Think of

Sustainability.

Invest Responsibly.

What is ESG?

ESG investing started in the 1960s as socially responsible investing, with investors excluding stocks or industries from their investment portfolios in accordance with their business activities like tobacco or nuclear weapons involvement.

Along with standard financial analysis, many investors are now trying to incorporate ESG factors into their investment process.

Why is ESG important?

ESG can allow firms to foster a meaningful change in the global economy, and in the communities in which we live and work. We believe that ESG analysis leads to more effective investment solutions that address global challenges and create sustainable value for our clients.

The integration of ESG factors is used to enhance traditional financial analysis by identifying potential risks and opportunities beyond technical valuations, providing data on issues such as potential reputational risk or identifying firms which are adapting to meet new market challenges. It is important to note that the main objective of ESG integration remains financial performance.We believe our role as an institution is about much more than financial returns. We aim to create positive impact in the world through a responsible approach to investment and stewardship that values all stakeholders.

Responsibility is in our DNA

In the below video, Marie-Laure Schaufelberger, Head of Group ESG and Stewardship at the Pictet Group, explains why our business model and unique governance have created a culture of long-term thinking inherently linked to sustainability. She considers the biggest challenges for the financial industry: we need robust ESG data and a change in the mindset to ensure sustainable practices become embedded in investor thinking.

Responsibility is embedded in everything we do

Responsibility is central to our way of thinking. It’s in the way we manage our clients’ investments and in the way we conduct our activities, all with the long-term in mind.

