Asset allocation: the value of bonds

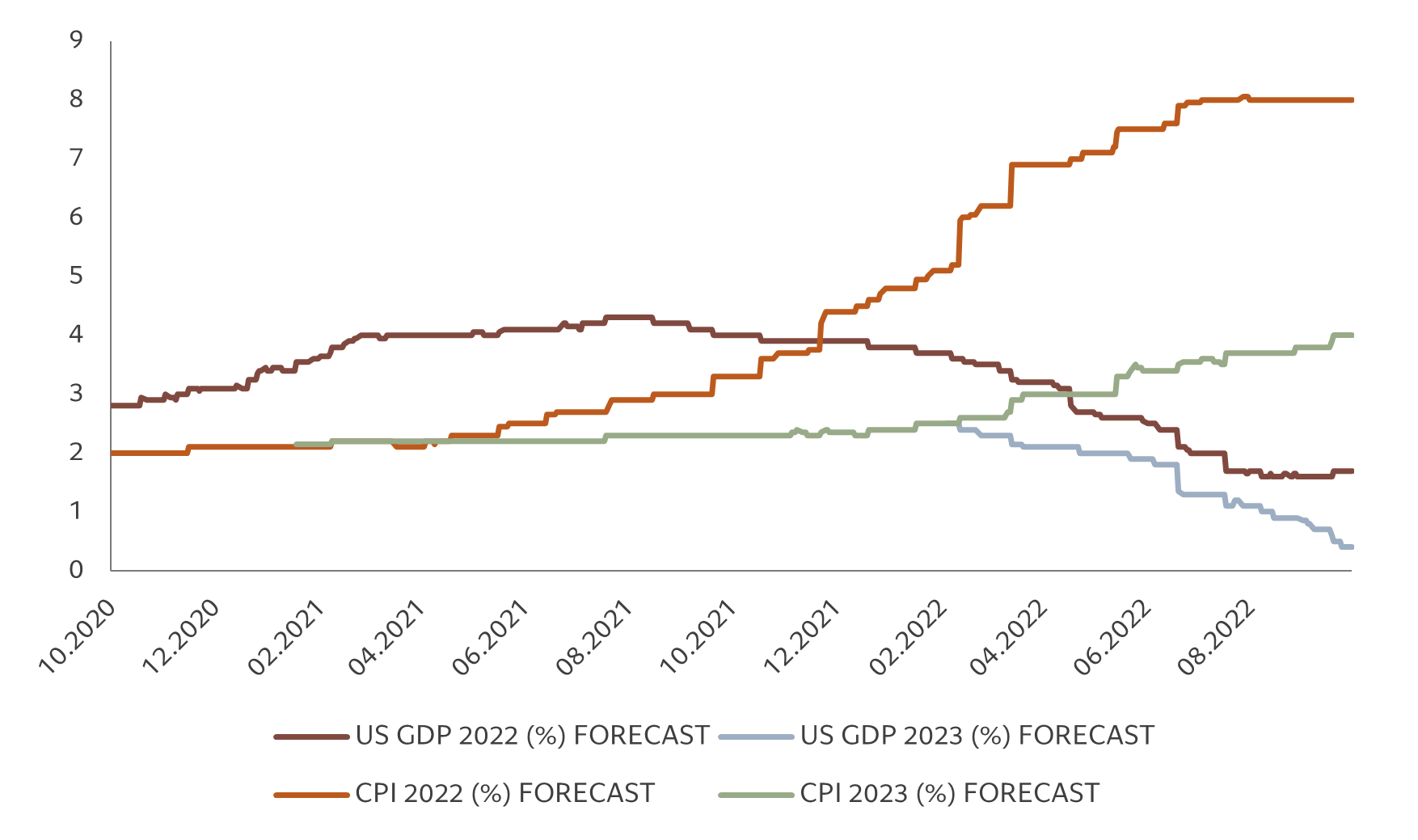

Prospects are darkening for the world economy. As central banks raise interest rates to combat inflation, GDP growth will slow further, raising the probability of a worldwide recession.

