Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Fixed income through the investment cycle

There are fixed income assets for every economic scenario.

The future is as murky as it has ever been during the past half century for bond investors: Have central banks done enough? Or too much? Will inflation fall back to target without triggering recession? Or will growth collapse too? Alternatively, perhaps both growth and inflation will take off again.

Different regimes of inflation and growth tend to favour different classes of bonds. That’s not to say it’s easy to identify the regimes, especially in times of transition. But our investment heuristic helps to simplify the choices investors face.

Identifying the economic environment

As the 1970s made very clear, though, rising inflation doesn’t always coincide with economic growth. Nor is it always true that economic weakness leads to falling inflation – remember stagflation? In which case, investors need to know what happens to assets under different inflationary and growth regimes.

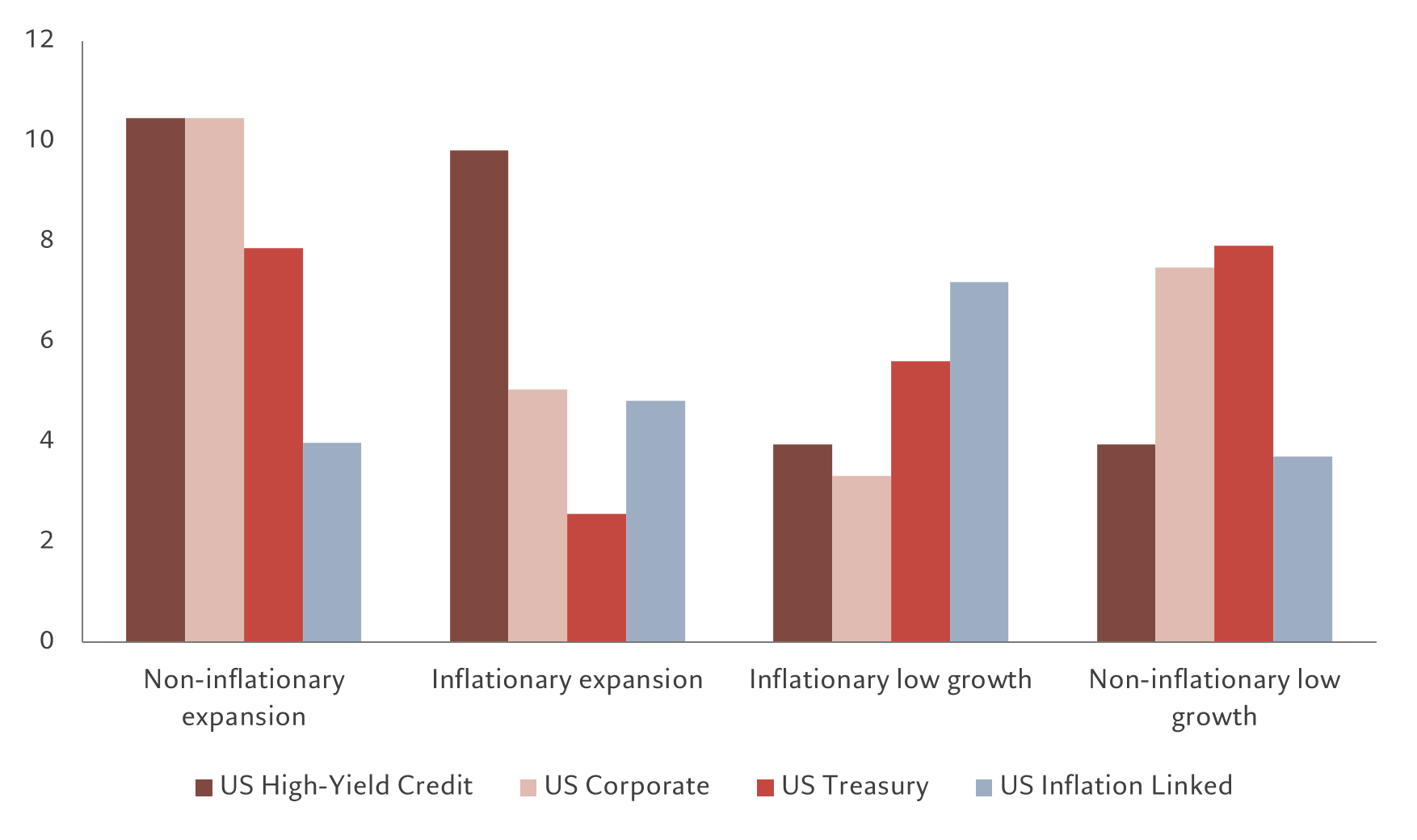

We classified periods based on whether US quarterly GDP growth was above or below its 7-year moving average, and whether inflation was above a 2 percent annual rate and rising or, alternatively, below 2 per cent or declining. These classifications, in turn helped us identify how different fixed income assets perform in different economic climates. To do so, we analysed one year total returns for various fixed income instruments relative to what was happening to US inflation and economic growth since 1950. The results are captured in the chart.

Overall, although money markets are positively correlated with inflation, their real returns during periods of high and rising prices are slightly negative. By contrast, TIPS post positive returns during inflationary periods.

US high yield bonds have only a modestly positive correlation with inflation, but are much more likely to do well under rising growth. US investment grade bonds, however, tend to do badly during periods of rising inflation, but register modestly positive correlation with growth. Finally, US Treasury bond returns are surprisingly uncorrelated with inflation, but negatively correlated with growth.

Investments for each regime

Goldilocks: strong growth, low inflation. The sort of early post-recession environment that also happens to be most comfortable for most people also favours risk assets. During this period high yield and investment grade credit fare best in the fixed income universe, with average annual returns of some 11 per cent for both in the US. This is the second-best economic environment for this group of investments, which suggests growth is a more important factor here than inflation. By contrast, US Treasury inflation-protected securities (TIPS), Treasuries and money markets have historically fared badly.

Slump:weak growth, low inflation. Periods of high inflation trigger reactions from central banks. Tightening monetary conditions not only take the heat out of the economy, but can drive it into outright recession, particularly if central banks over-react or make a policy error. This favours Treasury bonds and investment grade credit, which have historically posted returns of 8 per cent in such circumstances.

