Asset allocation: equities head into tougher terrain

Inflation has become investors’ chief concern. Price pressures are clearly building – US core CPI in April hit 3.0 per cent year-on-year, its highest level since 1995. But what is less clear is whether the rise is transitory or points to a more fundamental change in economic conditions as the world recovers from the pandemic.

Our analysis paints a positive picture over the short term. Strip out Covid-sensitive items from price gauges and inflation looks modest, having barely picked up at all in April. (We remove prices for air fares, lodging, used cars, car rentals, tvs, toys and personal computers). Look ahead, however, and the potential for a build-up in price pressures is considerable. Even if there is little evidence of a rise in wages, US consumers have plenty of disposable income, having accumulated some USD2 trillion in savings. Should as little as a third of that be spent on services – a bigger component of CPI than goods - it is possible to see core inflation hovering between 3.5 and 4 per cent in a years’ time.

June 2021

While such a prospect is, in itself, a cause for some concern, what worries us more is the possibility of high inflation coinciding with a slowdown in economic and corporate profit growth. Our leading indicators point in that direction. Growth is already moderating appreciably in China and also easing a little in the US; the global three-month rate of expansion has recently halved to 7 per cent.

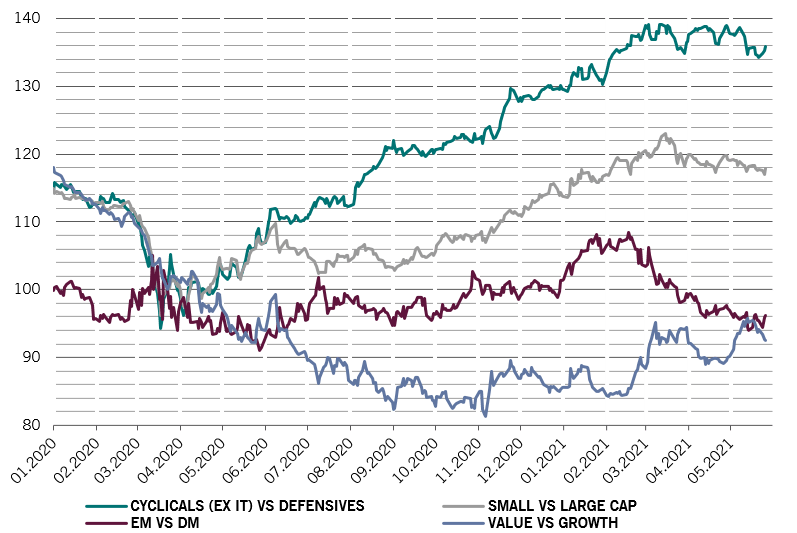

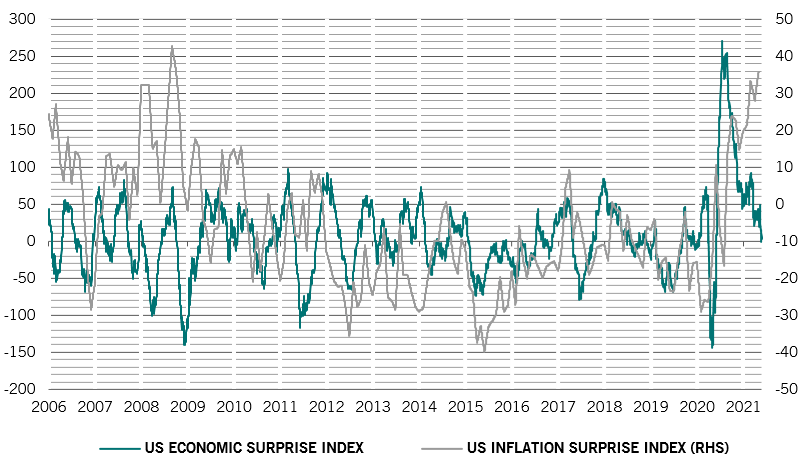

So with financial markets facing the possibility of persistent price pressures and weaker growth (see Fig. 2), we retain our neutral stance on stocks and shift to more defensive areas of the equity market.

