Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Sustainability stays strong in emerging debt markets

In an otherwise ugly environment for bond issuers and investors, the future for emerging market debt looks unquestionably green.

Rising global interest rates and volatile markets have weighed heavily on both supply and demand of bonds, particularly in emerging markets (EM). Yet one segment has remained surprisingly resilient. Our research shows that bonds with a tilt towards environmental, social and governance (ESG) factors have continued to increase in popularity among issuers and investors.

This should prove supportive for EM debt more broadly, ultimately paving the way for better structural development of the asset class.

In the first half of 2022, EM borrowers issued a total of USD81.9 billion of ESG-labelled bonds – an increase of 2 per cent compared to the same period of 2021.

The resilience of ESG-labelled issuance in EM stands in stark contrast to what is happening in the wider fixed income universe. For emerging markets generally, issuance dropped 48 per cent (although Asian local currency supply bucked the trend, rising nearly a quarter). Meanwhile, overall global debt issuance dropped 14 per cent to USD4.8 trillion during the first half of the year compared to 2021, according to Refinitiv.1

Emerging markets tend to have more work to do on ESG factors than developed peers, which is one reason why investors particularly welcome ESG-linked issuance from them. That in turn underpins demand, which can appeal to borrowers. Sometimes they also benefit from a 'greenium' – the potential that investors may be willing to pay a premium for such bonds, resulting in lower yields and thus lower borrowing costs for the issuers.

ESG-labelled bonds have proved particularly popular among investment grade-rated issuers (which accounted for over half of all issues in the first six months of the year). For investors, they can thus offer comparable yields to developed market high yield debt but with a significantly better credit risk – a particularly attractive proposition in a time of heightened market volatility and rising rates.

