[1] EPFR Global and MSCI, data as of 30.11.2022

[2] https://am.pictet/en/uk/global-articles/2022/pictet-asset-management/secular-outlook#PAM_Section_1

[3] MUFJ estimates, Pictet Asset Management, based on announcements through the Q3 earnings season as of 30.11.2022

[4] Ministry of International Affairs and Communications’ family income and expenditures survey as of November 2022

[5] World Bank as of 2021

[6] Ministry of Finance, Pictet Asset management and Refinitiv, as of 2020

[7] TOPIX banks, source: Refinitiv, Pictet Asset Management, data as of 13.01.2023

Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Japan: the land of rising prices?

The return of inflation in Japan should prompt further normalisation of monetary policy and trigger a rerating of its equity market.

Economic analysis provided by senior economist Nikolay Markov

After two decades of stagnant prices and wages, Japan finally looks to have shrugged off deflation, heralding a stronger yen and buoyant equity markets.

Evidence pointing to broadening inflationary pressures is everywhere. From soy sauce and beer to kitchen appliances and ski lift passes, the Japanese economy is witnessing price hikes on goods and services across the board. Core inflation hit a 41-year high of 3.7 per cent in December.

As a result, the Bank of Japan (BOJ) is edging towards scrapping its contentious yield cap policy, an economic stimulus measure that was aimed at sustainably achieving 2 per cent inflation.

Introduced in 2016, Yield Curve Control (YCC) is a policy through which the BOJ buys an unlimited amount of government bonds to keep 10-year yields in a narrow band close to zero.

Once praised for its inventiveness, the policy has since drawn criticism for distorting the yield curve, draining market liquidity and fuelling a plunge in the yen which inflated the cost of raw material imports.

In December, the central bank suddenly changed tack, taking what we believe is a first step towards exiting from the YCC and, eventually, its negative interest rate policy. It allowed the 10-year bond yield to move 50 basis points either side of its 0 per cent target, wider than the previous 25 bps band.

The BOJ will, in our view, gradually shift the upper band of 10-year yields, currently at 0.50 per cent, in two to three steps, before scrapping YCC altogether.

Moreover, we expect the central bank to stick to normalisation no matter who succeeds current Governor Haruhiko Kuroda in April.

The combination of policy normalisation and mild inflation is a potent mix for Japanese equities... This suggests Japan’s equities should be a more prominent feature of a global equity portfolio.

International investors should take note.

The combination of policy normalisation and mild inflation is a potent mix for Japanese equities.

With real rates likely to remain negative, Japan’s economy should register the fastest rate of growth in the developed world this year of 1.5 per cent, fuelled by a rise in investment and spending by cash-rich companies and households.

Under these conditions, investors can expect corporate earnings growth to gather speed and earnings multiples to expand. All of this suggests Japan’s equities should be a more prominent feature of a global equity portfolio.

Japanese stocks: key diversifier

International investors have been underweight Japanese equities since 2005, but their allocation is beginning to edge back towards the benchmark weight1.

Our long-term forecasts suggest the shift makes sense.

We expect Japanese equities to deliver an annual return of over 10 per cent in the next five years, outperforming US equities and almost matching returns from emerging equities in dollar terms yet with far lower volatility.2

This is thanks in large part to the yen appreciation we anticipate over the period, but it also reflects Japan Inc’s spending power and its impact on returns.

The country’s corporate sector is flush with cash. The cash-to-revenue ratio stands at its highest level in more than half a century, and companies are still generating even more cash with similarly record levels of free cash flow.

