Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

A market neutral portfolio powered by alternative data

Asim Nurmohamed, manager of the Pictet TR-Aquila strategy, describes his distinctive approach to market neutral investing.

What are the distinctive elements of your investment process?

We only invest in companies we really understand. That means being able to confidently analyse a stock, which in turn demands clearly observable inputs and outputs. We need to be able to confirm management has proper control of the top line and cost base. We need to be able to forecast its cash flow. And we also need to be able to measure the company’s performance against our expectations, not least so that we can confirm that our investment thesis is correct.

Building this depth of understanding allows us to be comfortable with a concentrated portfolio – that means around 20-40 long positions and 40 to 60 shorts. It also allows us to hold our positions for much longer than most market neutral strategies – one to three years for longs and three to nine months for shorts.

And it means we can be patient. Once we’ve identified an interesting company, we are willing to wait until it reaches the right price level before including it in our portfolio. That can be a long time. We recently participated in the IPO of a company that we had been following for over seven years.

Deep fundamental analysis allows us to forge independent opinions. Rather than depending on sell-side recommendations, we do our own primary research. That means going beyond scrutinising company financials and talking to management. We read specialised journals, attend industry conferences and, particularly, use alternative data.

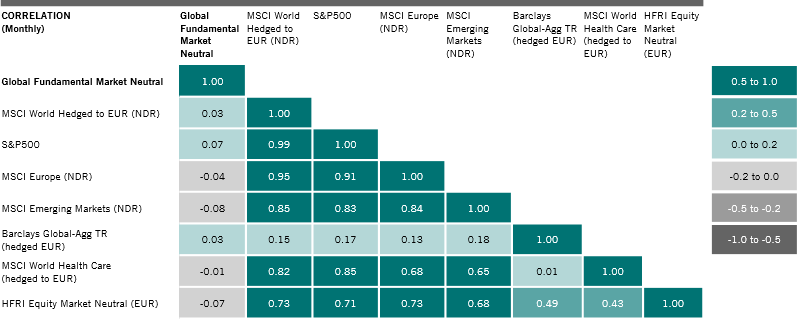

Our overriding concern is that during times of market turbulence – like when the Covid crisis hit – our capital remains as safe and protected from losses as possible. We use a methodical portfolio construction process to ensure our fund is market neutral and that we don’t take unintended sector, country or factors bets. We focus on idiosyncratic risk. As a result, our strategy has shown little or no correlation to equity and bond markets or to hedge fund indices in the more than two years we’ve been running it at Pictet.

You focus on just a few sectors. Why these? Are they complementary?

I started my career analysing health care companies and managing portfolios of these stocks, so I have a deep familiarity and understanding of the sector. But more importantly, we only invest in sectors in which we can apply our investment process. These are sectors that can be modelled effectively, which is to say where getting the model right translates into a better understanding of where share prices are likely to head. That also means we tend to stay away from sectors that depend on difficult to predict variables such as commodity prices or interest rate levels. In other words, we don’t invest in sectors that are sensitive to the ups and downs of the economic cycle such as commodities or energy or in interest rate sensitive sectors such as banking and insurance.

Each sector and sub-sector we invest in has its own dynamics, but they all share common analytical features: they are all rich in data that allow us to independently verify a company’s top line. Once we have understood and verified how the company achieves its revenues, we can then model it.

Why is a market neutral approach so suited to these sectors?

Let’s take health care. This is a diverse and complex sector which means that it’s prone to being mispriced by the market. Which, in turn, means that detailed and accurate analysis can unearth stocks that are too expensive or too cheap.

For instance, health care is being transformed by several long-term trends, including well-flagged tailwinds such as ageing populations, which are bound to drive a rise in spending over many years. The sector also offers a good mix of dominant players and smaller disruptors that constantly challenge the established order.

There is the added complexity that different countries offer very different health care systems and reimbursement levels. There’s a high degree of dispersion in stocks within the sector and its sub-sectors. And, crucially for stock pickers like us, health care is home to a multitude of idiosyncratic stories that are uncorrelated to macro or market events.

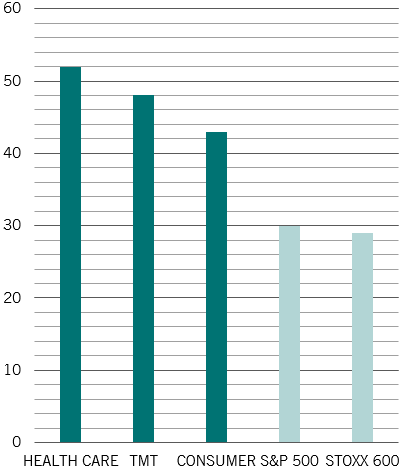

During each of the last three calendar years, there was nearly twice as much dispersion in the returns of top quartile US and west European healthcare stocks as there was within the wider market (see Fig. 2). That’s important, because the greater the dispersion – in other words the wider the gap between winning and losing stocks – the more opportunities long/short fund managers have for making outsized returns.