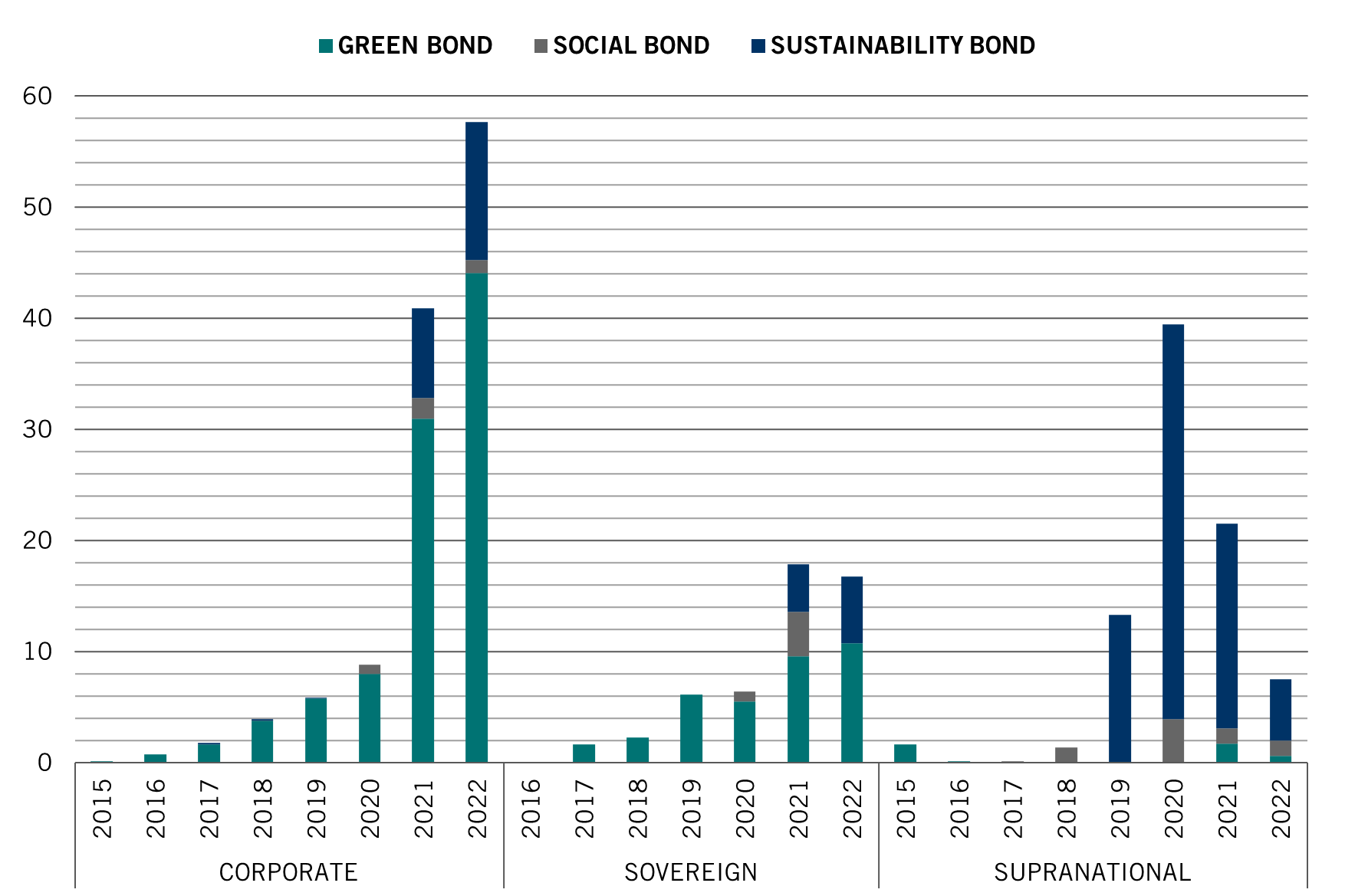

Source: Pictet Asset Management, Bloomberg. Data covering period 01.01.2015-30.06.2022.

Accountability and transparency

More long term, the growth of ESG-labelled bonds encourages sustainable reforms which ultimately leads to improving sovereign fundamentals.

However, not all ESG bonds are created equal, and strict controls are needed. As investors, we actively engage with EM issuers to encourage them to endorse the EMIA Enhanced Labeled Bond Principles and to apply them to future issues.

The creation of a robust framework for the issuance of ESG-labelled bonds provides us, as investors with a better view of governments' (or issuers' in general) policy priorities and reform objectives. This is true even if the issuance does not eventually materialise.

We believe that improving accountability, transparency and reporting helps create a virtuous cycle. Third party oversight is also very important, although it is no silver bullet – investors are still very much required to do their own work in assessing the credibility of sustainable bond frameworks and any issuance that follows.

Green priorities

Drilling deeper into the issuance data, corporate borrowers in particular have strongly embraced the benefits of ESG-labelled bonds. In the first half of the year, EM corporates issued around 40 per cent more ESG labelled bonds compared to the same period in 2021, totalling some USD56 billion.

Among sectors, such bonds remain particularly popular with financial and energy companies (about 54 per cent and 7 per cent of the total year-to-date, respectively) but the trend has broadened into other sectors as well, such as industrials, utilities and cyclical consumer companies.

After the strong issuance in the past two years, ESG bonds now make up about 7.5 per cent of the JP Morgan Corporate Emerging Markets Bond Index (CEMBI). Perhaps as a result of the widening universe, we have noticed that in general ‘greeniums’ have declined, although this varies a lot by sector and even issuer. Greeniums are typically lower where there is more supply of ESG bonds, like for some Korean utilities or Chinese financials where we have seen increased issuance. In areas with limited choices meanwhile, such as in Indonesian green sukuk bonds, greeniums can be high and persistent.

Chile's example

Among sovereigns, Chile remains one of the leaders on ESG debt, having issued green, social and sustainable bonds. We see Chile as an example of an issuer with a clear focus on sustainability and would expect this to continue given its strategic aim to reduce carbon emissions, as well as the social pressures that have arisen following the effects of the pandemic.

Notably, some of its issues have been in local currency – in contrast to most of the rest of the universe, which is denominated in dollars or euros. This could be a potentially interesting growth area.

In aggregate, the volume of issuance dipped slightly among sovereigns, year-on-year, and was down sharply among supranationals. We believe this could be pandemic-related. Last year, both countries and supranational institutions issued bonds to help pay for measures to stem the pandemic and its effects. But with mass vaccination this has become less of a pressing need.

That can also be seen in the types of ESG-labelled bonds being issued. Social-linked bond issuance has fallen sharply relative to 2021. In contrast, issuance was up nearly 12 per cent for green bonds and leapt 40 per cent for sustainability bonds, which are becoming increasingly popular with corporates in particular. A spate of extreme weather events – including recent heatwaves and wildfires – has helped keep climate change and the environment top of the agenda around the world.

We expect the growth of ESG-labelled bonds within EM to continue. Research from Pictet Asset Management and the Institute of International Finance suggests that annual ESG-labelled bond issuance in emerging markets could reach USD360 billion by 2023. This, in turn, will help emerging economies to generate more of the capital needed to meet the United Nations’ Sustainable Development Goals by 2030.

In our own emerging market debt funds – both sovereign and corporate – ESG considerations are integrated into fundamental analysis and decision making. While we don’t automatically favour ESG bonds, we assess each issue on its own merits, and our exposure to such debt is organically growing.

Overall, the trend should help emerging markets to develop and become more sustainable – which is good news both for the economies and for those who invest in them.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.