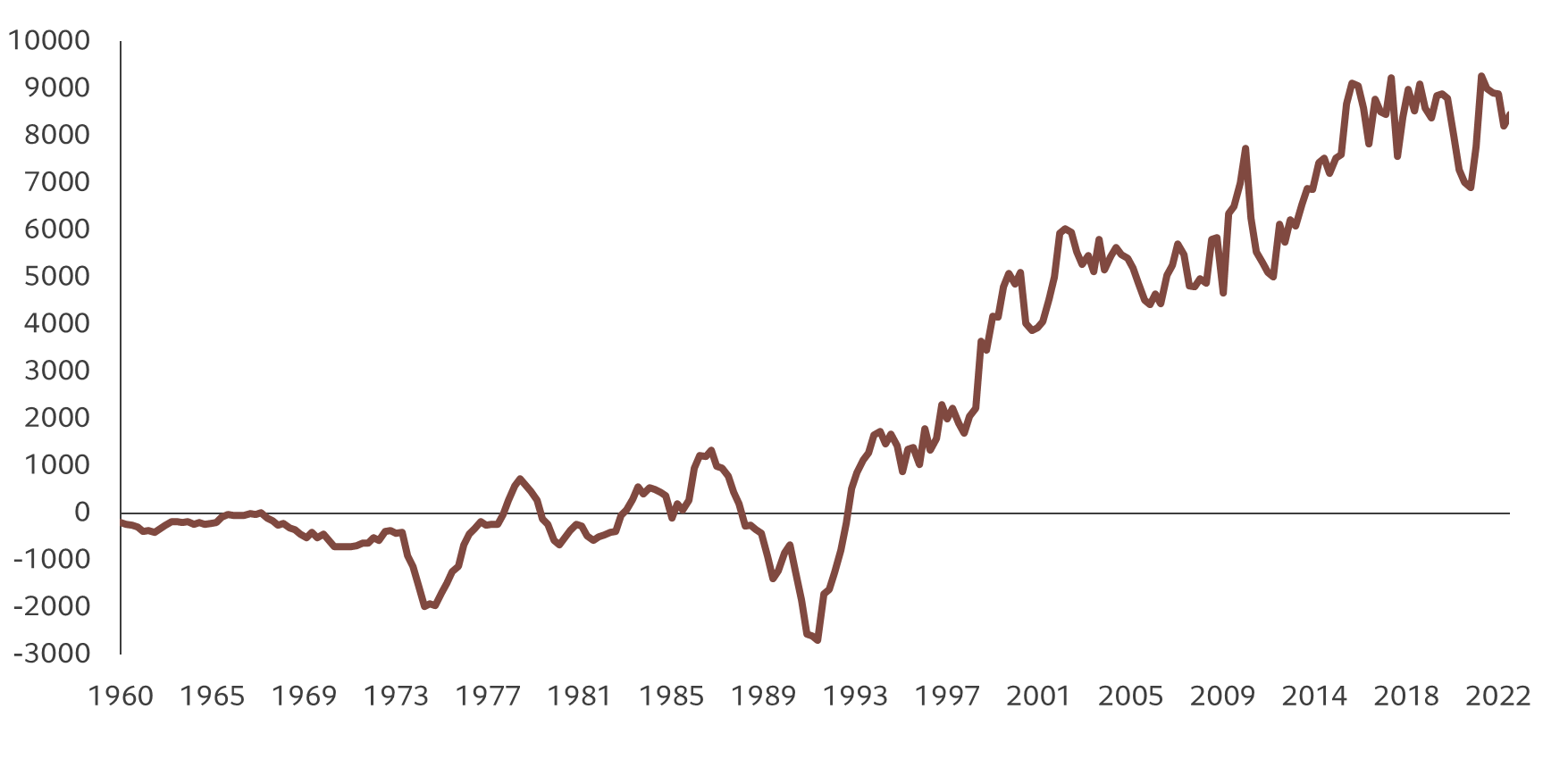

Fig. 1 - Cash-rich Japan Inc

Free cash flow of Japan's corporate sector, quarterly moving average in JPY bln

The level of confidence among company management plus the amount of cash on companies’ balance sheets are highlighted by the record level of shareholder returns, with both dividends and share buybacks expected to reach new all-time records for a combined return of JPY25 trillion.3

Wage inflation could also help finally unlock the potential of Japanese households, whose consumption accounts for more than half of the country’s GDP. Japanese household savings are at their highest in at least 22 years at JPY76,700 per worker per month while their income levels are also at the highest since 2000s.4

Strong yen: no hurdle

Sceptics might argue that the currency appreciation that comes with higher interest rates augurs badly for Japanese companies and their shares.

It is true that the yen looks set for a sustained appreciation. We expect it to strengthen beyond JPY130 per dollar, thus moving closer to its fair value which is estimated at around JPY108 based on our proprietary exchange rate determination model.

Yet the idea that a strong yen is bad for Japan Inc is wide off the mark.