You use alternative data. Why?

Alternative data is an integral part of our fundamental investment process and has been for a long time, since well before it became a buzzword. This comes back to my earlier point of being able to independently verify a company’s data and being better able to predict their top line. Alternative data can provide us with an edge, especially when we manage to identify enlightening series and sources that others have overlooked.

But it’s not just that we use alternative data, it’s how we use it. Most people buy data to find patterns and then invest based on these patterns. We take a different approach. When analysing a company, we ask ourselves a set of questions. We then source data to answer these specific questions and thus test our hypothesis about the company. We have a theory and we want the data to either prove or disprove it.

We use all sorts of data: credit card records from online retailers; subscribers for online video games; prescriptions from doctors. But what’s really exciting is when we are able to source custom data. For instance, we regularly commission surveys. We recently polled doctors about a new drug. This helped us to better understand its pricing and potential demand, giving us valuable insights when it came to forecasting the company’s future earnings and its ability to outperform market consensus.

Do you integrate ESG considerations within your investment process?

We do. Our investment focus naturally excludes some of the least environmental friendly sectors such as energy, commodities or transportation. But even within our investment universe, we spend a lot of time analysing governance. We assess the quality of a company’s management team, its compensation and forensically review its accounting. It can be a very useful red flag, helping to steer us clear of companies that might otherwise seem attractive. Alternatively, it can support the case for taking a short position.

We benefit from Pictet's deep strengths and long experience in ESG investing.

From a risk management perspective, what risk metrics do you focus on?

Risk control is thoroughly embedded in every aspect of our investment process – more so than any other metric we use. We construct our portfolio specifically to protect capital during steep market sell-offs, like the ones we saw during the final quarter of 2018 or the first quarter of 2020.

We do not have hard stop-loss limits. But when we add a position to the portfolio we establish a price target and a worst-case scenario. During share price pullback, we always refer back to this worst-case scenario to establish whether we might have misunderstood the company or not analysed it correctly or whether an unforeseeable, unprecedented event has led to a mispricing of the stock. Depending on our review, we might add to our position, or, alternatively, fully exit it.

It helps that, before we invest, we do a lot of scenario analysis to better understand how the stock should react in various market conditions. This approach ensures we hold appropriately sized positions and even leads us to exclude some stocks, even though they might have otherwise interesting bottom-up characteristics.

Factor analysis is an important part of our risk process. It’s not our intention to be perfectly factor neutral but we do aim to limit our factor exposure. We carefully review our country, sector and style exposures and are methodical in how we balance the portfolio. At times, and based on our analysis, we will make factor bets but these will be limited in scope and time. Pictet gives us a variety of tools to help us monitor and measure our risk and factor exposure.

Can you share your views on the health care sector? Has Covid-19 changed the way you analyse these stocks?

We like the health care sector because it offers so many idiosyncratic investment opportunities. That allows us to focus on bottom up corporate analysis without having to take sector or sub-sector bets.

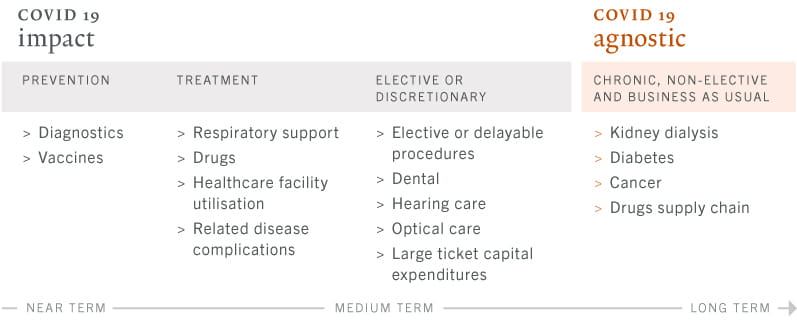

Having said that, Covid-19 has definitely changed and expanded the opportunity set within health care and its various sub-sectors. What we find especially interesting now is that all companies seen benefiting from the crisis have been re-rated substantially. This indiscriminate rally is creating some very interesting long/short opportunities: not all these companies will be able to sustain their current valuations once the Covid crisis recedes. The reverse is equally true among companies seen as losers from the crisis.

For example, we’ve counted about 150 different projects related to finding a Covid-19 vaccine. In all likelihood, no more than a small handful of companies will find an effective vaccine, but stock prices have materially re-rated for them all and continue to trade on positive headlines. Without taking views on which company will find a vaccine we believe this market move has created attractive opportunities.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.