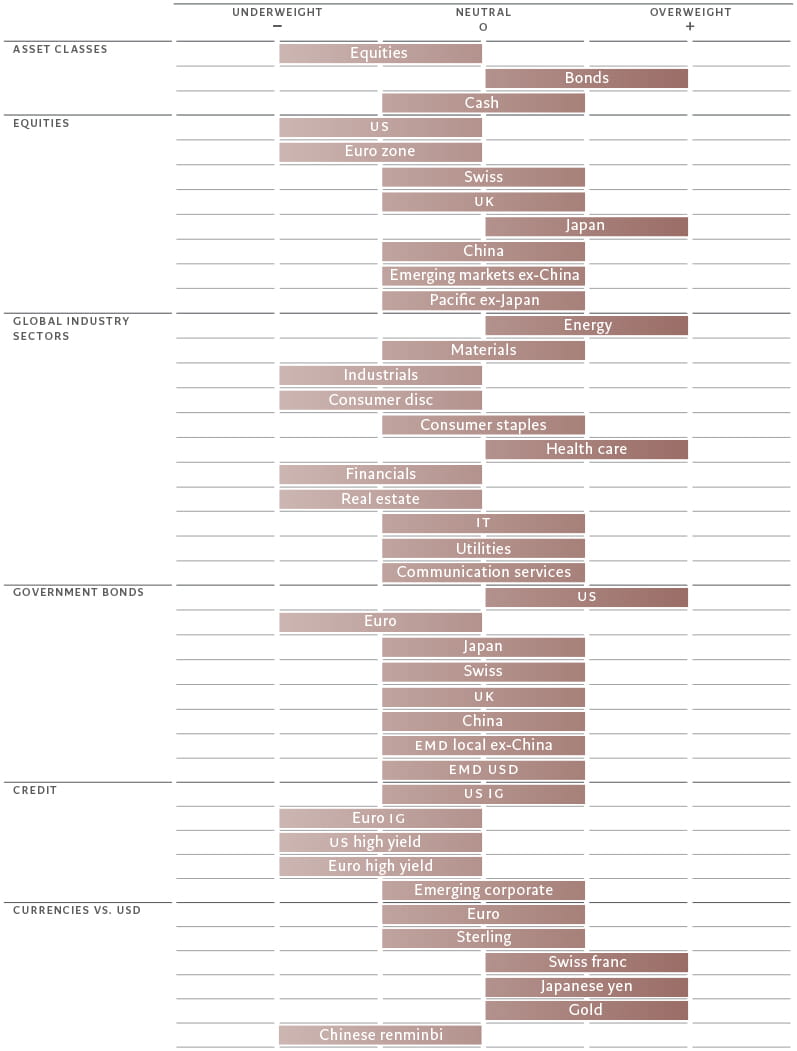

With global liquidity conditions continuing to worsen at the same time, we retain our underweight on equities, whose valuations are even more difficult to justify after the recent market rally. We hold our overweight on bonds; US Treasuries in particular are trading at levels that offer inexpensive protection from ongoing weakness in the economy.