Although economic conditions remain buoyant, our business cycle gauges suggest GDP growth will slow over the second half of the year; inflationary pressures, meanwhile, will linger. Signs of deceleration have multiplied in China, where recent data show that both industrial production and construction activity were below their normal levels for the month of April. Industrial profits for the month grew at a year-on-year rate of 57 per cent, down from 92 per cent the previous month. Elsewhere in emerging markets, price pressures have been building, with CPI having risen from below 2 per cent at the end of last year to above 3 per cent on average.

Japan is another weak spot. Our leading indicators point to a sharp decline in economic activity as Japanese authorities struggle to speed up vaccinations while trying to contain a fourth wave of the virus outbreak. Economic conditions in the US, meanwhile, are strong yet prospects remain hostage to potentially inflationary imbalances in demand and supply. While retail sales are booming – currently 18 per cent above pre-pandemic levels – industrial production is a lacklustre 3 per cent below normal.

Compared to the US, Europe is at the very early stages of a post-pandemic recovery. But with around 30 per cent of the population having received a first Covid vaccination and 10 per cent fully vaccinated, economic growth should begin to pick up rapidly over the summer.

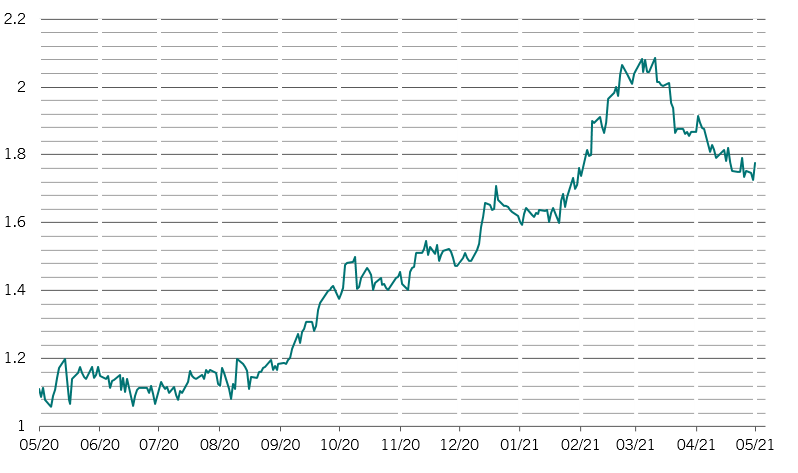

Economic growth surprise index vs inflation surprise index

Source: Refinitiv, Pictet Asset Management; data covering period 31.12.2005-25.05.2021

The provision of monetary stimulus from central banks remains just about sufficient to underpin riskier asset classes, our liquidity indicators show. The volume of liquidity flowing into the financial system is growing at a much slower pace, currently only one standard deviation above the long-term trend rate, down from four standard deviations a few months ago. Nevertheless, that aggregate reading masks the growing prospect of a sharp drop in short term US interest rates, the possible result of commercial banks parking ever increasing amounts of surplus cash at the US Federal Reserve’s reverse repurchase facility.

Looking ahead, it is unclear how long markets will be able count on support from central banks. The Peoples Bank of China has already tightened the monetary reins while the Fed, contending with a flood of fiscal stimulus, excess cash in the financial system and pent up consumer demand, will soon face a choice between withdrawing support early but modestly, or later this year/early 2022 but more aggressively. As things stand, it would seem policymakers prefer the latter.

Valuations indicate equities are expensive relative to bonds. The gap between equities’ earnings yield and bond yields is at its lowest level since 2008 while our ‘equity bubble’ index has now reached levels last seen in 1999 and 2007.

Our technical indicators paint a mixed picture. Seasonal trends favour bonds over equities. Nevertheless the scope for a decline in stock markets remains limited as investor surveys show investors scaled back on their holdings of stocks.