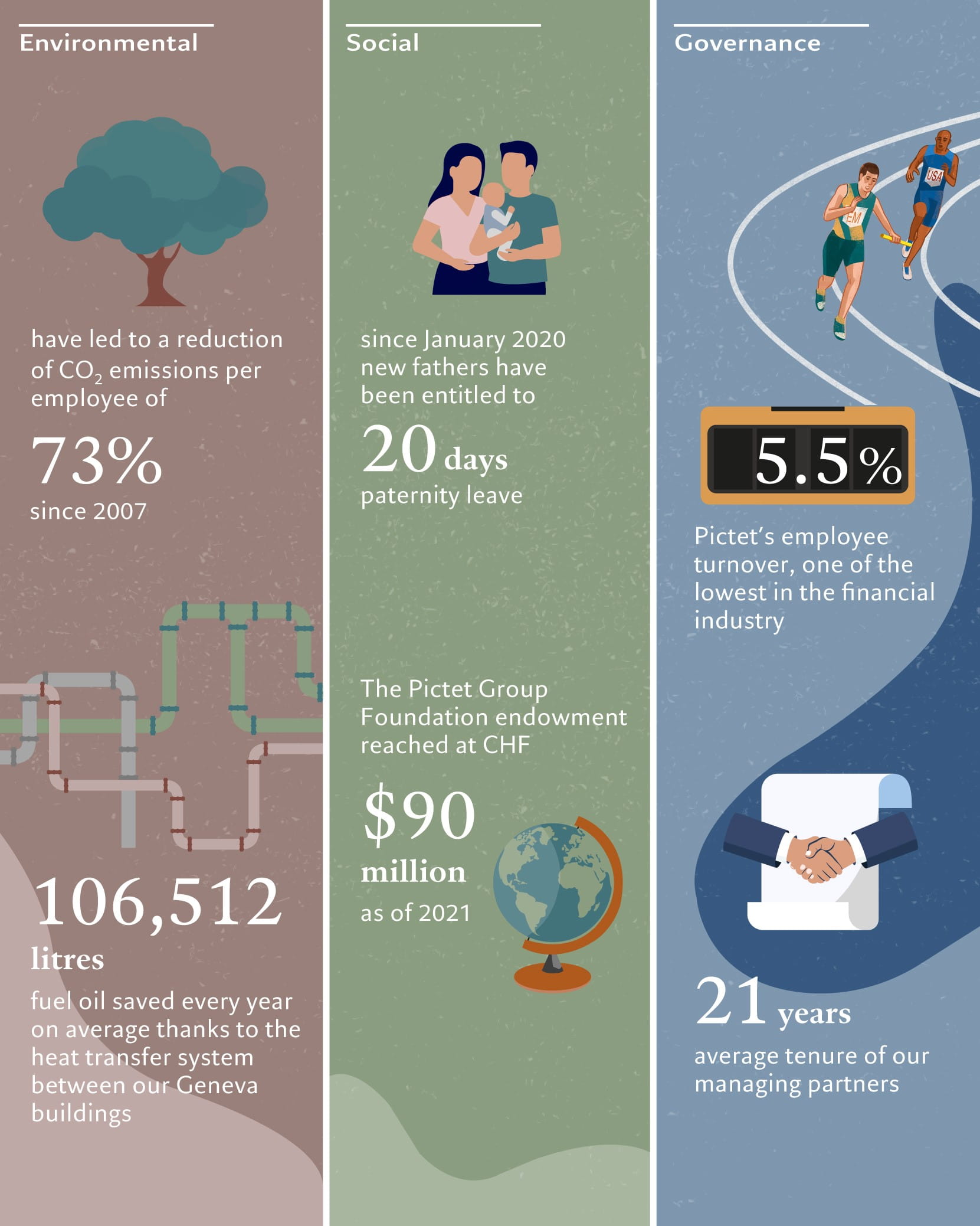

Over the past 216 years since the creation of the Pictet Group, there have been only 45 partners, each with an average tenure of over 21 years. This unique structure as a partnership has given us the stability and the independence to take the long view. In so doing, we consider not just the needs of today’s generation but also those of tomorrow’s.

Our responsible milestones

With the challenges the world is now facing, we need to move swiftly to a more resilient and sustainable economy. For the financial system, we believe this calls for a systemic shift in focus away from exclusively maximising financial returns. Instead, we have to embrace new models that are based on solid science and innovative partnerships and also take account of environmental, social and governance factors in investment decisions and active ownership practices. It also means further developing solutions that redirect capital flows to issuers best positioned to tackle these challenges.

Not only does it help us make better investment decisions for our clients, we take a responsible approach as we think it is the right things to do.

We are committed to these three ambitions before 2025:

How we conduct our activities and manage client assets

To achieve these ambitions, we have identified 10 levers of action for conducting our own activities and for managing assets on behalf of our clients.

We are convinced that these 10 levers of action will make us better investors and corporate citizens and help us play our part in designing a thriving system for future generations.

Walk the talk at firm level

Source: Pictet Group, as of 2020.

Responsibility is embedded in everything we do, starting with our investment framework.

1. ESG integration into investment processes and risk management

2. Responsible products and solutions

We continue to develop investment strategies that provide capital to companies that aim to have a positive impact on society or the environment. We also support those companies that strive to mitigate the negative externalities of their products, services, operations and supply chain.

