Asset allocation: policy bazooka

The global economy is grinding to a halt.

Nearly one in three people in the world is under lockdown to stop the coronavirus outbreak, leading to widespread factory and shop closures.

Testifying to the gravity of the problem policymakers face, the most recent jobless data showed the number of Americans filing claims for unemployment benefits hit a record

3.28 million in the week to March 21. That’s a surge of more than 3 million from the previous week.

In such an environment, corporate profits are sure to decline sharply, as will dividends. Financial markets have consequently experienced dizzying levels of volatility.

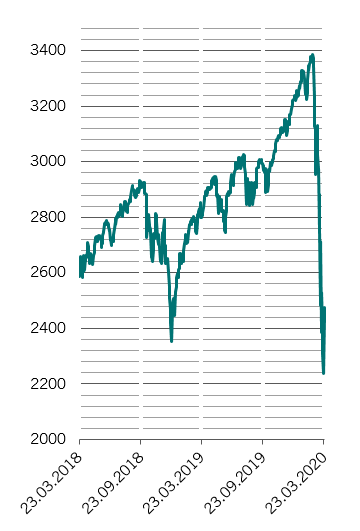

The S&P 500 index, for example, fell 35 per cent in the space of a few weeks – a decline that is comparable to that of Black Monday in 1987 and the 1929 crash.

Drastic times call for drastic measures, and that’s precisely what central banks and governments worldwide are putting in place.

We expect central banks to provide monetary stimulus that is equivalent to as much as a tenth of global GDP this year, while fiscal easing will equate to around 4 per cent of economic output.

It is thanks to these truly bold, coordinated measures that we believe the global economy will avoid a prolonged downturn.

However, investors should not let their guard down. Financial markets will experience renewed bouts of volatility in the coming weeks as the extent of economic damage from the pandemic becomes clear. For these reasons, we keep our neutral stance on equities and bonds.

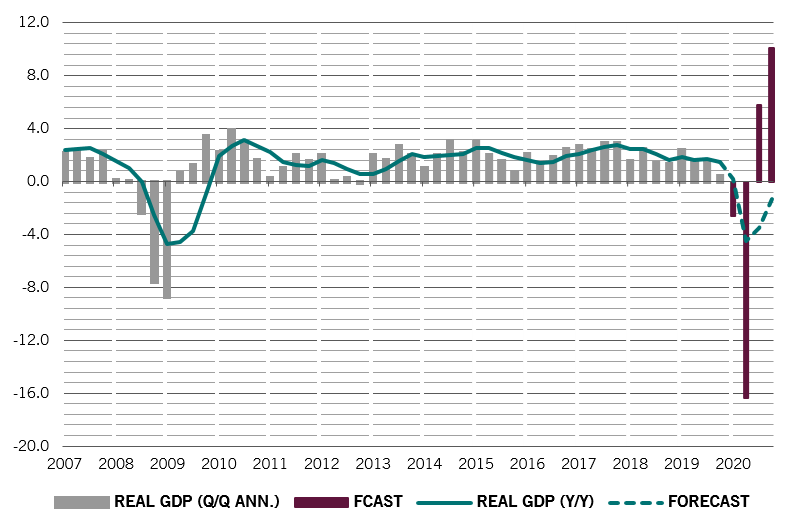

Our business cycle analysis shows the global economy will contract by 0.4 per cent this year.

Developed economies – especially the euro zone – will be in the firing line, while emerging counterparts, led by a recovering China, should fare better.

Not long ago the epicentre of the outbreak, China is gradually getting back to work. Judging from the country’s coal consumption and traffic congestion data, we estimate that China’s economic activity has returned to more than 80 per cent of normal levels.

Its economic recovery, therefore, could prove as sharp as its earlier slowdown.

The world’s second largest economy will grow 2 per cent this year – still short of what was needed to achieve Beijing’s objective of doubling its GDP and income in the decade to 2020.

Our liquidity models estimate that the world’s central banks will provide monetary stimulus of USD5.7 trillion, or 10 per cent of GDP – a third more than what they did in 2008-2009.

Some USD3.4 trillion will likely come from the US, where the US Federal Reserve is buying USD600 billion of bonds in a single week – six times the total amount it purchased in the last round of quantitative easing.

