Asset allocation: positioned for a rebound in stocks

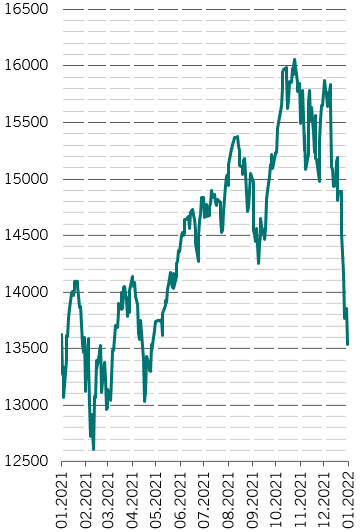

It’s been a gloomy start to the new year. Economic growth has disappointed, Covid cases have spiked and stocks and bonds have sold off sharply. But we believe the world economy and equity markets might be through the worst – at least for the short term.

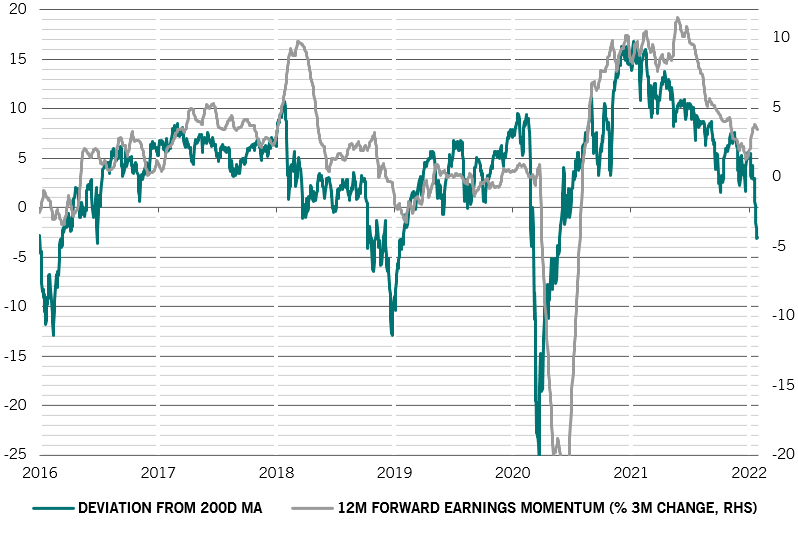

Following January's rout, we believe that global equities can return around 15 per cent by year-end, thanks largely to a 13 per cent rise in corporate earnings and a steady trickle of dividends. Global bonds, meanwhile, look likely to deliver capital losses.