Stagflation: weak growth, high inflation. In periods when inflation was high and growth low, TIPS generated 8 per cent returns and Treasuries 7 per cent, while high yield credit and money markets fared badly.

Boom: high growth, high inflation. When central banks have kept liquidity flowing longer than is warranted by economic conditions, or when governments have spent prodigiously – and occasionally when both have happened at the same time, as was the case in the immediate aftermath of the Covid pandemic – economies overheat. These conditions favour the riskiest assets risk assets, particularly high yield credit.

Interestingly, adjusting those returns for risk doesn’t alter these outcomes materially – though here we are restricted to using data available since 1998 rather than the full history back to 1950. The only difference of note is that TIPS look more attractive during periods of inflationary expansion on a risk-adjusted basis.

The emerging universe: emerging market bonds take their clue from how their economies are faring relative to developed markets. For instance, periods when they are growing and there is a significant gap over developed countries – as is the case now – are good for emerging market local currency debt.

Where are we now?

Inflation has clearly peaked across most developed and undeveloped countries and looks set to slow further. However, economic prospects are diverging. With emerging economies at a more advanced stage in the interest rate cycle, they’re managing to boost growth at a time when developed countries’ prospects are weakening. For instance, US households have eaten considerably into their excess savings, which is set to weigh on disposable incomes and, subsequently, on spending. At the same time, lending conditions are tightening, while global trade is contracting.

History might not repeat exactly, but it offers a strong framework in which to take investment decisions.

Softer inflation and slowing growth – at least in the developed world – suggests that investors are best placed holding US Treasury bonds and investment grade credit, according to our model. At the same time, they should be wary of high yield debt where spreads are still narrow and default risk is rising. By contrast, emerging market local debt should benefit from a softening dollar and more robust local economies.

Eventually, the cycle will turn. Inflation will drop to central banks’ target, which will prompt them to cut official interest rates. This will stimulate growth and economies will boom again. Investors will then be guided by a different regime in our model. History might not repeat exactly, but it offers a strong framework in which to take investment decisions.

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Investor Information Document (KIID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 15 avenue J.F. Kennedy, L-1855 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any. The KIID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus.

The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.