Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

What does the Russia-Ukraine crisis mean for markets?

Russia's invasion of Ukraine has unnerved investors. But the economic fallout from the conflict appears manageable.

Russia’s invasion of Ukraine has unsettled financial markets, causing a steep sell-off in equities and a rally in gold and oil.

The military assault could indeed have serious consequences for the global economy, but the range of possible outcomes is wide. While Russia has stated it does not plan to occupy the country, it is not clear whether it will settle for a limited offensive or is preparing a longer campaign that would lead to a wave of severe economic sanctions from the West.

Faced with these scenarios, investors could be forgiven for wanting to shore up their defences. Yet we would caution against taking drastic measures. History suggests that wars do not always lead to sustained declines in riskier assets. Much depends on how long the conflict lasts.

Take the Iraq war of 2003, for instance. While stock markets were weak in the lead up to the US invasion of the country, they began to recover within 10 days of the start of the military campaign.

At the same time, it is important to put Russia’s economic influence into context. It accounts for just 1.8 per cent of world output – a level that is lower than Italy’s. And while it has a population of 143 million, double that of France, it is not a major export market for most countries.

All of which means that if a protracted conflict can be avoided, the economic fallout should remain manageable, allowing the world to build on its recovery from the pandemic and the bull market in equities to continue.

Source: Pictet Asset Management, CEIC, Refinitiv

Our analysis shows that economic growth remains relatively strong – we see global GDP rising by 4.4 per cent this year (0.2 percentage points higher than consensus forecasts). Crucially, savings levels – among both households and corporations – are high, while monetary and fiscal policies remain supportive.

Inflation is a much greater risk, particularly given that the Ukraine crisis has caused a surge in oil prices – which were already high in the first place. Even before the Russian invasion we had raised our forecast for global inflation to 5.1 per cent this year (from 4.1 per cent a month ago).

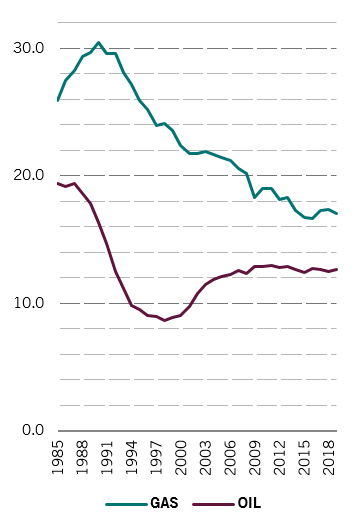

Russia is responsible for 13 per cent of the world’s oil production and 17 per cent of its gas. It is also a major producer of metals, particularly palladium, platinum and gold.

Taking Russian supply out of the equation could usher in a sustained rise in the price of oil and other commodities, adding to global inflationary pressures. Higher prices would reduce consumer purchasing power and possibly eat into corporate profit margins.

However, here too we see mitigating factors. The base effects on inflation are about to turn more favourable and Covid-related transitory factors (such as supply chain disruptions) are abating. Even with oil prices at around USD100, we would expect headline inflation to start declining in the coming months.

Another silver lining for the economy could be that central banks – having in recent weeks ramped up their hawkish rhetoric – see fit to scale back their monetary tightening plans.

Defensive measures

Still, there are some defensive measures investors might want to consider, particularly given Russia’s position as major oil, gas and metals exporter to several major economies.

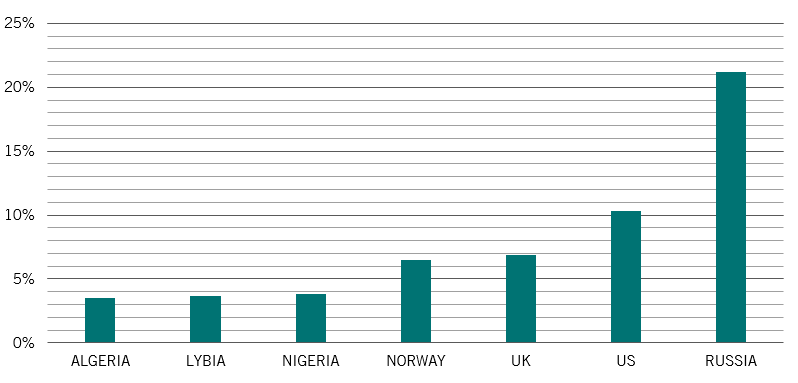

From this vantage point, the euro zone also stands out as being at risk. Our analysis shows that 21 per cent of the euro zone’s energy imports come from Russia. Combine that with the more hawkish tone from the European Central Bank in recent weeks, and we think a more cautious stance on European equities could be warranted.

However, it is important to point out that the euro zone’s trade ties are not strong outside energy, which accounts for two-thirds of the value of euro zone’s Russian imports. Europe does have some exposure via its banking sector but that, too, is modest. Even in Austria, whose banks have by far the strongest links to Russia within the euro zone, exposure is equivalent to just 1.7 per cent of GDP, according to our analysis. On the other side of trade, meanwhile, Russia consumes 2.6 per cent of euro zone’s exports.

Of course, there is a fine line between keeping calm and being complacent. The situation is clearly volatile. The conflict – and economic sanctions – could become more serious, which in turn would have more significant consequences for the global economy and markets. Raw materials, gold, Swiss franc and Chinese assets could all serve as potential hedges against such risks.

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Investor Information Document (KIID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 15 avenue J.F. Kennedy, L-1855 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any. The KIID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus.

The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.