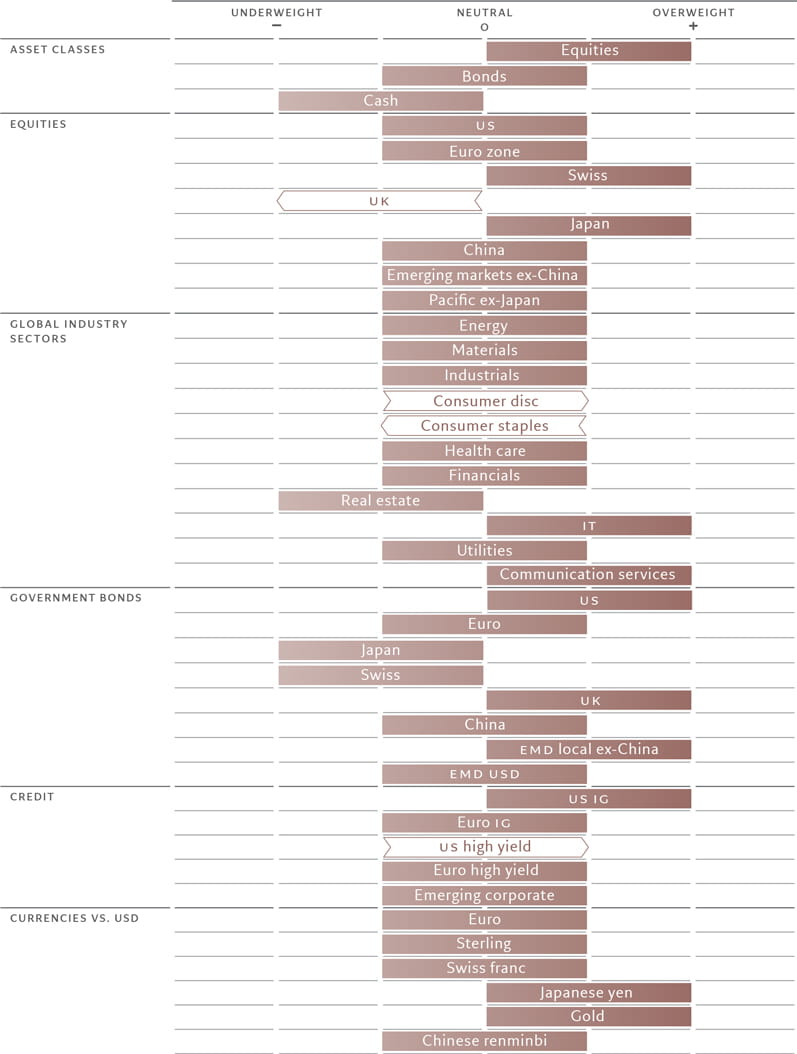

Asset allocation: equities still looking good

The US economy’s resilience and US inflation’s resistance to swiftly return to the US Federal Reserve’s target means we remain overweight equities and neutral bonds.