3. Active ownership

4. Client disclosure

5. Research and thought-leadership

Pictet Asset Management, November 2019

Active engagement and stewardship

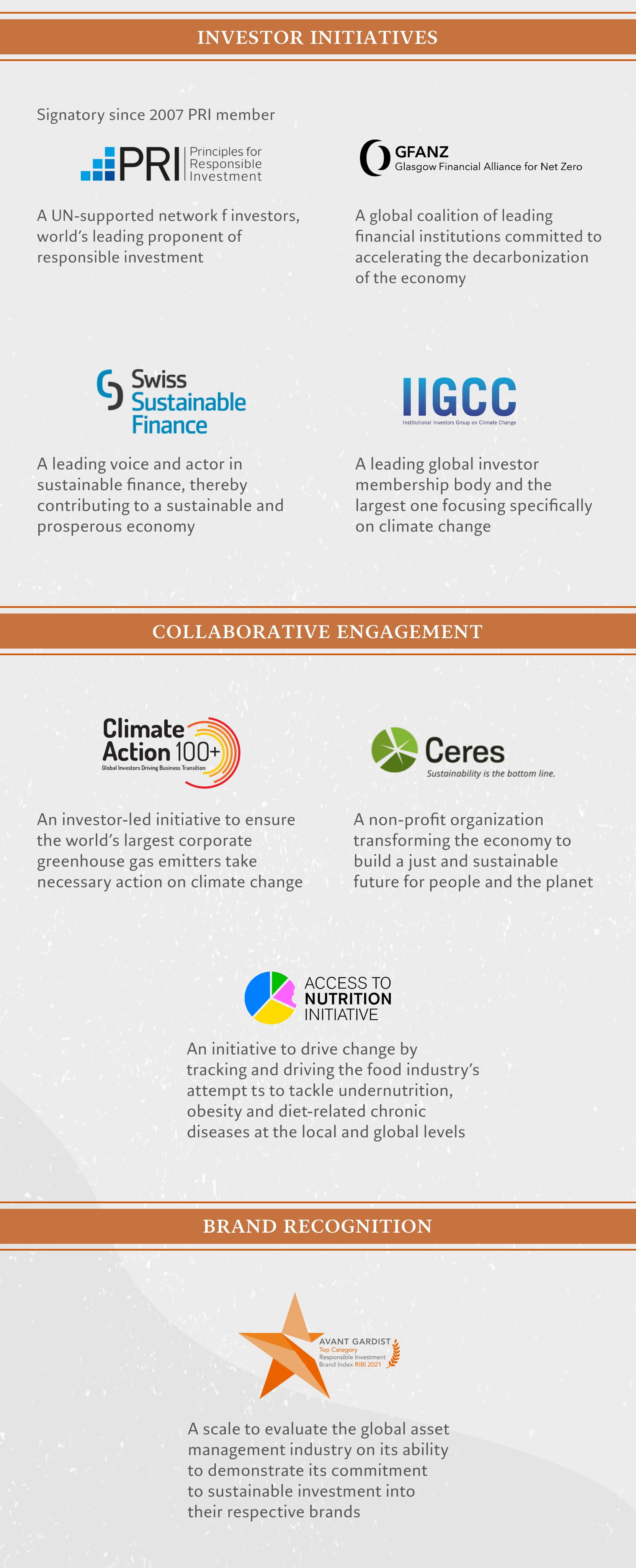

Key Initiatives

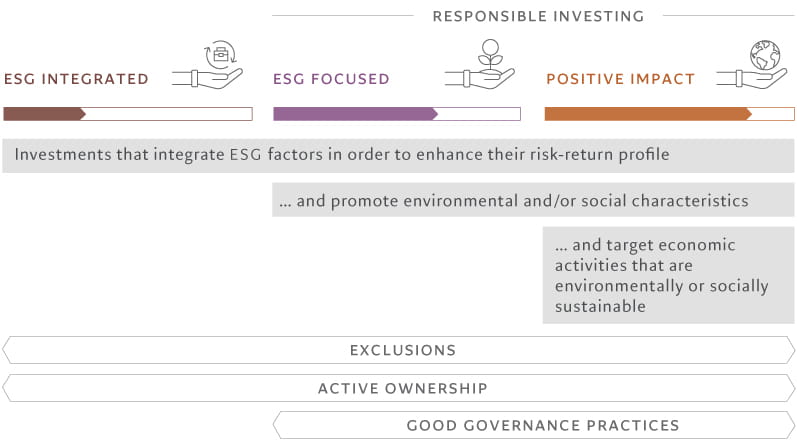

Spotlight on our responsible investing strategies

ESG integrated is equivalent to an article 6 SFDR and may invest in securities with high sustainability risks. ESG focused is equivalent to an article 8 SFDR. Positive impact is equivalent to an article 8 or 9 SFDR.

SFDR: Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on Sustainability-related disclosures in the financial services sector.