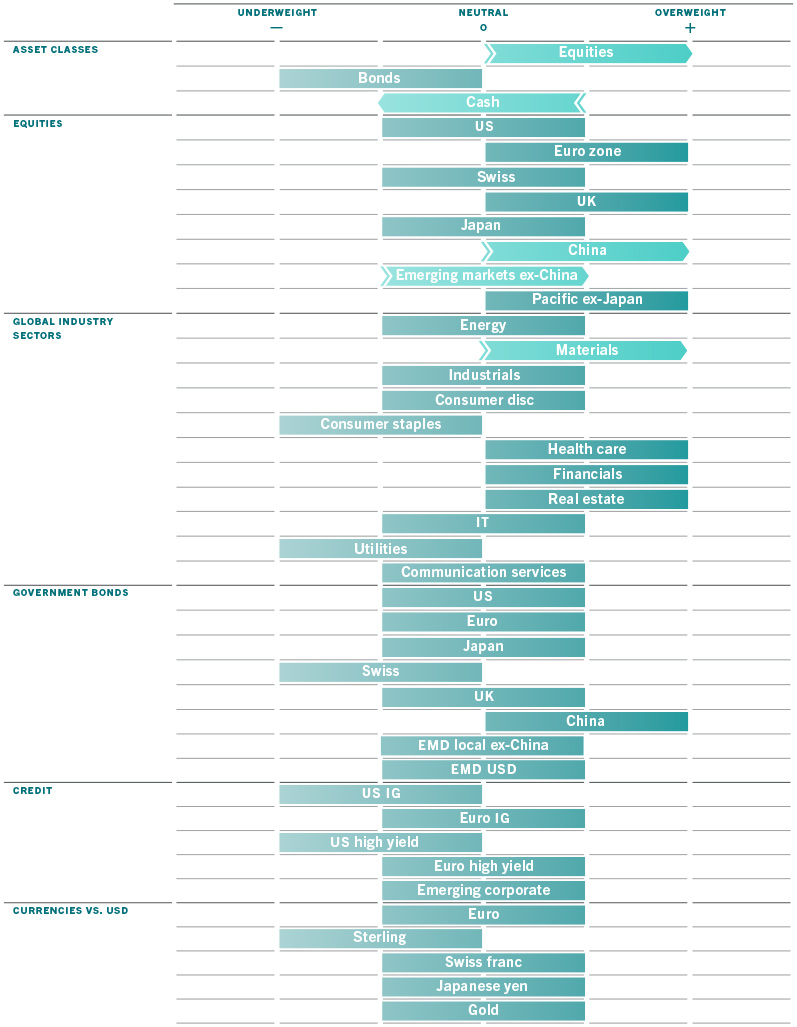

Taking advantage of attractive valuations, we have chosen to upgrade equities to overweight. This is a tactical move, conditional on the speed of US monetary tightening and on a successful resolution of the crisis in Ukraine. Reassuringly, our multi-asset risk appetite indicator – which measures the extent to which the market has been rewarding or penalising historical volatility – remains in positive territory, in contrast to past market corrections.

Even though recent economic data has been mixed at best, our business cycle indicators suggest the recovery remains intact. Although have reduced our forecast for global growth in 2022 to 4.4 per cent from 4.8 per cent, that projection is still above the 4.2 per cent consensus estimate.1

The negative impact from the Omicron Covid variant should largely be contained to the first quarter of this year and we continue to believe that a return to more normal economic conditions should be the theme for this year – service sectors should reopen and recover to pre-pandemic levels of activity, supply chain constraints should ease and, crucially, price pressures should peak early in the year.

In the US, we expect inflation to crest in March, which should offer some reassurance to financial assets by reducing the risk of excessive tightening from the US Federal Reserve. Delivery times are shortening and purchasing manager surveys are pointing in the direction of disinflation.

Elsewhere, we see more grounds for optimism in China, where a broad-based recovery is now evident across all sectors. While our leading indicator is still in negative territory, momentum has improved. The reacceleration in fixed asset investment is particularly strong, especially in manufacturing, and infrastructure spending is picking up as well. Credit conditions are improving, too, and policymakers remain willing to respond to growth concerns.

While markets are discounting the prospect of sharp tightening of monetary policy worldwide, our liquidity indicators paint a more balanced picture.

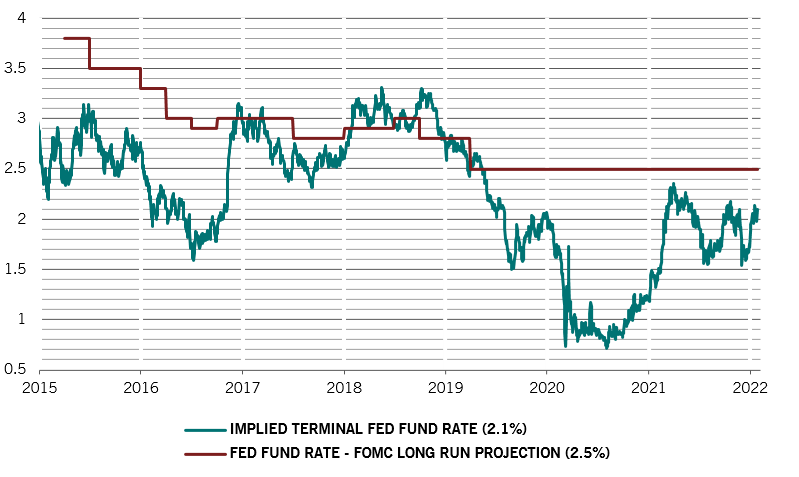

Clearly, our readings have felt the impact of the Fed, which has turned incrementally more hawkish; one FOMC member suggested the central bank could hike rates by 50 basis points in March. The market has already priced in more than four rate hikes for the year. However, there remains uncertainty around the timing, pace and data dependency of quantitative tightening and indeed around the impact it will have on assets.

