Health care, re-invigorated

The health care industry's fight against the coronavirus should boost its long-term investment appeal.

The global health care sector is pulling out all the stops in the fight against the coronavirus. Not only have pharmaceutical, life science and health care equipment companies deployed a range of advanced technologies, they have also shown a remarkable willingness to work together to battle their common enemy. This could re-invigorate the entire industry, and boost its long-term investment prospects.

Its first major success could come within 12 months, by which point there is likely to be a significant increase in range and availability of effective coronavirus treatments. That will vastly improve the global population’s ability to live with the disease. True, vaccine development will take a while longer.

Questions remain over the safety and durability of treatments, and it is also not yet clear whether vaccines will have to be tailored for different demographic groups (the elderly, children). Complicating matters further, the medical profession does not yet know how long antibodies will protect those who have already been infected.

But even without an early breakthrough on vaccines, huge progress is possible.

In the early days of HIV, for example, average life expectancy upon diagnosis was two years. Now, with the help of a daily tablet, people can expect to live a normal-length life.

What is most encouraging is the level of collaboration that we are seeing in what has historically been a disparate and opaque industry. Sanofi and GSK – two of the biggest vaccine manufacturers – are working on a joint venture, AstraZeneca is collaborating with Oxford University.

Through such partnerships, health care companies have the opportunity to speed up the development of treatments against coronavirus and to demonstrate that it is an industry that serves the common good. That would mark a major turnaround for a sector long plagued by scandals over excessive drug prices and poor safety disclosure.

It is clear that the pharmaceutical industry in particular needs to abandon the short-term profit maximising strategies it has pursued in prior periods in favour of a long-term, patient centric model. Such a shift would lead to more stable profit growth over the next decade.

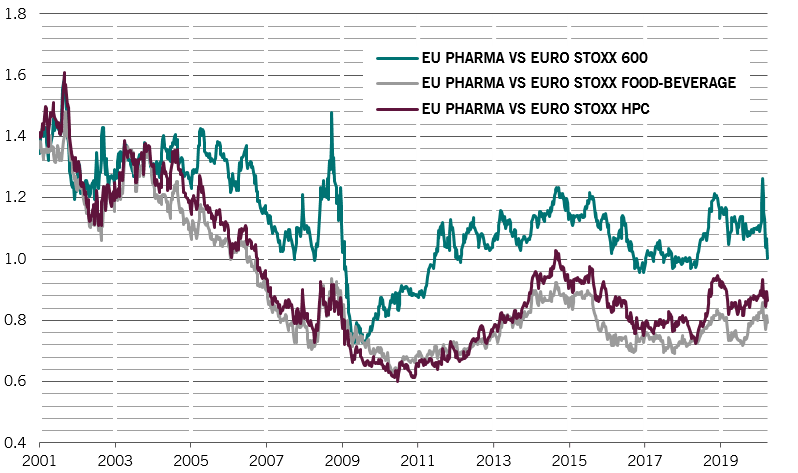

That in turn could lead to valuation uplift for health care stocks. Despite their recent strong performance, European health care companies still trade at a 20 per cent discount to their counterparts in the food and beverage sector, in price-to-earnings terms (PE). If the industry is willing to learn from mistakes, to work with society and to switch its focus to sustainability of earnings rather than profit maximisation, we believe that gap can close over the coming years.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.