Click here to find a glossary with the main terms. Source: Pictet Asset Management, 31.12.2022.

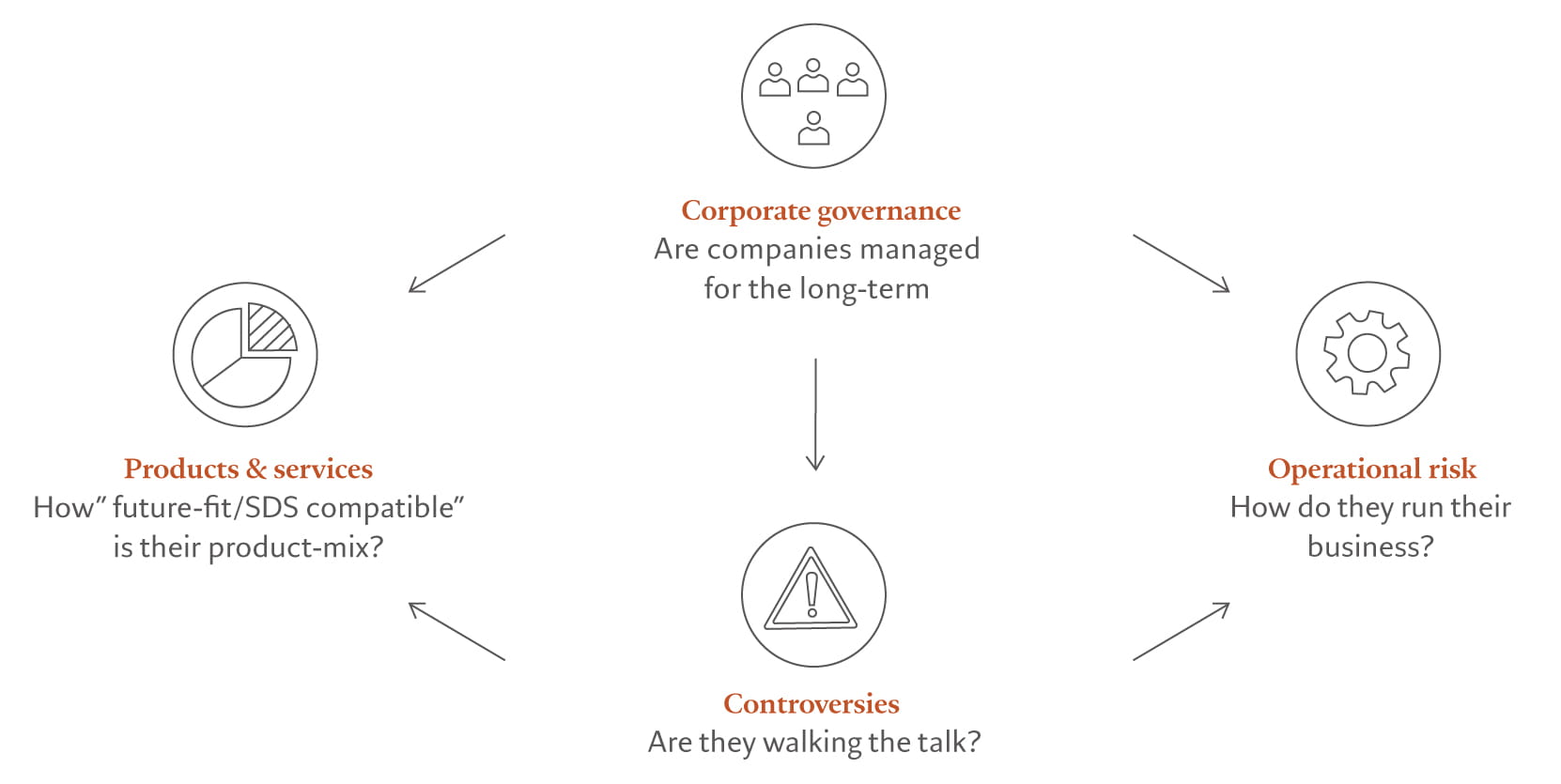

Assessing the risk and opportunities

Spotlight on our ESG scorecard

Making the right choice

Responsible investment strategies at Pictet Asset Management

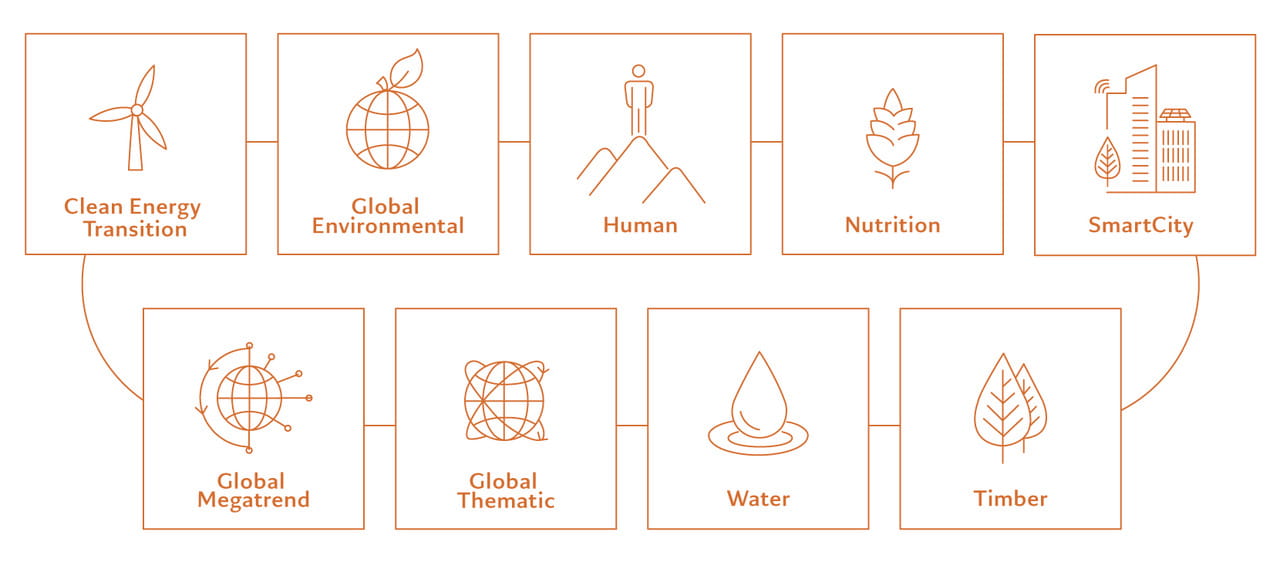

01 Clean Energy Transition

|

|

Clean Energy Transition is increasingly vital to the lives of people, industries and nations across our planet. Clean energy promises a smarter future, not just in power generation, but a range of innovative technologies and applications. → Watch the video → Strategy deep dive |

02 Global Environmental Opportunities

|

|

Our wellbeing and health is directly linked to our environment. By investing in companies that make a positive contribution to society and the environment we can create better living for all. → Watch the video → Strategy deep dive |

03 Human

|

|

|

04 Nutrition

|

|

Invest in the solutions to help secure the world’s food supply and provide better nutritional value to the global population. → Watch the video → Strategy deep dive |

05 Smartcity

|

|

Smart cities use technology for sustainability. It will make urban living better, more connected and more sustainable. → Watch the video → Strategy deep dive |

06 Timber

|

|

Timber is one of the world’s oldest resources. More than ever, this resource has to be managed sustainably. As demand for timber and wood products rises, pressure grows to conserve stocks, and it’s a resource that is likely to increase in value. → Watch the video → Strategy deep dive |

07 Water

|

|

Next to oxygen, water is the most important life support system of all, however, only 2.5 percent of it is fresh. We believe companies providing solutions to the global water challenge are likely to represent attractive long-term opportunities. → Strategy deep dive |

