Asset Allocation: no spring thaw

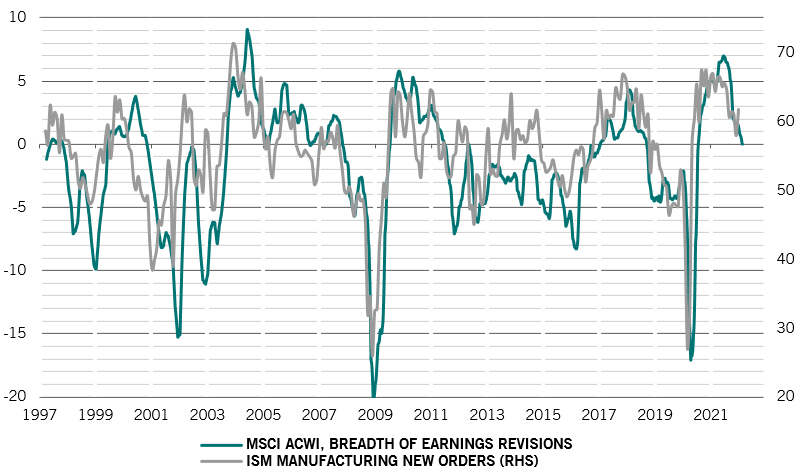

With the Russia-Ukraine war entering its second month, expectations for even slower economic growth and higher inflation are mounting. Given weaker consumer sentiment and persistent volatility in energy prices, the global economy is unlikely to expand as much as initially hoped. While many economies will still grow above trend, we believe risks to corporate earnings are skewed to the downside.

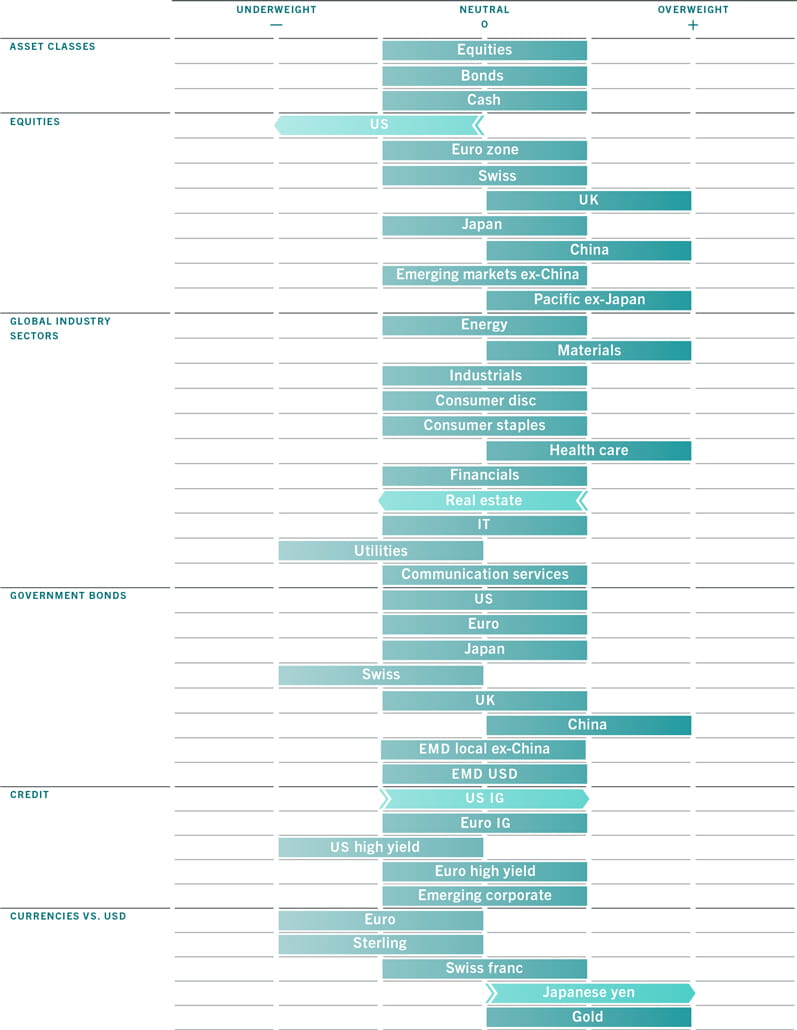

Against this backdrop, we downgrade US equities to negative. A growth-oriented market with the most unattractive valuation in the world, we think US stocks are likely to bear the brunt of the adjustment, with sectors sensitive to interest rates and economic cycles especially under pressure.

That said, we don’t think an outright negative stance on equities is warranted. Investor morale is bouncing off very depressed levels, offsetting deteriorating fundamentals at least in the short term. We therefore remain neutral on equities and bonds.

In our analysis of the business cycle, we downgrade our global growth forecast to 3.5 per cent this year from 4.4 per cent; we expect emerging economies and the euro zone to suffer more than other areas, given their proximity to the Ukraine conflict.

Our global inflation forecast this year rises to 7 per cent from 5.1 per cent, although we expect to see a peak in price pressures in the coming few months.That said, the world economy has room to absorb the double shock from higher oil prices and tightening monetary policy.

In the US, energy intensity, which measures the quantity of energy required per unit output or activity, has fallen sharply since the 1970s, while household balance sheets remain healthy with their debt service ratio 4 percentage points below 2008 levels. Other buffers built through the Covid pandemic include excess savings, which stand at 10 per cent of GDP.

We are turning more bearish on the euro zone than the consensus, with our 2022 growth forecast downgraded to 3.2 per cent from 4.1 per cent. Our leading indicators are slipping into territory consistent with recession and are now at their lowest in more than a year. Consumer sentiment indicators are dropping precipitously, which augurs badly for consumption in the coming months.

