Overview

On November 3, Americans will not only be voting for whether Donald Trump or Joe Biden should be their next President. They will also be choosing the whole of the House of Representatives as well as 35 of 100 seats in the Senate. If the permutations were not complicated enough for investors, there is now an unnerving twist to this already fraught and bitterly-contested campaign. Trump's positive test for Covid-19 32 days before the election throws US politics into uncharted territory. The range of outcomes has, to put it mildly, widened.

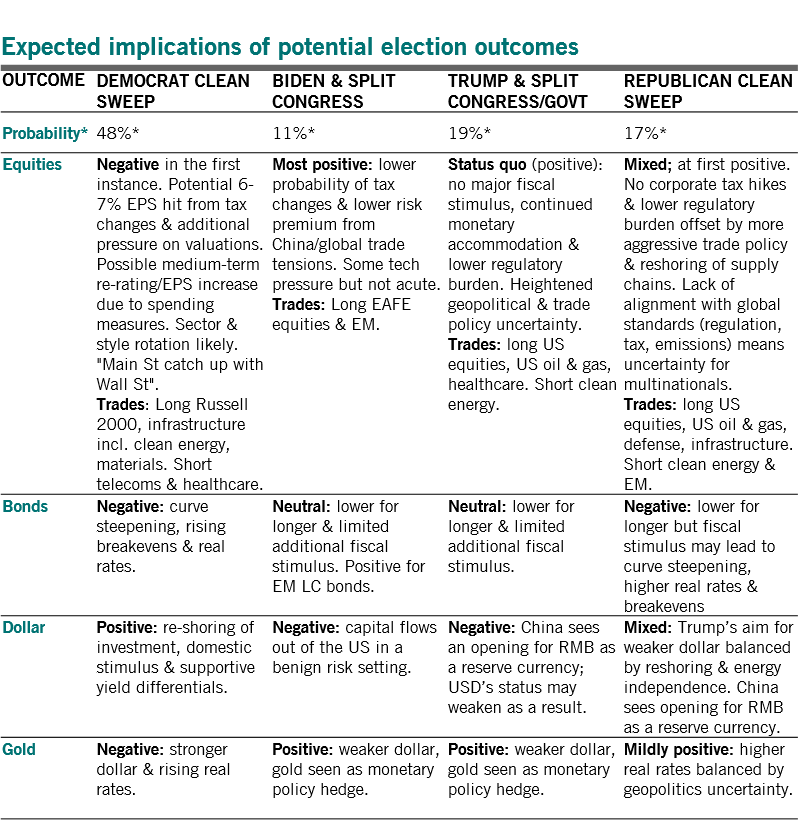

Before Trump's medical predicament was revealed, prediction market Predictit offered a 48 per cent chance of a Democratic clean sweep (both Houses of Congress and the White House) and a 17 per cent chance of a Republican one.1 Both probabilities looked overstated at the time – the prospect that either Biden or Trump would face a divided Congress was under-priced. Now, the situation is far more complicated. It is unclear how Trump's diagnosis will affect voters.

Still, even if investors are faced with numerous permutations, the central issues remain unchanged. Two scenarios in particular are worthy of consideration and analysis: a clean sweep for either the Democrats or the Republicans. A decisive victory for either party (both houses of Congress and the White House) has the potential to bring about significant changes in policy and would thus have important market consequences.

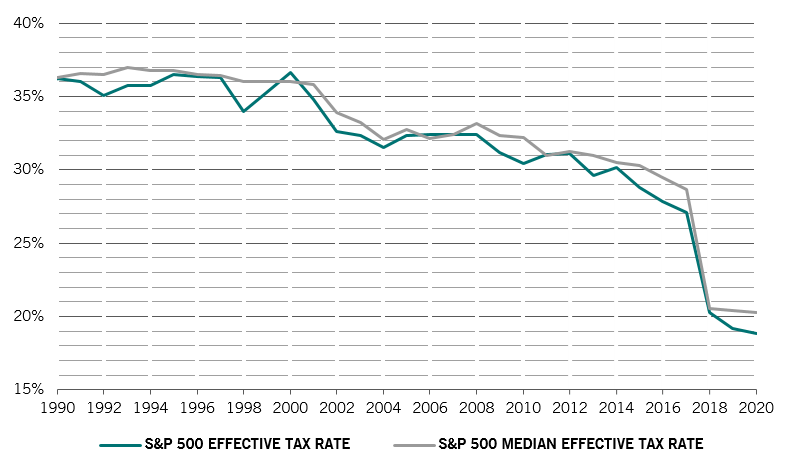

One key difference is the parties’ approach to taxes – and thus fiscal stimulus. For Republicans, tax cuts are a supply-side fiscal tool used to stimulate the economy. Trump’s primary economic legacies from his first term were a reduction in the statutory tax rate from 35 per cent to 21 per cent and broad-based tax reform. Equity markets were disproportionately boosted by these measures, with lower effective tax rates accounting for 5.2 percentage points of 13.4 per cent total returns in the S&P 500 since January 2018, according to our calculations.

Democrats, on the other hand, see tax hikes as a means to fund demand-side measures to achieve the same result and re-distribute wealth from higher income to lower income groups.

(Click here for a detailed summary of the likely policy outlook in each scenario.)