[1] Climate Action Tracker, November 2021 https://climateactiontracker.org/global/temperatures/

[2] International Monetary Fund, October 2021 https://blogs.imf.org/2021/10/13/fiscal-policy-for-an-uncertain-world/

[3] https://ourworldindata.org/greenhouse-gas-emissions

[4] https://ourworldindata.org/co2-emissions?country=

[5] https://am.pictet/en/globalwebsite/global-articles/2022/expertise/esg/ESG-bond-market-transformation

[6] Simulation period: 1995-2021. Benchmark: FTSE World Government Bond Index (WGBI), USD hedged. Backtested performance is not an indicator of future actual results. The results reflect performance of a strategy not historically offered to investors and do not represent returns that any investor actually achieved. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data (annual rebalancing) and based on assumptions integral to the model which may or may not be testable and are subject to losses. For any investment in a portfolio implementing this strategy, the investor's returns will be reduced by the management fees and other expenses.

[7] https://www.netzeroassetmanagers.org/

Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Sovereign bond investing: a climate-focused approach

When it comes to responsible investment strategies, sovereign bonds have so far largely been overlooked. We believe that needs to change.

Responsible investment has taken equity markets by storm. Although its penetration into fixed income markets has been slower, it is picking up speed there too. Yet one area remains overlooked – government bonds.

That’s a major oversight. After all, governments set the rules and regulations that companies and individuals follow, and without their support and investment, the world will not be able to tackle its most pressing problems – climate change in particular.

Global average temperatures are already 1.2C higher than they were in the pre-industrial era. And even if countries deliver on all the carbon emission-cutting pledges made so far, that degree of warming is expected to double to 2.4C by 2100.1

Fixed income investors have a key part to play in providing the capital required to keep climate change in check. While individually, investors have a negligible influence on government policy, collectively they can make a real difference – after all, the investment community holds USD88 trillion in bonds issued by governments and their agencies.2

Focus on emissions

So how might fixed income investors construct government bond portfolios in a way that has biggest possible impact in the fight against climate change?

Investors in emerging market bonds are central to the transition. That’s because developing economies are more vulnerable to the physical impacts of global warming than their developed counterparts, in part due to geographical factors, but also because of weaker economic and institutional underpinnings. At the same time, emerging nations can be global leaders in many of the technologies needed for transition. But investors in developed sovereign bond markets also have a key role to play in the transition.

In all cases, however, the key to climate-focused government bond investing is high-quality data and the ability to draw accurate conclusions from it. Only then can investors be sure of making sound capital allocation decisions.

Identifying ESG-aligned government bonds requires investors to focus on the root cause of global warming – greenhouse gas emissions. While methane and nitrous oxide clearly play a part, CO2 accounts for 74 per cent of all emissions.3 Our research shows that emissions of the different greenhouse gases tend to be correlated; countries with high emissions of one tend to also generate a lot of the others.

The next question to tackle is how to measure and compare emissions by country. In absolute terms, bigger countries will obviously have larger greenhouse gas emissions than smaller ones. On this measure, China the biggest emitter. Looking at things on a per capita basis paints a somewhat different picture, however. Mongolia comes out in the “lead” while China emits less than the US, Russia or Australia.4

An even more effective way is to compare emissions relative to the size of the economy – after all, it is the total level that matters from the point of view of climate.

Yet looking at GDP alone has its limits. The UK, for example, imports a relatively high volume of foreign goods, the emissions for the production of which are accounted for on other countries’ balance sheets. Some experts argue that imported CO2 emissions should be added to the importer's carbon footprint. But this is difficult to capture with any degree of accuracy. Ultimately, we believe each government is responsible only for its domestic policy; they do not have direct control over how their imports are produced.

