Asset allocation: a war of nerves

Inflation. War. Covid. They’re each taking their toll on investors’ nerves.

Russia’s attack on Ukraine continues to squeeze commodities, adding to the inflationary pressures that were building during the Covid pandemic and forcing central banks across the world to hike interest rates and drain liquidity from the global financial system.

And Covid itself hasn’t gone away – not least in China, where the more authorities try to throttle a new infection wave, the more they throttle the economy.

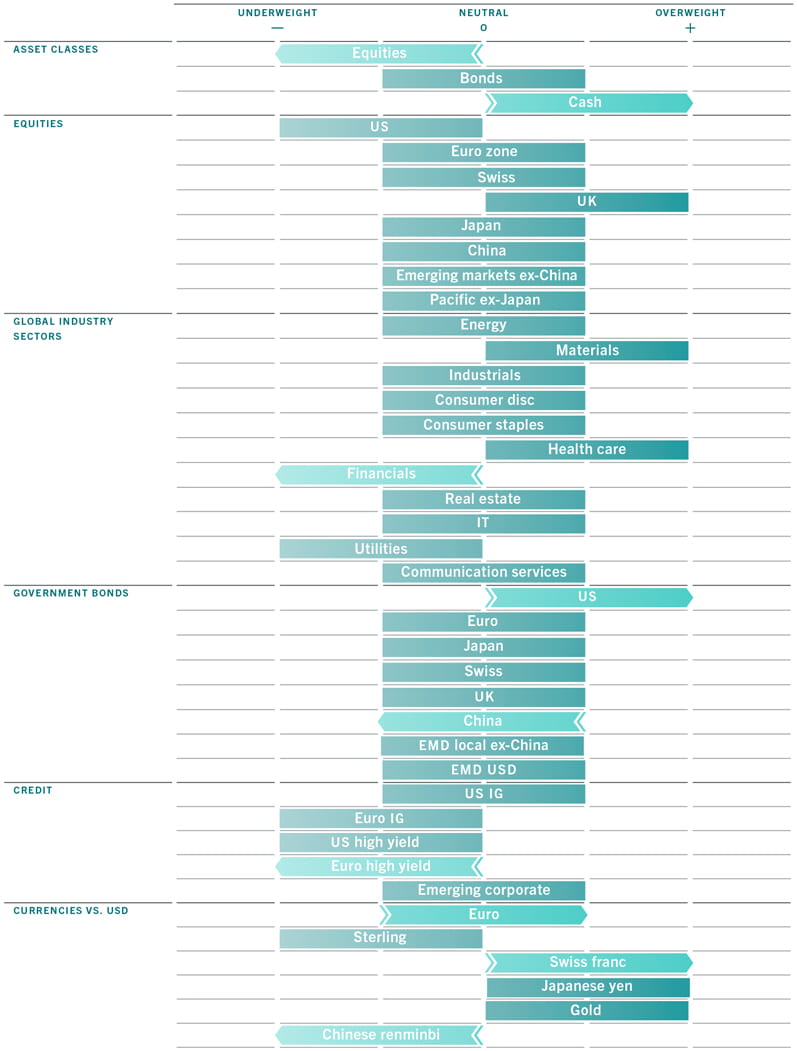

This pernicious combination of rising real interest rates and worries about how the global economy will cope with a shortage of fossil fuels and other commodities weighs heavily on the outlook for equities. As a result we have downgraded the asset class to underweight, and upgraded cash to overweight – we await confirmation that inflation and bond yields have peaked before re-allocating to fixed income.

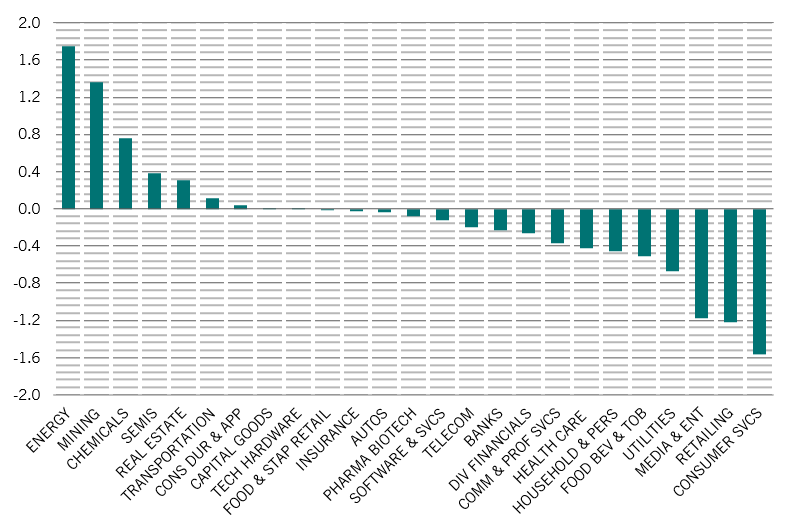

Although equity valuation multiples have shrunk significantly – down 30 per cent from September 2020 on a price-earnings basis – they’re still not attractive enough to compensate for the risks. For instance, market projections for corporate earnings haven’t sufficiently factored in the prospect of recession. At the same time, profit margins are being squeezed by rising input costs.

As for bonds, performance is likely to track inflation expectations and national growth prospects.

Though the risks are on the downside, our business cycle indicators are only just managing to stay neutral, though there are warning signs of stagflation across the major regions. We have revised down our expectations for global growth for 2022 to 2.9 per cent from 3.4 per cent last month and inflation is revised up to 7.3 per cent from 6.8 per cent.