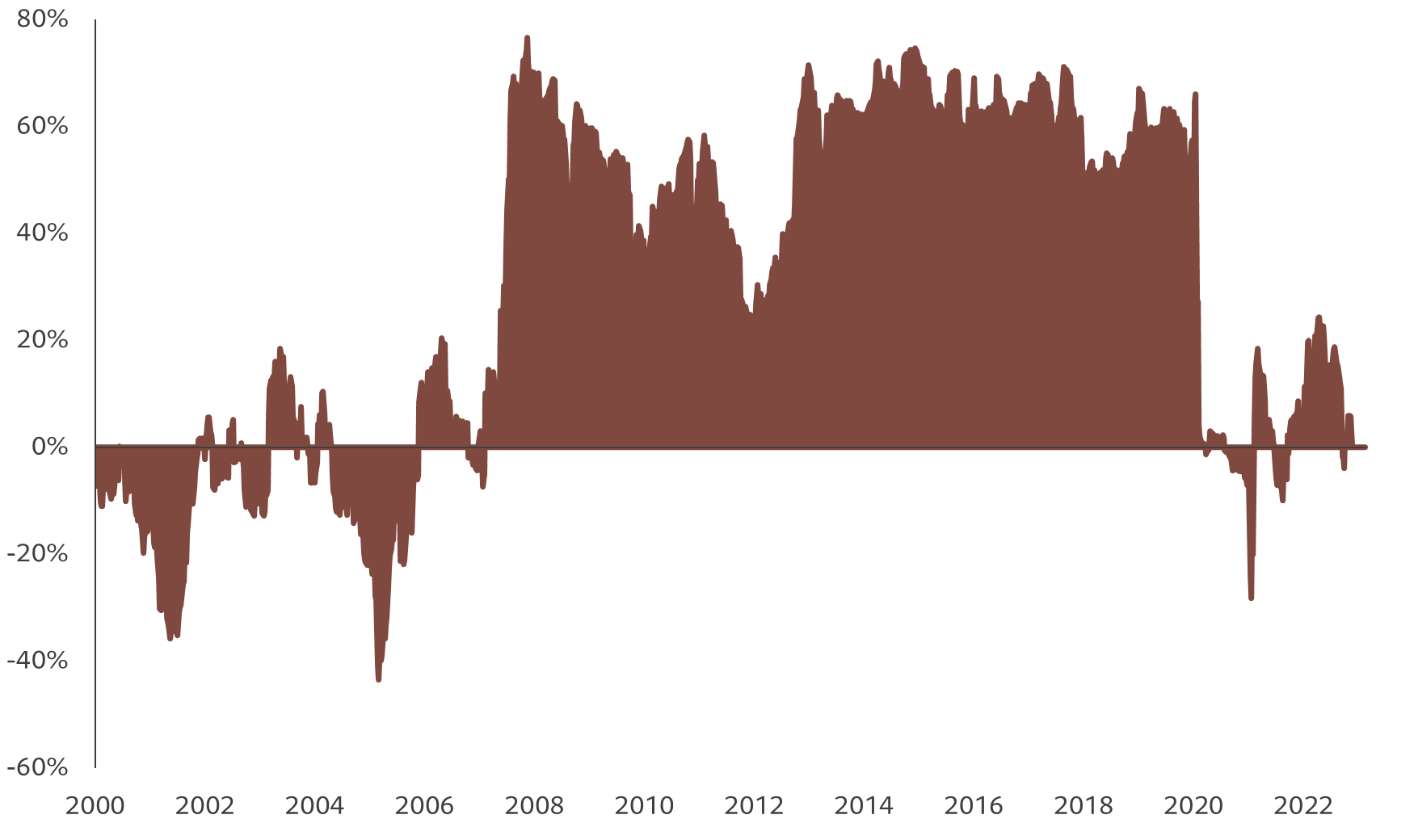

The negative correlation between Japanese stocks and the yen has only held for particular period from the late 2000s. This is no longer the case.

Fig. 2 - FX and stocks

52-week correlation of USD/JPY and TOPIX

Japan’s earnings prospects are not as dependent on export growth as they used to be.

The exports of goods and services contribute less than 20 per cent to the country’s economic output.5 What is more, Japan’s share in global exports has halved to 3.4 per cent since 1998 as production moved offshore.6

Companies that are sensitive to increases in capital spending and consumption are likely to benefit the most from the new environment of rising prices.

They include machinery, factory automation, housing and retailers.

As for banks, which tend to benefit from tighter monetary conditions, we are beginning to take profits as the sector has already gained nearly 50 per cent since the beginning of last year.7

As Japanese households and companies wake up to the return of inflation for the first time in 40 years, investors should be prepared for a radically different economic landscape, where a virtuous circle of rising prices and higher spending and investment boost the country’s stocks.

More on japan and asia

Secular Outlook 2022

How will the investment landscape evolve over the next five years? In our Secular Outlook, we provide our return forecasts for all the major asset classes and analyse the powerful long-term trends that will transform the economy and financial markets.

June 2022

Asia's growing heft, post-pandemic

Writing in Singapore's Business Times, Pictet Asset Management's Chief Economist Patrick Zweifel and Chief Strategist Luca Paolini explain why emerging Asian assets will grab a greater share of global investors' portfolios.

March 2021

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Investor Information Document (KIID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 15 avenue J.F. Kennedy, L-1855 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any. The KIID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus.

The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.