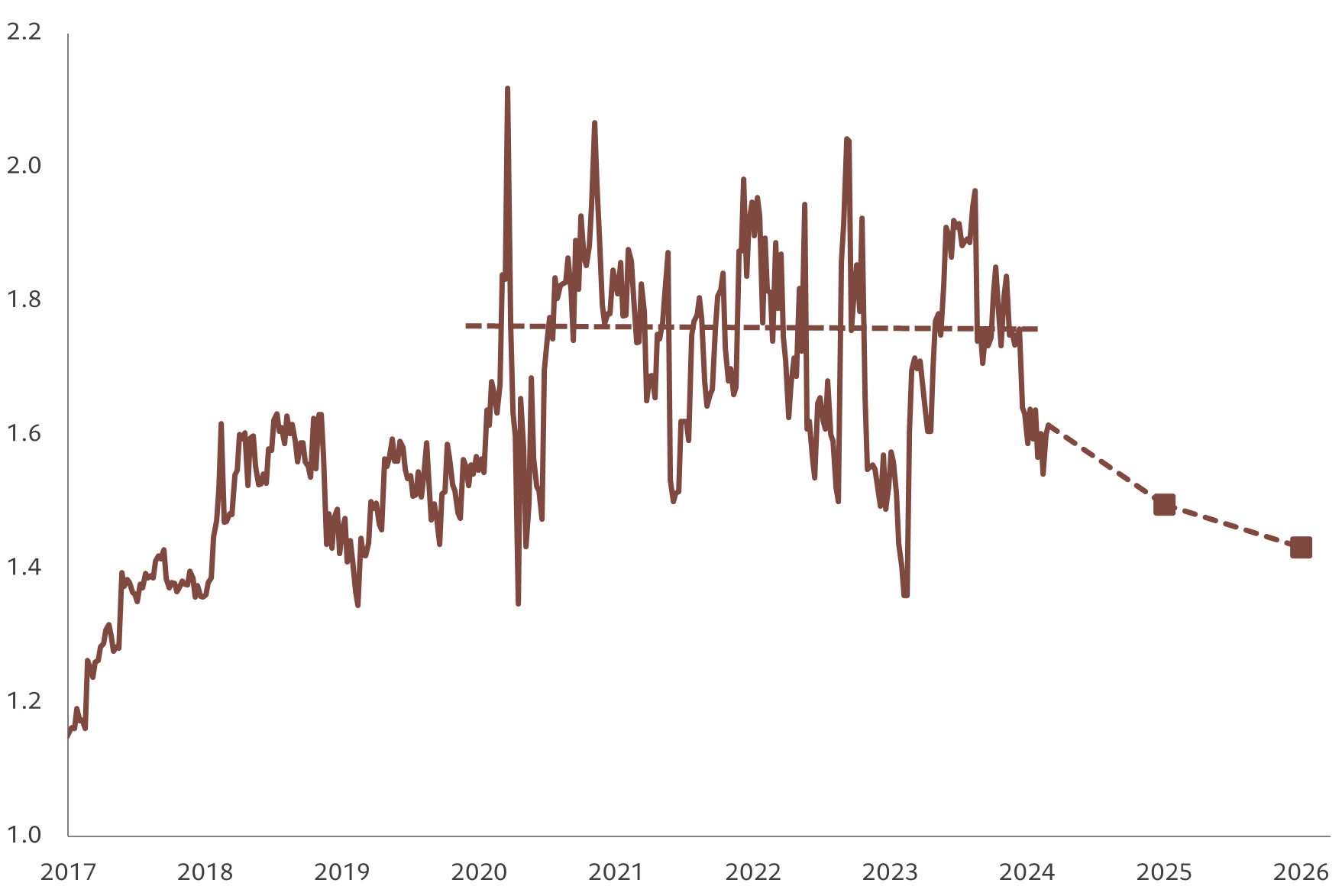

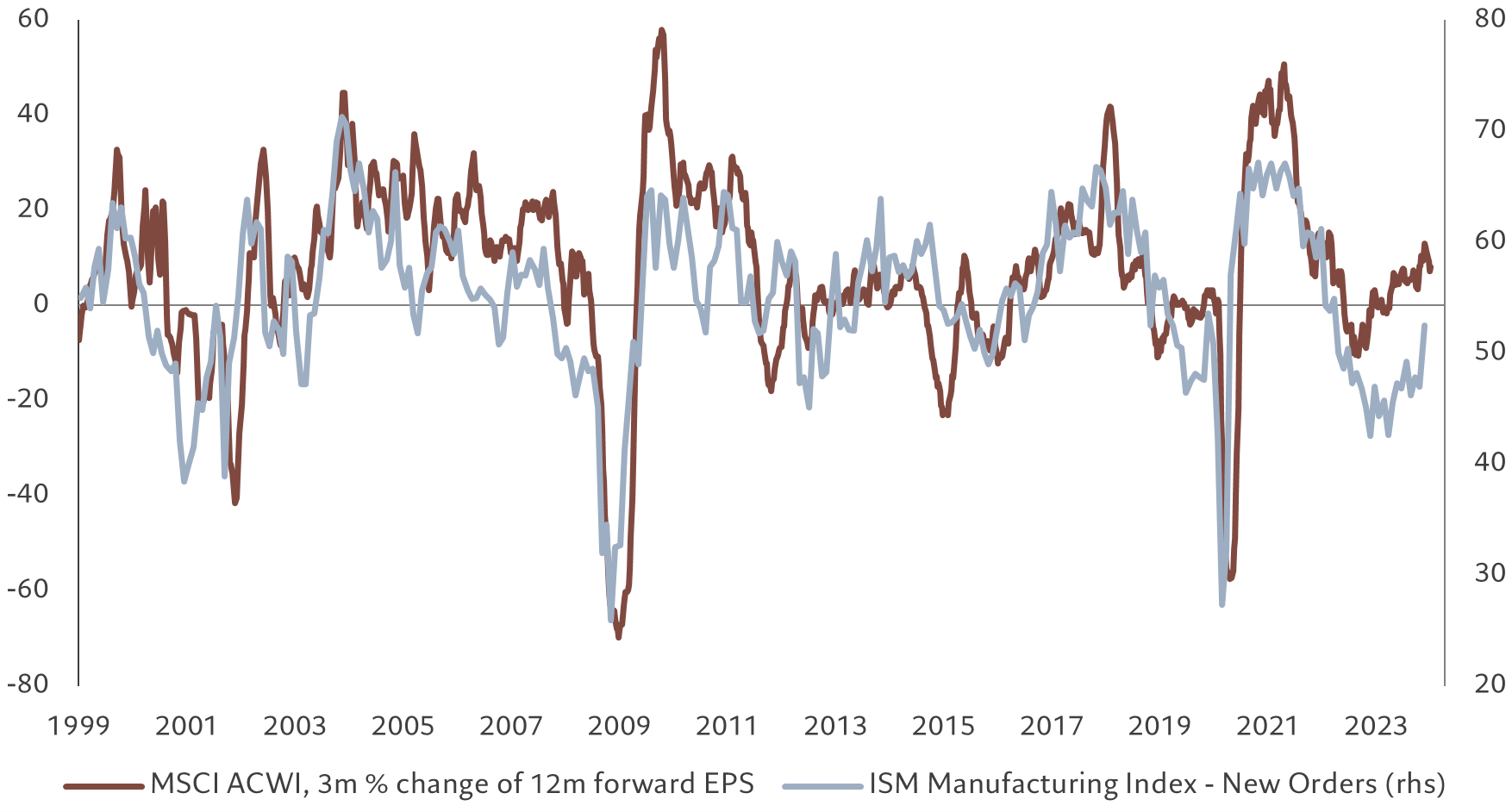

We retain our view that economic growth will slow later in the year, but the timeline is stretching. Corporate profits remain buoyant and the Fed is clearly indicating an aversion to premature monetary easing. So where a few months ago we felt that bond valuations were attractive we now think they’re fair; the near -term prospects for equities, meanwhile, remain encouraging. As Fig. 2 shows, earnings among the world's listed companies have been responding positively to improving US economic data.

Our business activity indicators show that the US economy is stronger than we’d previously envisioned and is one reason why we remain overweight global equity.

If US consumers continue to spend much more than they save - the US savings rate is currently running at 3-4 per cent of disposable income compared to a historical 7-10 per cent - both growth and inflationary pressures could remain elevated for some time. Inflation looks likely to linger as price rises within services sectors remain high and conditions in the labour market are still tight.

On balance, though, we think consumer and business spending will eventually fade, converging towards the other already weak parts of the US economy, like the residential sector.

In contrast with the US, the euro zone has been flirting with recession for the past few months due to weak manufacturing activity. Growth should pick up, however, as the post-Covid supply shock and impact of the Ukraine war both lessen. Elsewhere in Europe, the UK economy is flat, with construction activity struggling and the hitherto tight labour market starting to loosen. On top of that there are signs that inflation expectations are starting to pick up, hampering the Bank of England's ability to cut interest rates.

