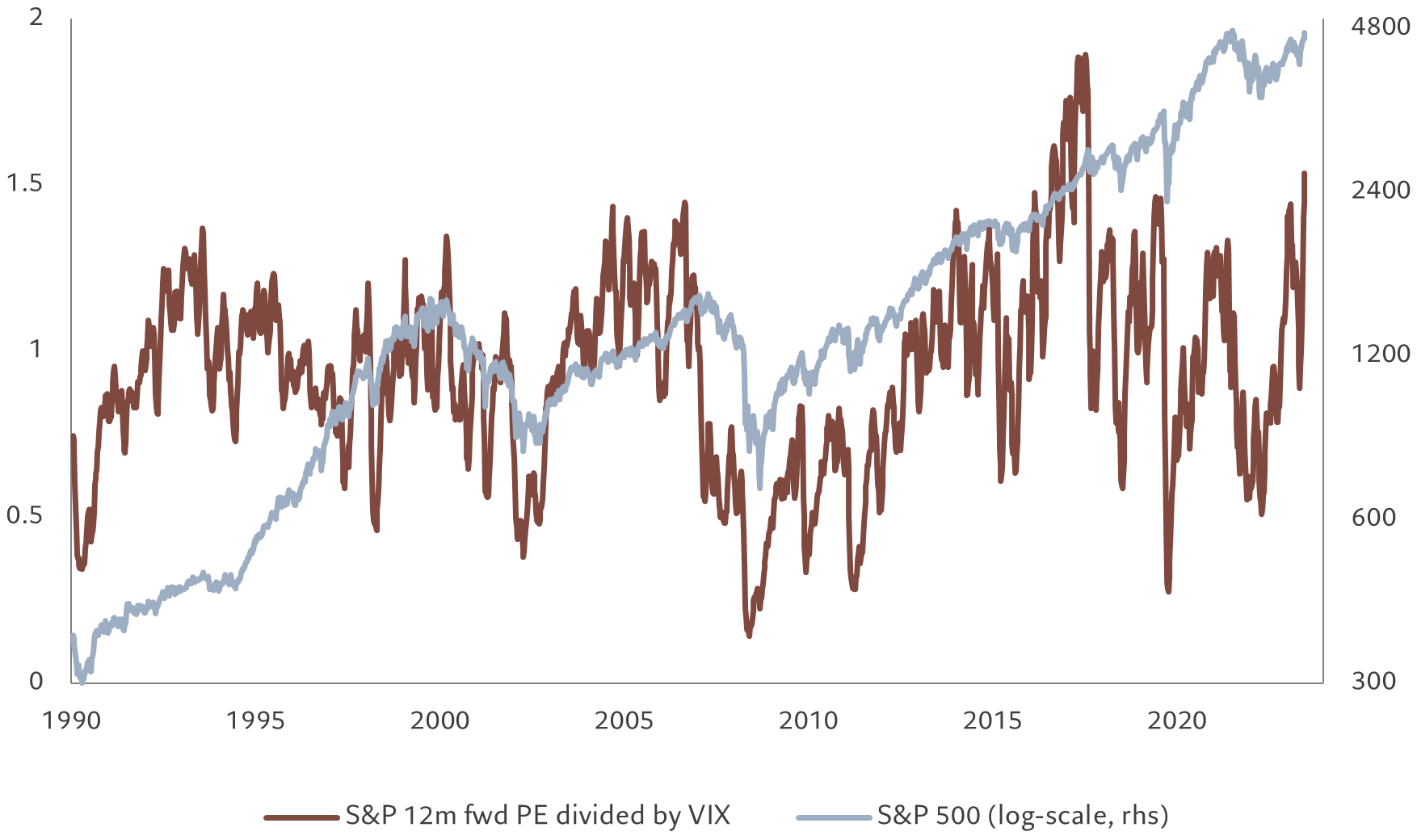

Our valuation model shows equities remain relatively expensive even after the rally in bonds, particularly in the US where the equity risk premium stands at a multi-year low of 3.8 per cent. We expect corporate earnings growth in developed companies to be well below consensus forecasts, especially in the US where our base case for an EPS increase of 2.5 per cent is less than a fifth of the market estimates. While bonds offer value in the longer term, especially Treasuries, the asset class looks slightly overbought given a recent rally.

Finally, our technical indicators score neutral for both equities and bonds.