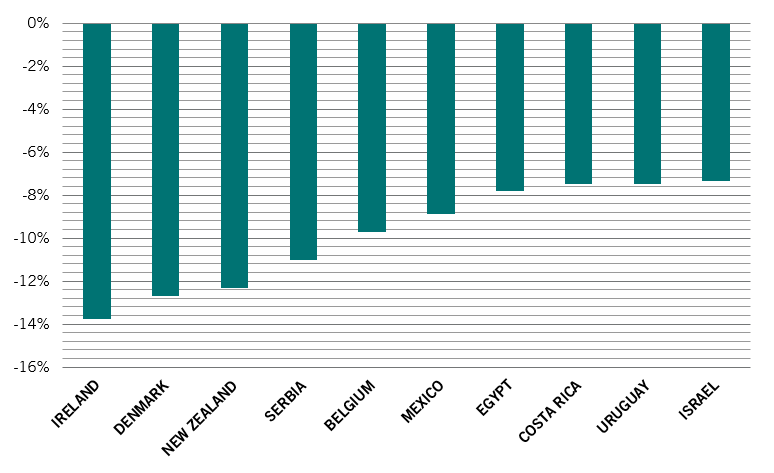

Based on today’s level of emissions relative to GDP, bond investors should reward Western Europe (particularly Scandinavia). Some emerging markets, such as Mexico, are also relatively green. To tackle global warming, though, fixed income investors also have a duty to incentivise the laggards to reduce emissions. In other words, bond investors should consider allocating capital to countries whose carbon emissions are falling at the steepest rate relative to the size of their economy (see Fig. 1).

Focusing investments in the bonds of these nations may mean leaving out countries which are the mainstays of traditional bond indices. But that, in turn, increases diversification benefits for investors and should placate those who complain that funds that claim to embed environmental, social and governance (ESG) criteria are too often remarkably similar in their composition to non-ESG labelled ones.

Data as of 23.02.2022. Emissions exclude land use, land use-change and forestry (LULUCF) as data not yet available.

Data tells only part of the story and is, by its nature, backward looking. Future emissions are determined by policies implemented today, which is why it makes sense to incorporate a qualitative assessment of each country’s regulation and policy path, comparing it to the Paris Agreement goals. Net zero pledges are a good start, but they must also be followed by concrete action.

By focusing on countries that are actively working on reducing emissions, sovereign bond investors can play a part in the fight against climate change and significantly reduce the carbon footprint of their own portfolios. As more investors take this view, we believe we can start to incentivise change in government policy.

Green returns

In terms of the type of investment, green bonds are a natural choice for climate-conscious government bond investors. It’s a small but rapidly growing universe. According to research by Pictet Asset Management and the Institute of International Finance, the size of the sustainable bond market almost doubled in 2021. But the bulk of that growth came from corporate bond markets and the total amount of ESG-labelled debt accounts for only 2 per cent of the overall bond universe. By 2030, however, that proportion could be as high as a third, with particularly strong growth in emerging markets, the analysis shows.5

As well as its limited size (so far), the green bond market is hampered by a lack of universal rules and standards. Currently, the labelling and certification of sustainable bonds differs considerably from one country to another, while efforts to harmonise disclosure requirements haven’t met with much success. We expect to see increased standardisation as the green bond market deepens and increases in value.

Given these limitations, we believe that a climate-focused sovereign debt portfolio shouldn’t focus exclusively on green bonds. It should also invest extensively in traditional bonds, which are in greater supply, are easier to understand and exhibit more attractive valuations.

This last point is worth stressing. The return potential of any investment is of paramount importance, and we believe that there is no need for compromise here. Our research with IIF shows that returns on green government bonds have outpaced those on conventional benchmarks since end-2017, with an average monthly excess return of over 1 basis point. Other studies, meanwhile, find a positive correlation between climate vulnerability and the cost of borrowing, particularly in emerging markets – even after other macroeconomic variables are taken into account.

Backtesting points to outperformance of a climate-focused portfolio relative to the benchmark.6 Furthermore, the use of an overlay strategy can help reduce currency, interest rate and spread risks.

Change starts with planting a seed.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.