08 Global Thematic Opportunities

|

|

Access the best of Pictet Asset Management’s thematic franchise. → Watch the video → Strategy deep dive |

09 Global Megatrend

|

|

A single platform that harness the power of megatrends. → Strategy deep dive |

Find the financial advisor

| Distributor | Phone Number |

| Bank of China (Hong Kong) Limited | +852 3988 2388 |

| China Construction Bank (Asia) Corporation Limited | +852 2903 8343 |

| Hang Seng Bank Limited | |

| Industrial and Commercial Bank of China (Asia) Limited | +852 2189 5588 |

| Nanyang Commercial Bank | +852 2622 2633 |

| Shanghai Commercial Bank | +852 2818 0282 |

| The Bank of East Asia, Limited | +852 2211 1311 |

| OCBC WING HANG | +852 2815 1123 |

Busting 5 ESG investing myths

Myth 1: ESG comes at the expense of investment performance.

This is the most common misconception.

An analysis of over 2,000 academic studies on how ESG factors affect corporate financial performance found ‘an overwhelming share of positive results’, with just one in ten showing a negative relationship. Meta studies suggest that in most research papers, there was a positive correlation between ESG performance and corporate financial performance, including stock prices. These provide evidence that ESG issues can be financially material to companies’ performance and potentially to alpha, especially during the pandemic.

S&P analyzed 26 ESG ETF funds and mutual funds with over $250 million in AUM during 5 March 2020 to 5 March 2021, 19 of them beats S&P 500 over the same period. The is just the latest piece of the mounting evidence.

Source: S&P Global Market Intelligence, 2021.04

Myth 2: ESG is a new asset class or new sector.

No, it is not.

ESG are non-financial factors that help investors to identify materials risks and growth opportunities in their analysis process. ESG factors form the basis for the different responsible investing approaches which includes: exclusion, ESG-integration, core standard and best-in-class etc. It applies to all the asset classes across investment decision-making process.

Myth 3: ESG issues are mostly about environmental issues and climate change.

Not exactly.

As its name tells, ESG covers environmental, social and governance. Through active ownership and different responsible investing approaches, fund managers are able to analyse and assess the companies in their screening process, e.g. the board accountability, human capital, climate change etc.

Myth 4: Only institutional investors invest in ESG.

Not exactly.

In recent years, ESG investing has progressed to cope with the spiraling demand of institutional and retail investors, together with public sector authorities that would like to better integrate financial risks and opportunities into their investment decision-making process, so as to generate long-term value. According to Morningstar, assets in European sustainable funds have surpassed the EUR 1 trillion milestone end of 2020, growth rate was almost 10 times from the past decade. Demand is driven by increased interest in ESG issues from both institutional and retail investors.

When in comes to ESG investing, OECD report shows that institutional investors focused on the benefits of ESG investing for financial returns and risk management, whereas end-investors are more concerned with portfolio alignment with societal values.

Source: OECD, ESG investing: Practices, Progress and Challenges, 2020; Morningstar: European Sustainable Funds Landscape: 2020 in Review, 2021.02.

Myth 5: Impact investing, responsible investing and ESG investing are inter-changeable

No, the three concepts are NOT interchangeable.

Responsible investment refers to any investment approach, integrating environmental, social and governance factors (ESG) into the selection and management of investments. There are many different forms of responsible investing, such as best-in-class investments, ESG integration, exclusionary screening, thematic investing and impact investing.

ESG investing has been generalized to describe different approach in responsible investing. ESG are non-financial factors that help fund managers to identify risks and opportunities in their analysis process, and these factors form the basis for the different responsible investing approaches.

Impact investing is one of the approaches within responsible investment. It intended to generate a measurable, beneficial social and environmental impact alongside a financial return.

What are the UN sustainable development goals?

The sustainable development goals are a set of global social, environmental and economic targets, agreed by the United Nations in 2015 for its member countries.