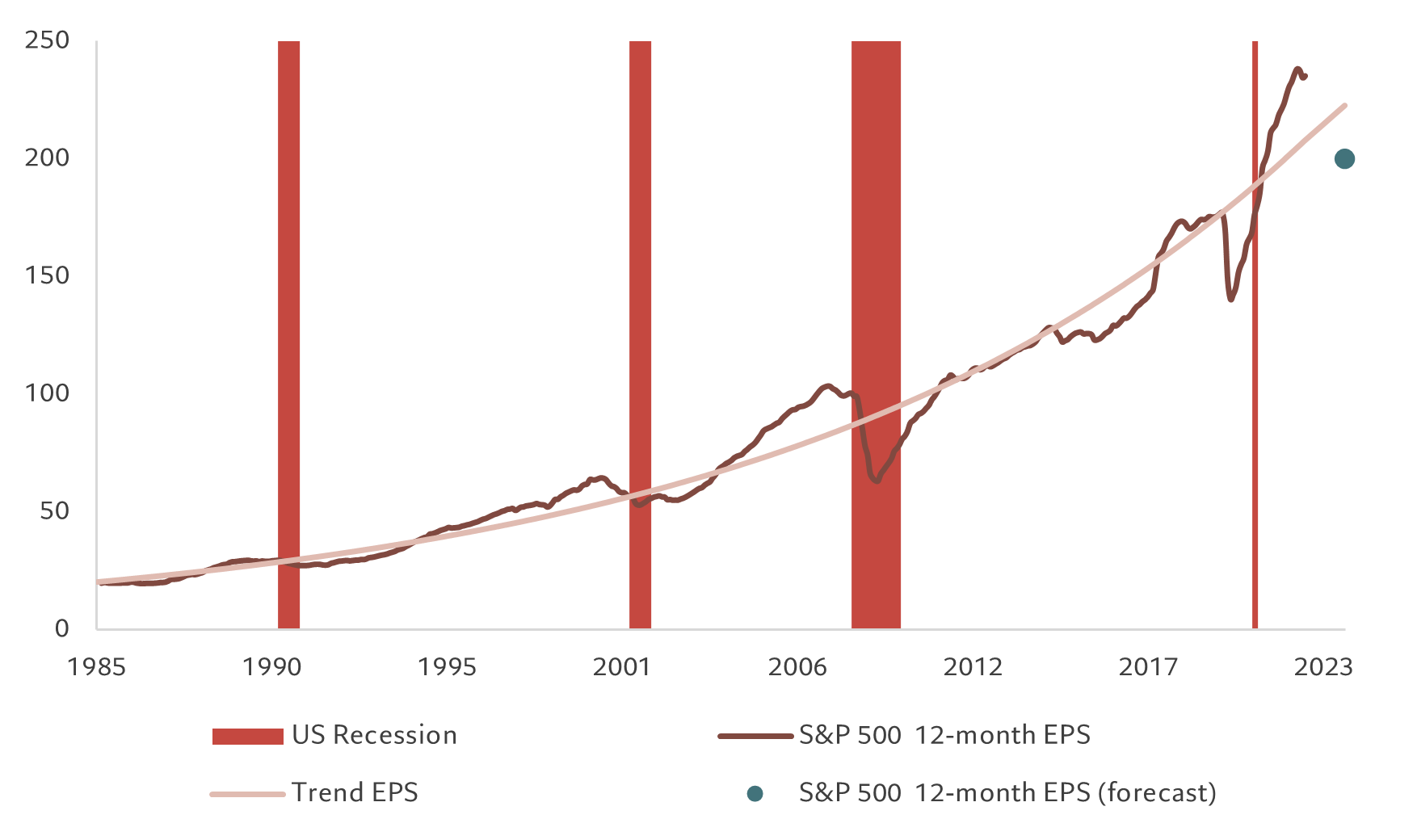

Our business cycle indicators show that momentum in the US is negative and deteriorating, as reflected in analyst forecasts (see Fig. 2). There is increasing evidence of weakness in the housing market, construction activity has collapsed and domestic demand has stalled.

Looking ahead, we expect US GDP growth to slow to well below trend for the next three quarters (at an annualised 0.4 per cent quarter-on-quarter) before a tepid recovery emerges in the second half of next year. Even if price expectations appear stable – a silver lining of sorts – there is still a risk of persistently sticky inflation. This, in turn, would trigger additional monetary tightening and tip the US economy into recession.

For the euro zone, a recession looks even more likely and, indeed, is our base case scenario. One positive is the improvement in energy security dynamics thanks to increased gas storage levels (with a number of countries at full capacity) and a corresponding fall in gas prices. Nevertheless energy rationing beyond the winter months is still a possibility, which poses a risk for industrial production.

Elsewhere, in the wake of President Xi Jinping’s consolidation of power in China, we are reassessing both the near- and medium-term prospects for the Chinese economy. The annual Central Economic Work Conference due to take place in December should offer further clarity on the direction of economic policy.