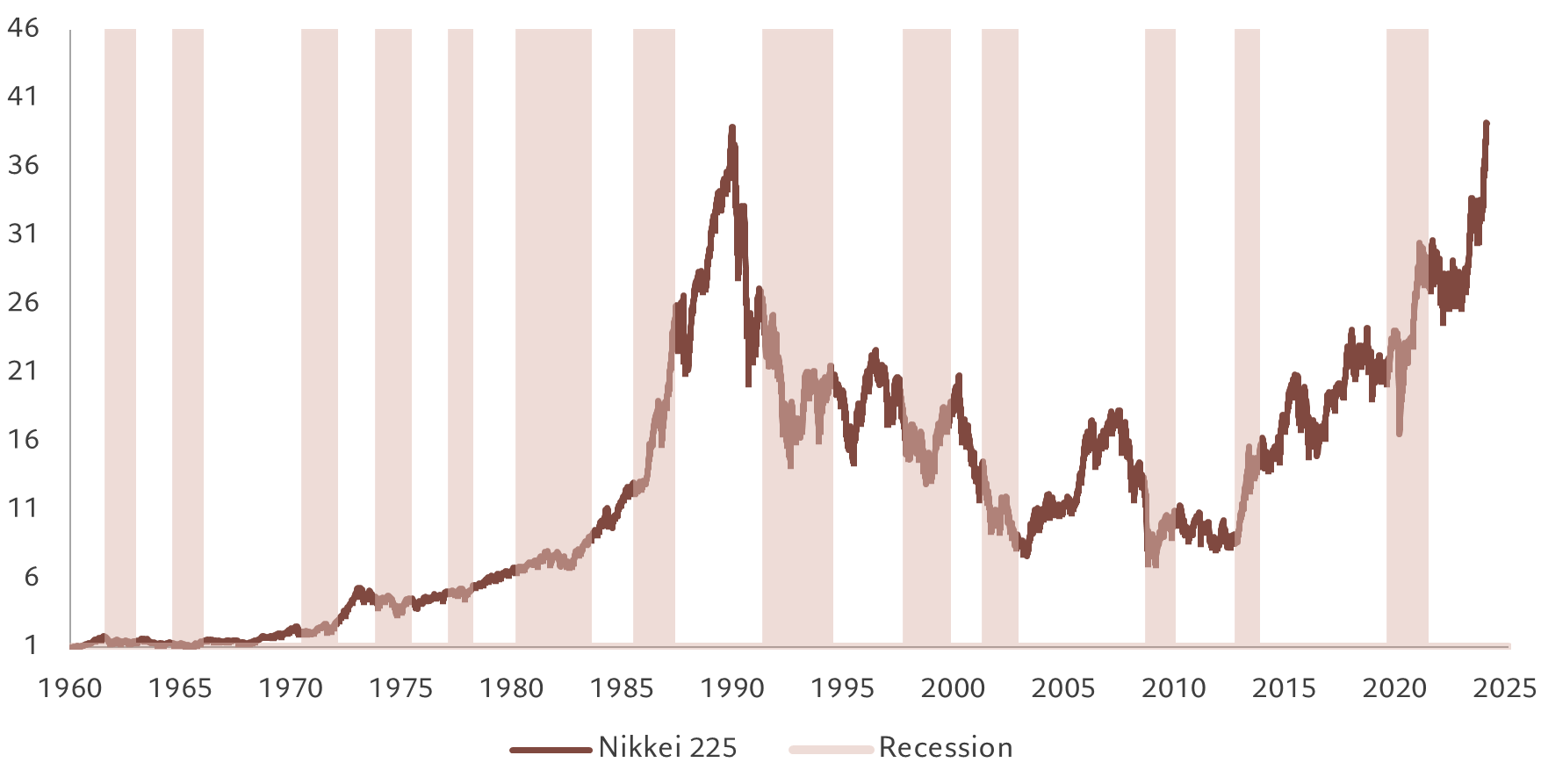

Japan’s economy is also starting to splutter. Retail sales are contracting, as are machinery orders. And industrial production is still very weak. Nonetheless Japan’s is still expected to grow near its long-term potential while its long period of deflation is finally over.

Strengthening the case for being overweight equity are our liquidity indicators. These show a short-term increase in the supply of liquidity from both central and private sector banks. Even the Swiss central bank has started to shift from quantitative tightening to easing. But it’s not certain the easing will gather pace. Signs from the Fed are that its central bankers view the risks of waiting a little longer to cut rates as smaller than the risk of cutting too soon and then having to reverse course.

As for private credit, banks are beginning to ease lending standards. It’s early days yet, but the direction is clear. The question, though, is of magnitude.

Elsewhere, the Chinese central bank has accelerated its modest pace of easing policy, but it remains alert to any potential foreign exchange instability, which is likely to limit how far it goes. For now, it is focused on targeted credit provision.