Initially designed for policy makers and governments, the SDGs are now being embraced by businesses as they try to report on their sustainability efforts and credentials.

In the financial services sector, investors also want to know how the companies in their portfolio are exposed to the SDGs. However, so far, very little standardisation in company reporting is available. Some companies only focus the communication on their own strong points, carry out assessments at a very superficial level or outright “greenwash” their own unsustainable activities.

How do we apply the framework at Pictet Asset Management?

At Pictet Asset Management, our thematic investment team identifies investment themes that lay at the intersection of megatrends. Our sustainability-themed strategies follow impact objectives that are captured to an important degree by the SDG framework. Often, our thematic universes have a close link to at least one or more SDGs based on the nature of their investable universe. This allows us to provide a foundation for a viable investment framework despite the inefficiencies of companies’ SDG reporting.The set of goals outlined can provide a foundation for a viable investment framework despite the reporting and impact measurement challenges. For example, most of the strategies in our thematic franchise and other selective strategies are directly aligned with one or multiple SDGs in particular, while having cross-links with other SDGs.

Our investors want to know whether the companies we invest in are helping to build a better future.

Glossary

Active ownership

This refers to investors addressing concerns of environmental, social and governance (ESG) issues by voting on such topics or engaging with corporate managers and boards of directors.

Best-in-class

Investment approach based on a sustainability rating in which a company's or issuer's environmental, social and governance (ESG) performance is compared with the ESG performance of its sector peers. All companies with a rating above a defined threshold are considered as investable.

ESG

ESG stands for Environmental (e.g. energy consumption, water usage), Social (e.g. talent attraction, supply chain management) and Governance (e.g. remuneration policies, board governance). ESG factors form the basis for the different responsible investing approaches.

ESG integration

The explicit inclusion by asset managers of ESG (Environmental, Social and Governance) risks and opportunities into traditional investment strategies based on a systematic process and appropriate research sources.

Engagement

Investor-led dialogue with issuers on ESG matters with a view to share potential concerns, seek additional information, enhance public disclosure and/or influence behavior.

Exclusions

An approach excluding companies, countries or other issuers based on activities considered not investable. Exclusion criteria (based on norms and values) can refer to product categories (e.g. weapons, tobacco), activities (e.g. animal testing), or business practices (e.g. severe violation of human rights, corruption).

Exclusionary / Negative Screening

An investment strategy excluding companies, countries or issuers on the grounds of activities considered as not investable. Exclusion criteria can refer to product categories (e.g. weapons, tobacco) activities (e.g. animal testing) or practices (e.g. severe violation of human rights, corruption). They can also be based on personal values (e.g. gambling) or on risk considerations (e.g. nuclear power).

Impact investing

Investments intended to generate a measurable, beneficial social and environmental impact alongside a financial return.

Proxy voting

A ballot cast by one person on behalf of another. One of the benefits of being a shareholder is the right to vote on certain corporate matters. Since most shareholders cannot, or do not want to, attend the annual and special meetings at which the voting occurs, corporations provide shareholders with the option to cast a proxy vote.

Responsible investment

Responsible investment refers to any investment approach, integrating environmental, social and governance factors (ESG) into the selection and management of investments. There are many different forms of responsible investing, such as best-in-class investments, ESG integration, exclusionary screening, thematic investing and impact investing. They are all components of responsible investments and have played a part in its history and evolution.

Thematic investing

Investment in businesses contributing to sustainable solutions both in environmental and/or social topics. In the environmental segment this includes investments in renewable energy, energy efficiency, clean technology, low-carbon transportation infrastructure, water treatment and resource efficiency. In the social segment this includes investments in education, health systems, poverty reduction and solutions for an ageing society.

Introduction

Conducted online between 30 December 2021 and 20 January 2022, the HKUST Business School designed survey collected a total of over 3,500 responses across different social demographic sectors.

The survey results came a day before the Hong Kong government opens the first-ever retail green bond subscription.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.