Megatrends – a group of powerful social, demographic, environmental and technological forces of change that are reshaping our world and the future – will impact economies worldwide. As an investor, you may capture new opportunities along the way.

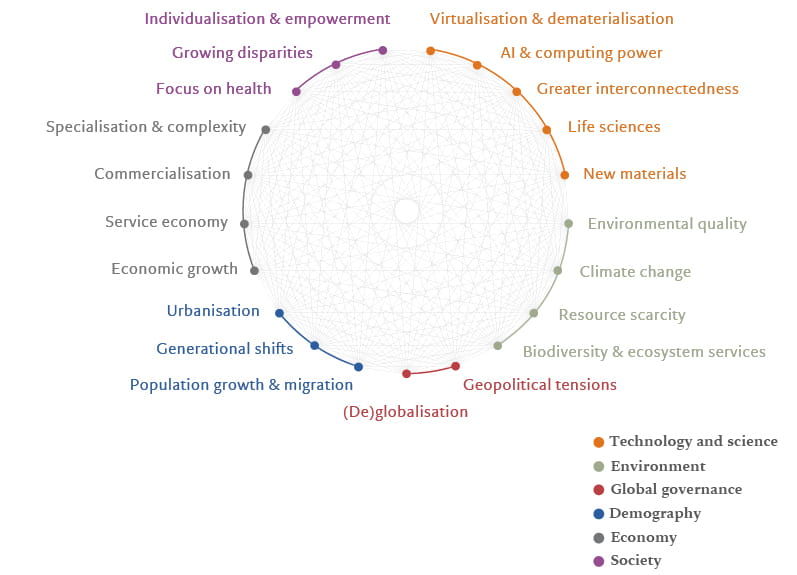

The interactions between these megatrends create investible themes Pictet Asset Management identifies through the Pictet Megatrend Framework, a model that forms the basis for our thematic investing approach.

Explore the megatrends framework

A framework for thematic investing

Delivering sustainable and long-term outcomes requires elevated expertise to identify, analyse, and monitor the impacts of the secular forces that influence companies and economies.

Our framework for thematic investing was developed in collaboration with the Copenhagen Institute for Futures Studies, a recognised leader in the field of megatrends. The framework is designed to provide a high level of granularity applicable to thematic investing. We also incorporate insights from Pictet's 13 Thematic Advisory Boards.

Megatrends: from secular growth drivers to sustainable investment themes

Megatrends are a group of powerful social, demographic, environmental and technological forces of change that are reshaping our world and the future.

READ MORE

Megatrends in action

Climate change is one of the megatrends sitting within the environment cluster. Our investment professionals utilise the framework to assess the extent to which climate change and related megatrends constitute secular growth drivers for a particular investment theme.

Megatrend example: climate change

The impacts of climate change will have far-reaching implications for our shared prosperity. To mitigate its effects, governments and numerous sectors are creating solutions to reduce greenhouse gas emissions.

By supporting companies that seek to alleviate the problem, investors may gain exposure to emerging technologies like clean energy that will become increasingly important in the coming decades.

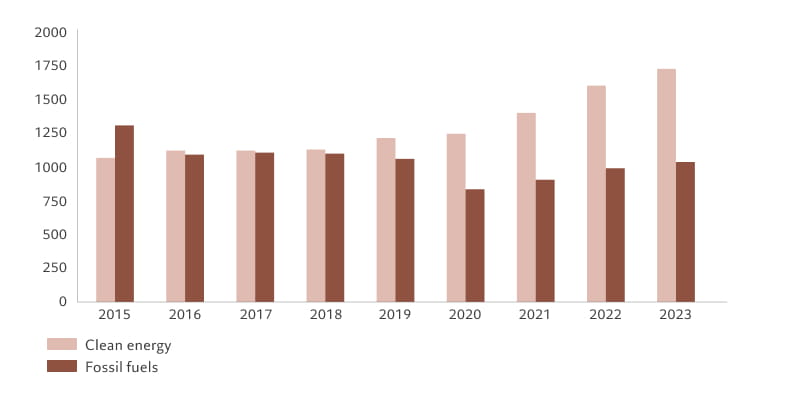

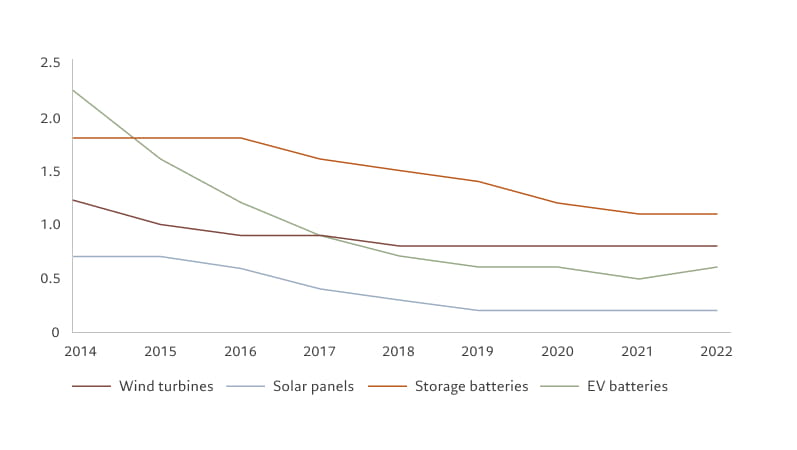

Investment in clean energy sources to address emissions reduction is increasing, while the price of mature clean energy technologies generally continues to fall over time.

Asia's changing role in addressing climate change

Climate change is one of the megatrends reshaping Asia and the world. Understand the sustainable and environmental investing strategies driving change.

READ MORE

The information and data presented in this material are for information purposes only and are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments in any jurisdiction. Investment involves risk.

Past performance is not a guarantee or a reliable indicator of future performance. Before making investment decision, investors should refer the offering documents. The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Information, opinions and/or estimates expressed in this material reflect a judgment at its original date of publication and are subject to change without notice. They are not prepared for any particular investment objectives, financial situation or requirements of any specific investor and do not constitute a representation that any investment strategy is suitable or appropriate for an investor’s individual circumstances or otherwise constitute a personal recommendation. Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on www.am.pictet in the “Resources” section. If in doubt, please seek independent advice.

For Hong Kong investors: This material has not been reviewed by the Securities and Futures Commission or any other regulatory authority. The issuer of this material is Pictet Asset Management (Hong Kong) Limited.

For Singapore investors: This material is issued by Pictet Asset Management (Singapore) Pte Ltd. This material is intended only for institutional and accredited investors and it has not been reviewed by the Monetary Authority of Singapore.