We are looking at a potential 'quadruple tightening' in the US: an exit from quantitative easing (QE), rate hikes, the start of (QT) and real tightening as inflation recedes. Our liquidity models suggest that the cumulative effect of these moves may result in a 4.5-5 percentage point increase in the US “shadow” real policy rate – which is adjusted for QE and QT policy moves – this year alone.3 To put that in context, the tightening in 2014-19 was 6 percentage points.

But that tightening is offset by easier conditions elsewhere.

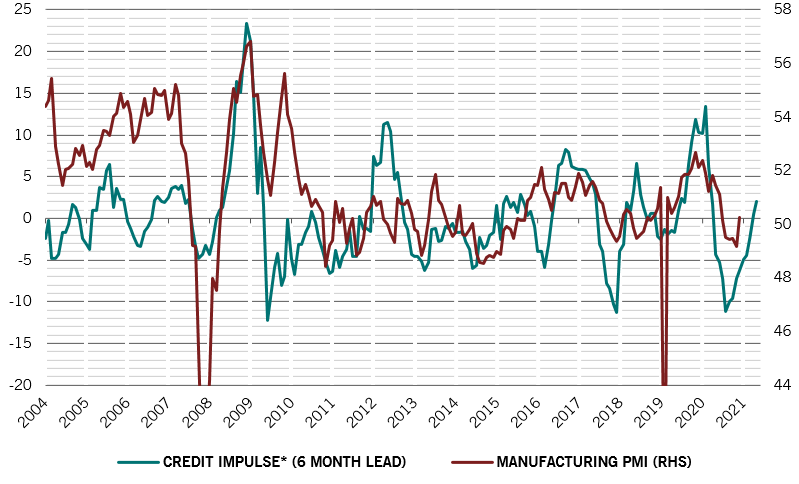

In the private sector, for example, the flow of credit is accelerating and has now reached 10.2 per cent of GDP on a global basis.2

Furthermore, even as some central banks are tightening policy, China continues to move firmly in the other direction. Since December, Chinese authorities have announced a 50 basis point cut in the reserve requirement ratio (RRR), a reduction in lending rates for small and medium-sized enterprises and rural loans and, crucially, a 10 basis point cut in policy rates and a cut in loan reference rates. The rhetoric from various policymakers appears synchronised, pointing towards further easing.

We will be watching closely, potentially on standby to return to a more cautious stance on equities later in the year if needed. For now, though, global liquidity conditions are broadly neutral for risk assets.

Our valuation indicators show that equities as a whole look relatively attractive, exhibiting the best valuation score on our scorecard since March and trading close to fair value. Given the approximate 20 per cent decline in MSCI ACWI’s price-earnings ratios since September 2020 (from 20.7 to 16.7 the pre-pandemic level) our models now suggest no further contraction in earnings multiples till year-end.

Among sectors, materials and healthcare stocks look particularly attractively valued and even tech is no longer excessively expensive. Chinese equities are well positioned to make up for some of the steep underperformance seen in 2021. China is currently one of the cheapest equity regions, according to our models.

Valuation scores have also improved across fixed income, too.

Technical indicators show poor seasonality trends for bonds; bond funds have seen only muted inflows since the start of the year. In contrast, equity funds have seen inflows of some USD67 billion, despite the recent sell-off. Notably, flows into Chinese stocks have accelerated, chiming in with our more positive stance on its stock market.