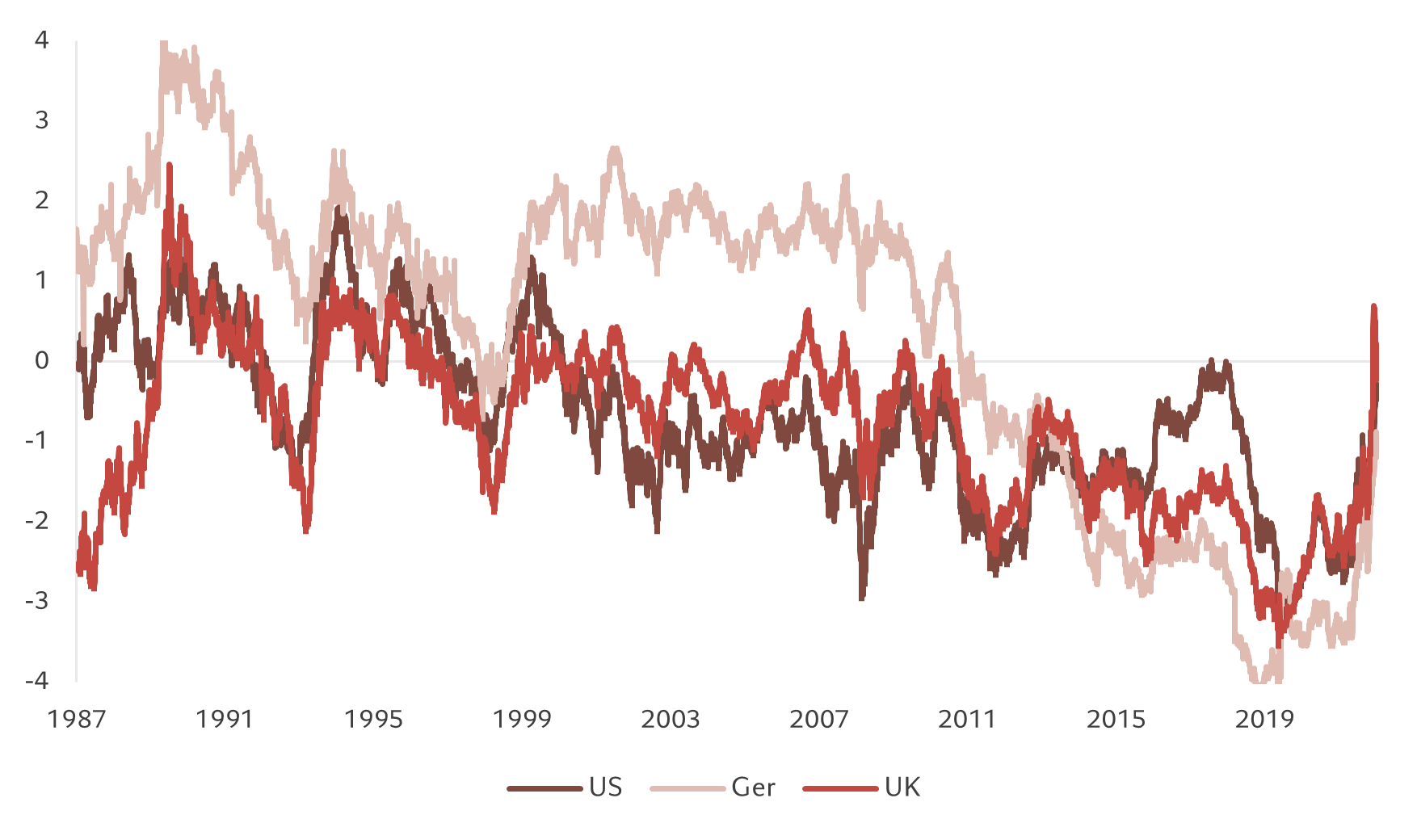

Our liquidity indicators show that excess money – which we measure as broad money minus domestic industrial production growth – is shrinking rapidly. Some USD8 trillion of post-pandemic monetary stimulus has been withdrawn by central banks since March. At the current pace, it would take another five months to reclaim pre-pandemic trends and fully purge monetary inflation. The effects of quantitative tightening - the selling of bonds held by the US central bank - have been amplified by the actions of both commercial banks and central banks in the emerging world, which have also been shedding holdings of US bonds.

We expect that liquidity conditions will remain negative for riskier asset classes heading into the start of the new year, and quite possibly longer, which would normally put pressure on stocks’ earnings multiples.

The main change in our valuation models is that fixed income offers increasingly good value, with global bond yields now at their highest levels since mid-2011. Notably, 10-year US Treasury yields have surged to 4.3 per cent, far exceeding our fair value estimate of 3.5 per cent.

Although stocks have suffered a sharp sell-off – the MSCI World index is down 22 per cent year-to-date – they are not yet cheap enough to account for possible further deterioration in economic growth and corporate earnings prospects. We see global earnings per share staying flat over the coming 12 months, well below the analyst consensus of 6 per cent growth. Even our forecast could prove optimistic.

Technical indicators support our underweight stance on equities. Trend signals remain weak across regions. Investor positioning in riskier assets is relatively cautious, especially among institutional investors. Net long positions on S&P 500 futures are at a record low, pricing in a significant deceleration in growth momentum, which could be consistent with the US ISM index falling to 45 (compared to September’s level of 50.9).