Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Block by block

With the real estate industry facing growing calls to reduce its outsized environmental footprint, modular construction is back in fashion. It's greener, faster and more efficient.

Modular construction is not new. In the nineteenth century, British immigrants shipped prefabricated houses to Australia, while Americans used them to rapidly construct accommodation for fortune hunters during the California Gold Rush. Later, it played a crucial role in the rebuilding after World War Two, especially during the 1970s-1980s big building rush. But the results were not always durable – or aesthetically pleasing. In many of these buildings you could see the line where the modules were fitted.

Today, technology has vastly improved what is possible. We are looking at Modular 2.0, or even 3.0. And it offers several key advantages over conventional building, including the disappearance of those dreaded lines, as builders have learned to add external tiles on site.

The first advantage is environmental. Construction and demolition account for more than a third of all waste generated in the European Union, including cement, bricks, wood, glass, metals and plastic.1 A modular approach can reduce this to near zero by building in a factory, to exact plans, and putting in exactly what is required. Any surplus can then be used for the next module.

Modular also works particularly well with wood, which is in itself a very environmentally-friendly material. This is a growing but still small sub-segment of modular construction.

Secondly, modular buildings need much less on-site construction time. A regular building project would usually be on-site for six to 15 months, while a modular one can be assembled in as little as three weeks. Everything – from kitchens and floors to televisions – can be inserted into each unit in the factory. On-site work is limited to creating foundations and then assembling the modules – almost like pieces of lego. Latest technology has greatly improved the precision with which the blocks fit together. And the use of lighter materials (such as timber) means the foundations don’t need to be as deep, nor use as much as cement.

Plus, there is less pollution – both from noise and from traffic. Modular construction sites generate up to 70 per cent less traffic relative to traditional ones.2 That’s because you no longer need multiple deliveries of each building material and each fitting, all coming from different locations.

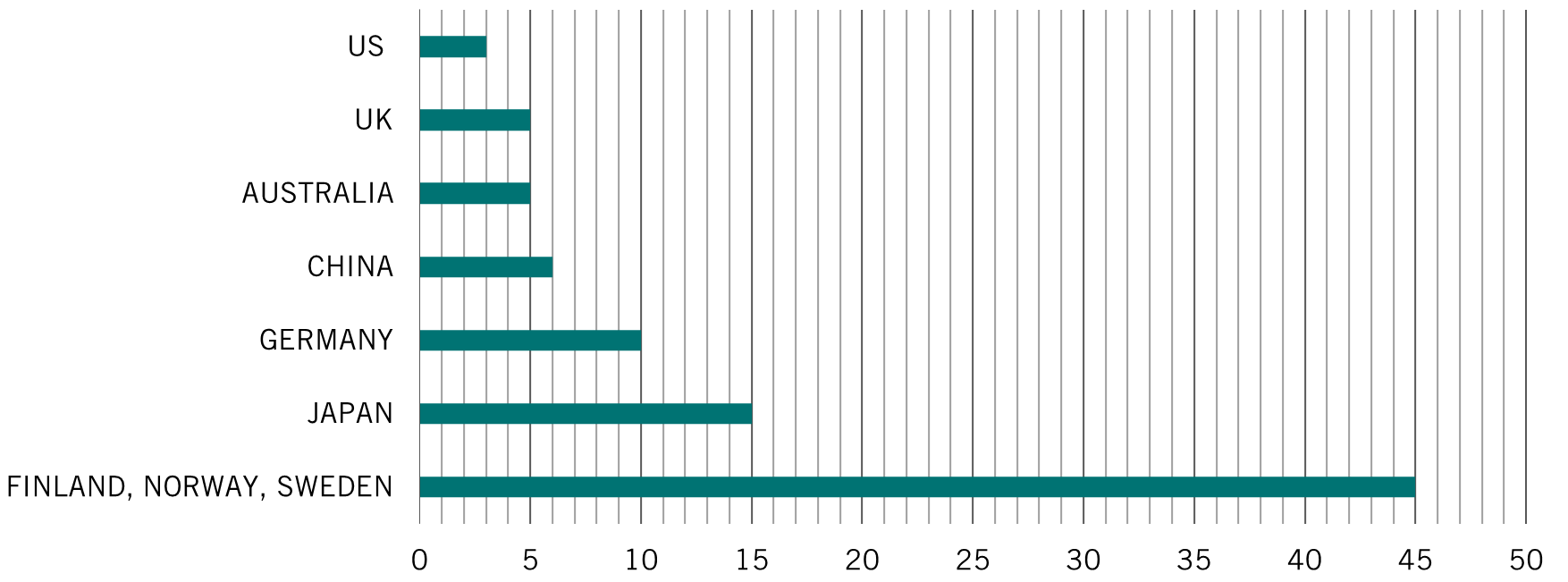

Source: KPMG, "Scaling modular construction", September 2019.

Of course, the factory process also takes time – usually two to four months from ordering – and the planning and design phase is broadly the same for all types of construction. Overall, though, modular buildings can still be produced faster and more efficiently. The total project timeline typically compressed by 20-50 per cent, according to McKinsey.3

Fully modular construction, in our experience, is best suited to buildings that are naturally split into small units, such as residential, hotels and student accommodation. That’s because the last phase of transportation is always by road, so the load must fit onto a truck. That means a module can have a maximum width of 4-5 metres and a length of 10-12 metres – not much use for large open plan offices or logistics warehouses.

However, a partially modular approach – assembled from individual parts, such as walls, rather than whole units – can be used more widely. The UK, for example, is looking into developing a flatpack kit for railway stations.

When it comes to cost, the benefits of modular are more nuanced. Research from McKinsey estimates that there is an opportunity for savings of up to 20 per cent over traditional construction, largely due to labour, but up to half of that can be eaten up by increased spend on logistics and materials. This potential for cost savings has to be put into context. If you employ people in your modular factory and you are not at full capacity, your modules could even cost more. Hence the importance of managing long-term capacity for many of the newly established small modular operators.

Over time, we expect the cost savings to increase as the market likely consolidates, production volumes ramp up, and economies of scale become increasingly possible. There is also the potential to construct the modules in areas where this can be done more cheaply. For example, modules for use in Sweden, where it is very expensive to build, could be put together at a factory in Italy or even further afield and then transported. Last – but by no means least, especially in the current environment of high inflation – modular projects tends to have less volatility in pricing because the factories order the same materials all the time and often have their own supplies (such as forests for providing timber).

At Pictet, we are currently working on a few modular apartment projects, in particular in Spain.

The environmental and efficiency benefits are already there, and greater cost savings are likely to come. We expect modular to account for an ever more meaningful part of residential construction in the years to come.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.