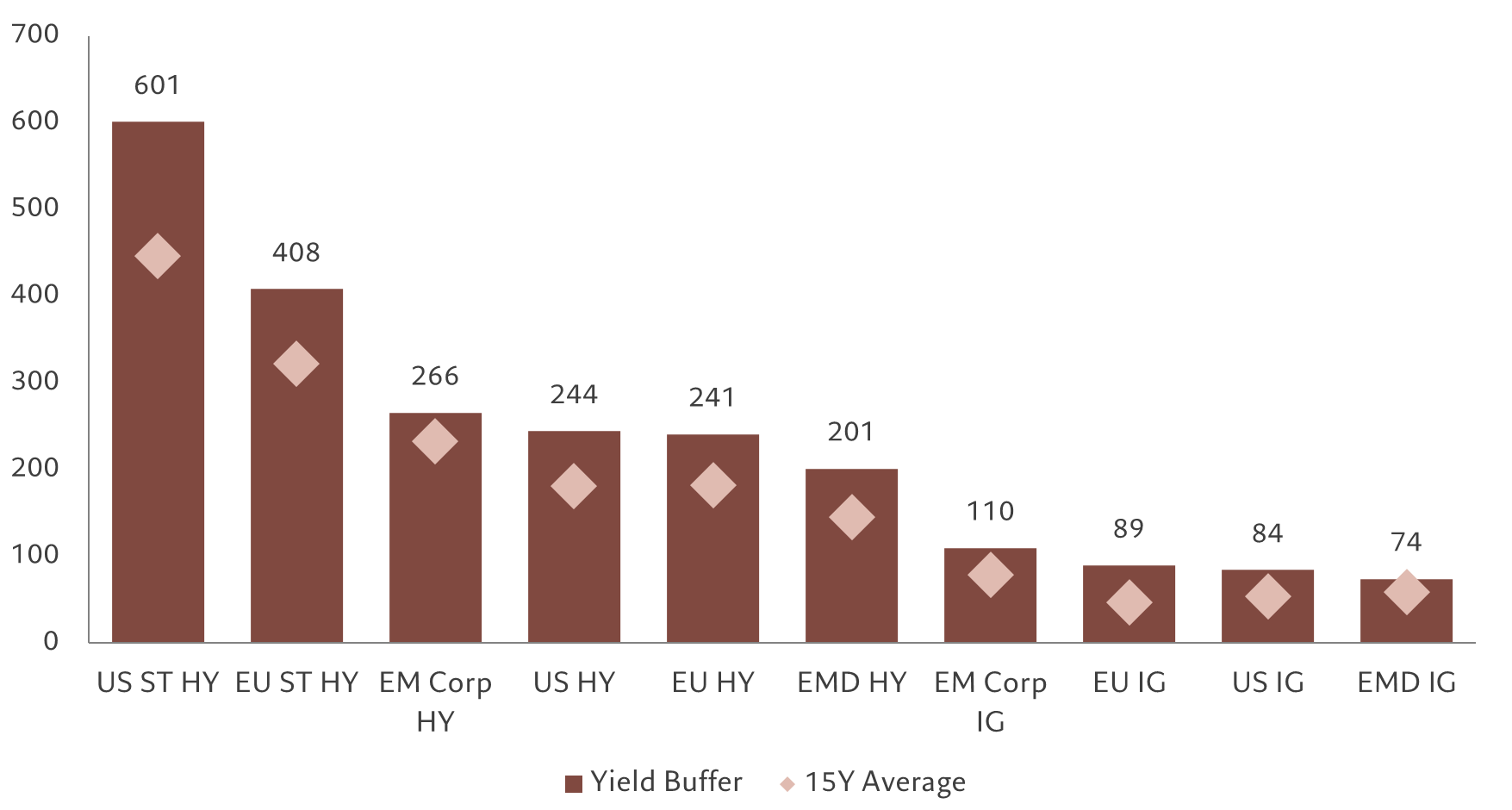

Our valuation indicators show equities trading at their most expensive levels since December 2021. With US equities trading at multiples of 20.5 times earnings - considerably higher than the 10-year average of 17.5 - there appears to be little headroom for the market to add much to its gains. Still, corporate earnings have been solid and consensus analyst projections for 2024 are now reasonable considering the continued resilience in global growth. Bonds are marginally more attractive, with US government bonds at fair value and inflation-protected Treasuries also trading at reasonable levels. Gilts look attractive too, albeit vulnerable to news from the upcoming budget.

Our technical indicators show that equities are supported by a strong trend while bonds are less so and Chinese bonds look overbought.

Investor positioning data paints a less positive picture for riskier assets, however.

Risk sentiment among professional investors is firmly in bullish territory according to market surveys, with fund managers having cut their cash positions and turning their most overweight on equities for two years. Moreover, portfolio flows into equity and bond funds have been strong while those into money market funds have slowed. All of which suggests there is less scope for the market to extend its rally.