China’s economy saw some strong momentum following its initial recovery from the pandemic in the fourth quarter. However, a renewed surge in Covid cases and fresh lockdown measures may hurt short-term growth prospects in the world’s second largest economy, eclipsing early signs of a turnaround in construction activity.

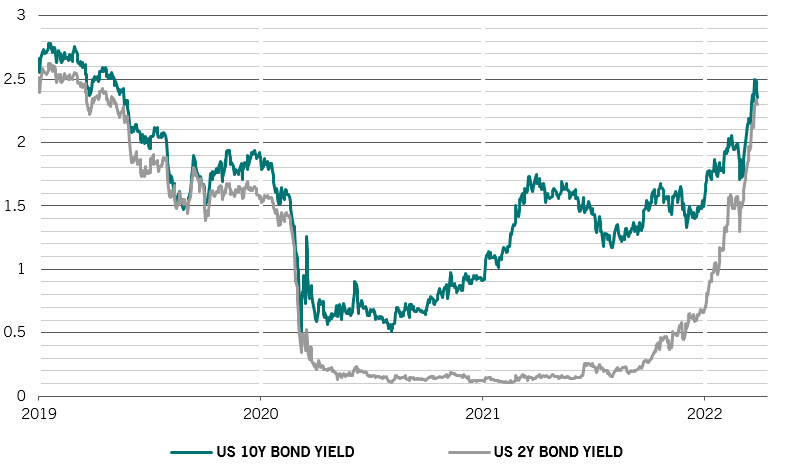

Our liquidity reading continues to deteriorate because of central bank tightening in the US and UK. We think the US Federal Reserve has completed 40 per cent of the tightening we expect it to deliver in this cycle, and should reach 75 per cent by the year end. If anything, investors should be wary of even faster tightening, which will put pressure on the economy. China’s liquidity conditions are improving but the pace of monetary policy easing is slower than the central bank rhetoric suggests.

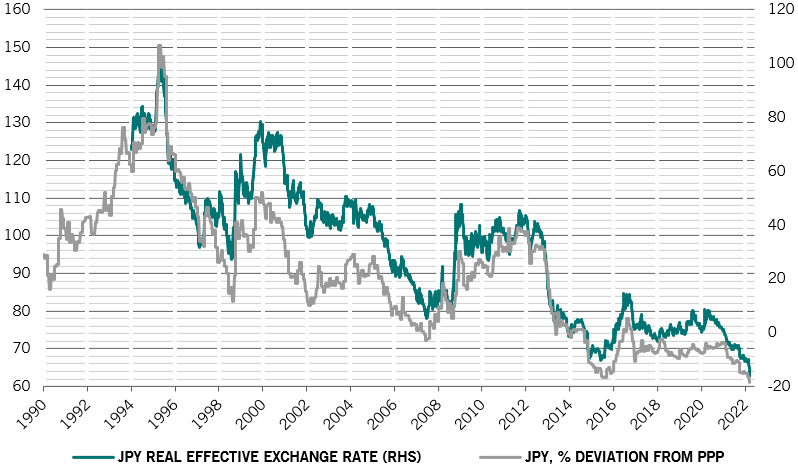

Japan’s liquidity conditions are tightening slightly as the Bank of Japan continues to phase out its ultra-easy monetary policy. The central bank, however, is pledging to defend its yield cap against the global tide of higher interest rates by offering to buy unlimited amounts of 10-year Japanese government bonds. This is leading to a sharp sell-off in the yen (see Fig. 2).

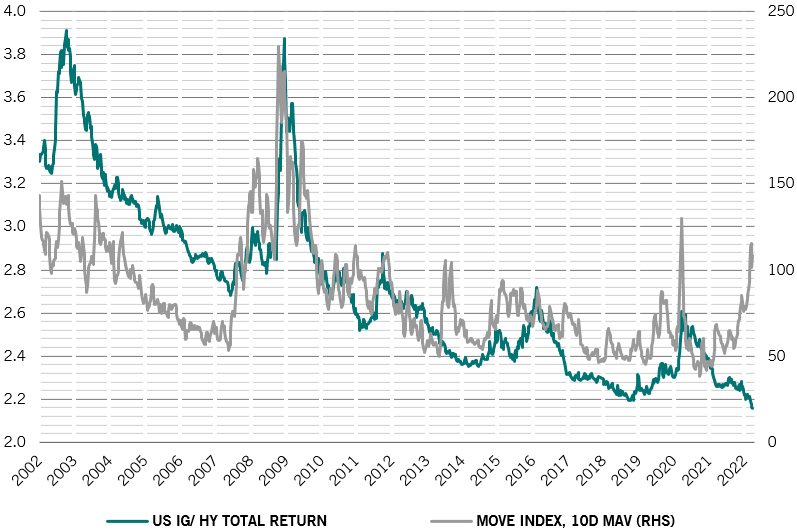

Our valuation indicators for bonds have turned positive after the recent sell-off in major government bonds. Investment grade credit, which is the worst performing major asset class this year, appears oversold and attractive relative to riskier bonds.

The overall score for equities is still negative. With deteriorating liquidity and higher real yields, a further decline in price-to-earnings multiples is possible. In the following 12 months, we expect a contraction of around 5 per cent, which suggests total equity returns could end up flat in 2022 compared with the previous year. That said, pockets of value are opening up in euro zone and Chinese stocks. US and technology stocks remain unattractive from a valuation standpoint.

Technical indicators support our neutral stance for equities. Investor sentiment has bounced off strongly from depressed levels, in line with falling implied volatility in the asset class. A drop in implied volatility below the realised measure makes protection from future sell-offs cheaper. This, in turn, is making it more attractive for investors to take on more risk.