We think the Fed has plenty more ammunition at its disposal – the scale of bond purchases, in our view, could easily double from current levels.

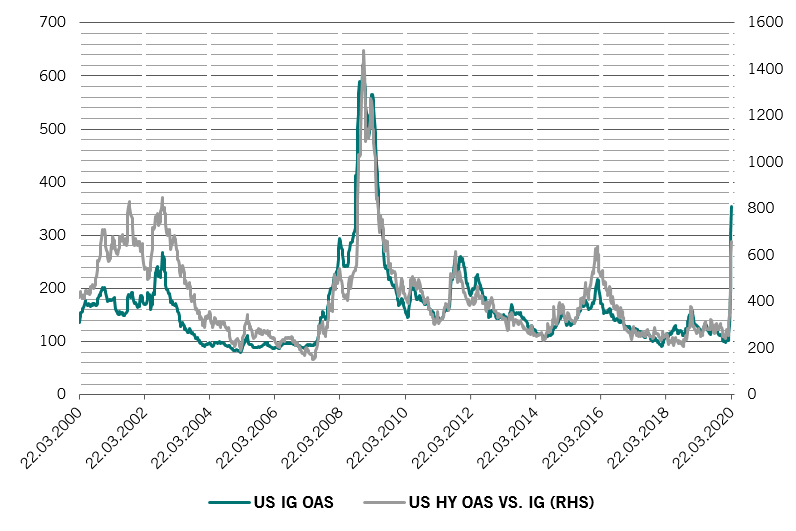

The Fed’s corporate bond purchase programme, conducted via the Exchange Stabilisation Fund (ESF) – a Treasury-funded special leveraged vehicle, could buy as much as USD4 trillion of credit.

The European Central Bank, for its part, will inject EUR1 trillion of liquidity into the financial system.

We think the region’s policymakers stand ready to do more – likely to abandon the self-imposed limits on bond purchases and deploy Outright Monetary Transactions (OMT), an emergency scheme which allows the ECB to make unlimited purchases of a particular country’s debt.

At a global level, central bank money printing will effectively underwrite this year’s government spending, which so far amounts to some USD2.2 trillion.

Following stocks’ sharp fall in just five weeks, our valuation readings show global equities have priced in a lot of bad news.

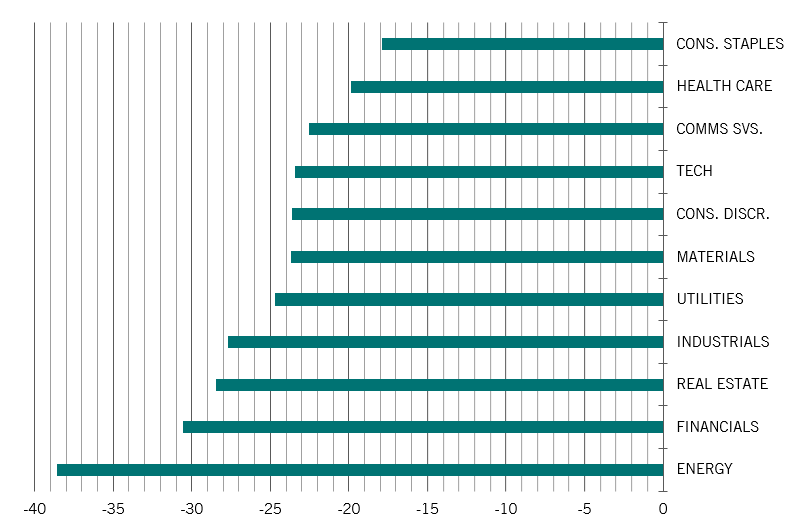

Equity markets indicate investors expect a double-digit cut in dividends in the US, euro zone and Japan this year while our own analysis shows that profits generated by S&P 500 companies will decline by more than 10 per cent this year.1

But our long-term model suggests global equities will outperform bonds by more than 10 per cent every year in real terms in the next five years.2

Current equity valuations should, therefore, prove attractive for long-term investors.

Our technical readings show equity markets are “oversold”. Sentiment and investment flow gauges indicate an extreme level of pessimism.

That said, there remains the possibility for more market swings, due in large part to the unwinding of instruments linked to volatility indices.