Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Peak hawk

The US Federal Reserve may be hitting the peak of its hawkishness in response to persistently strong inflation.

We’ll soon reach peak hawk – if we haven’t already. That’s to say, the world’s most important central bank, the US Federal Reserve, is close to its most aggressive in the current inflationary cycle. Not only will price pressures begin to ease over the coming months, but a recent spike in bond yields shows that the Fed’s hawkish rhetoric has already done some of its heavy lifting.

That the Fed hiked interest rates at its May policy meeting by 50 basis points and flagged further similar moves in the meetings that follow merely confirms what the market had been anticipating. But there are reasons to believe that investors' most pessimistic expectations about policy tightening won't come to pass.

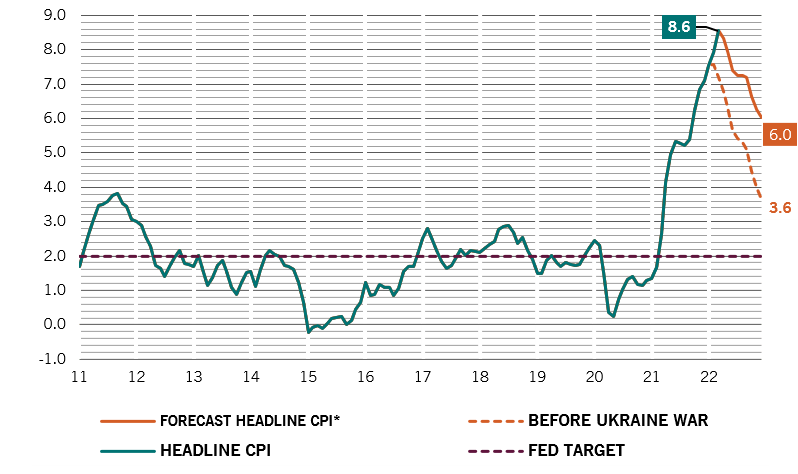

We expect inflation to roll over during the second quarter, peaking at 8.6 per cent in the US (see Fig. 1). US inflation has been running hotter than elsewhere in the developed world because of the country’s aggressive policy responses to the Covid pandemic, not least huge infusions of fiscal stimulus. But the fiscal taps are closing and the Fed has started to unwind its exceptionally easy policy. At the same time, some of the supply constraints that have caused a surge in commodity and other input prices are starting to ease. And though the Ukraine conflict could yet drive another spike in energy and raw materials prices, they are unlikely to revisit earlier highs due to slowing global growth and as emergency stockpiling tapers off.

Oil prices have been a major driver of rising price pressures. But their decline from highs is already filtering through to headline inflation. If oil prices stay at current levels – some USD107 from a peak just under USD140 – this will already prove disinflationary on a headline basis. So, subject to the caveat that Western sanctions against Russia cause an even bigger drop off in Russian energy supplies, energy prices should be less of an inflationary force over the coming quarters.

Core inflation – which strips out volatile food and energy prices – will meanwhile moderate on the back of base effects. Goods prices have already peaked, with those for durable goods dropping back and input prices falling. The latest purchasing manager surveys show that delivery times have started to shorten which highlights that supply bottlenecks are starting to open. And it seems that core personal consumption expenditure, the Fed’s preferred inflation measure, has peaked already. It was down to 5.2 per cent year-on-year in March from 5.3 per cent in February on declines in Covid-sensitive items and durable goods.

Expectations management

Meanwhile, the market's anticipation of US interest rate rises has led to a tightening of financing conditions: 30-year US Treasuries have lost a third of their value from their peak in response to expectations of Fed tightening. This has fed through to mortgage rates – the average 30-year fixed rate mortgage rate has risen some 220 basis points over the past year to nearly 5.4 per cent. This has had a chilling effect on mortgage demand, with both loan applications and refinancing dropping sharply.

Given the importance of housing to the US economy, the Fed will have taken note. It is less likely to take comfort in first quarter GDP, however, even though on advance indicators fell 1.4 per cent on an annualised basis against expectations of a 1.1 per cent rise – the first fall since the pandemic. That’s because domestic demand was up to 3 per cent annualised from 2 per cent annualised in the previous quarter – and domestic demand is what matters to the Fed in setting monetary policy. Yet risks to growth are certainly building and further weakness in the data is likely to make the Fed pivot again, as it did away from the “transitory inflation” view when it saw inflation really wasn’t going away anytime soon.

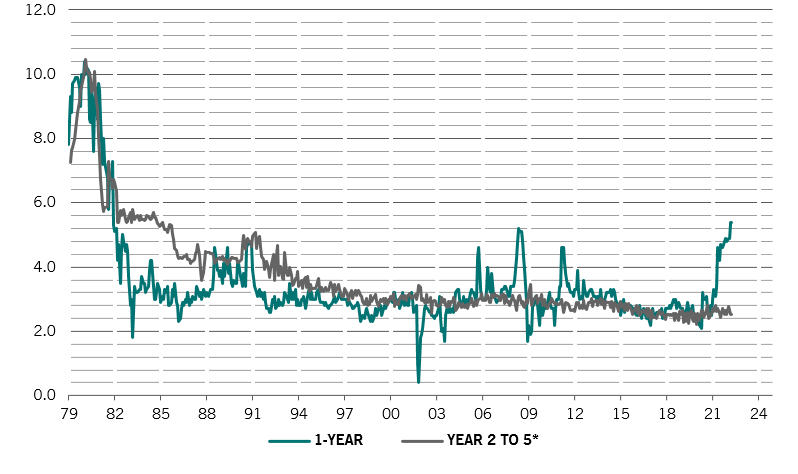

Above all, the Fed is likely to take encouragement from the fact that inflation expectations remain well anchored. Although surveys show that inflation expectations for next year have jumped, reflecting the current state of price rises, those for two and five years hence are well anchored at only a little above the Fed’s 2 per cent target (see Fig. 2). This is in sharp contrast with the state of expectations during the late 1970s – a repeat of which represents the Fed’s nightmare scenario. Then, inflation expectations were consistently high across time horizons.

Perhaps one of the strongest signs that the Fed has reached ‘peak hawk’ was when arch dove San Francisco Fed President Mary Daly raised the prospect that the central bank’s next move could be a 75 basis point hike in an effort to speedily return overnight borrowing rates to around 2.5 per cent. That’s broadly accepted as the likely neutral rate for the US economy, which it to say it is neither stimulative nor contractionary.

Daly has been among the Fed’s most vocal doves and to have her talk about a 75 basis point hike – even if she doesn’t advocate it – suggests a hawkish consensus at the central bank. This capitulation by the doves is another reason to suppose the Fed is getting closer to peak hawk. Fed chair Jerome Powell made it clear that the board was not actively considering a move of this magnitude in comments following the May rate hike, which went some way to soothe the markets. If, indeed, the central bank has reached peak hawk, short-dated bonds start to look attractive, and investors should be looking for a recovery in US bonds, emerging market debt and investment grade credit in particular.

Inflation has become a significant political issue. Given the Fed board’s solidifying consensus around taking an aggressive anti-inflationary stance, any evidence suggesting inflation really is transitory is likely to mark both a high point in the central bank’s hawkishness and signal that tightening will soon come to an end.

PictetAM chief strategist Luca Paolini contributed to this article.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.