We have reduced our growth projections for the US economy, revising down our GDP growth forecast for the current year to 3.0 per cent from 4.0 per cent as our leading indicator slipped into negative territory for the first time since August 2020, reflecting the fact that rising mortgage rates are starting to take a bite out of the housing market. On the plus side, retail sales have held up and household balance sheets remain in good shape.

The downward revision to US GDP projections have been more significant than those for the euro zone during the past month.

While the US Federal Reserve has set the hawkish tempo, other central banks, especially the European Central Bank, have started to catch up. Although regional inflation is set to peak in May, wage growth could be a spanner in the works. There are signs of significant pay increases in some sectors in France and Germany. If that starts to pick up the peak in inflation could be delayed.

Lockdowns have sent the Chinese economy into a deep slump. Retail sales, industrial production and fixed asset investment have all come under pressure. We have cut our 2022 full-year growth forecast for the economy to 4.2 per cent now considerably below the official target of 5.5 percent which always looked ambitious. We are however optimistic about a strong recovery in the second half as the economically key regions start to open up again.

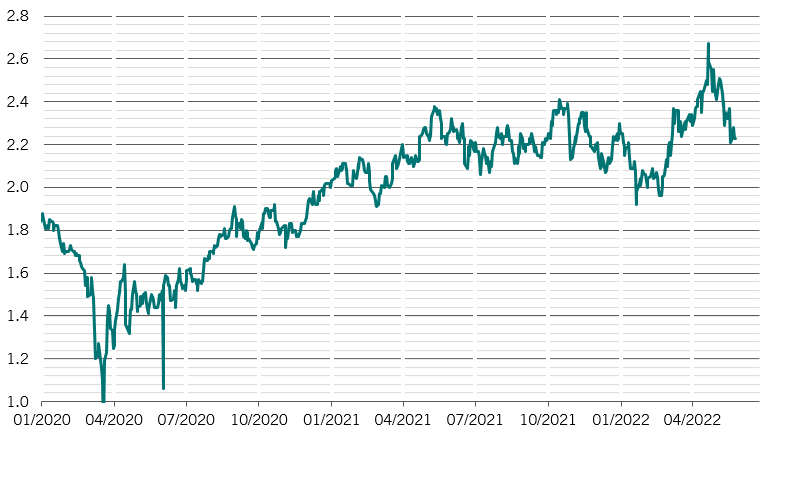

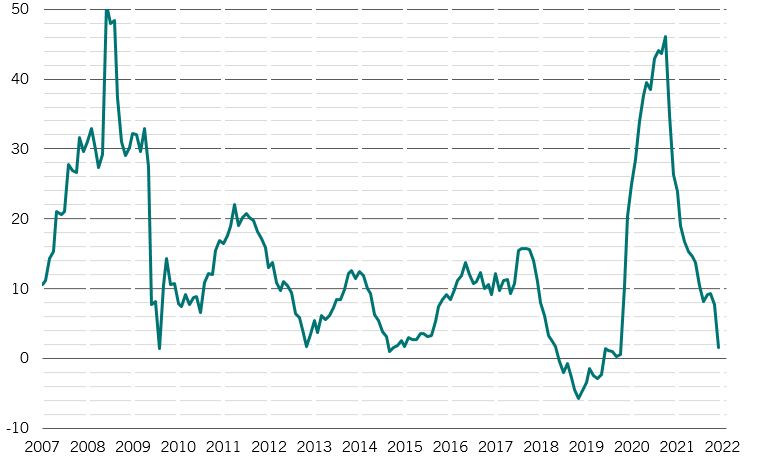

Our liquidity readings show central banks are removing stimulus at the fastest pace ever – there has been a USD600 billion drain over the past three months.1 Our liquidity indicator is at its most negative for the US and our readings for the euro zone and emerging Asia ex-China also show a marked retrenchment.

We believe that the US is half way through its monetary tightening cycle – including both Fed rate hikes and the central bank's quantitative tightening programme. The Fed is increasingly caught between the frying pan and the fire – forced to choose between tightening and causing a recession or failing to tighten sufficiently and allowing inflation to become entrenched. We think the former scenario is more likely. So far, however, the contraction of Fed liquidity is being partly offset by an increase in private sector lending.

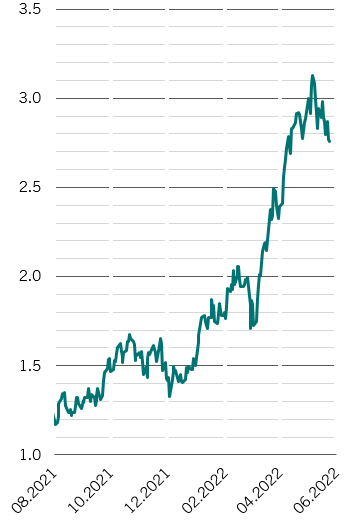

China is an exception to the wider rule of contracting liquidity. Central bank policy easing is beginning to have an effect and excess liquidity – money supply in excess of what is needed to maintain current economic conditions – has jumped.

For the first time since the summer of 2011, both bonds and equities look reasonably attractive on our valuation metrics. Commodities, on the other hand, remain at their most expensive in 20 years. Emerging market local currency government bonds are positive while valuations for US dollar and euro denominated high yield credit are improving as their yield spreads have widened. Meanwhile, real estate now looks cheap.

Our technical indicators show that the trend for equities has turned negative for the first time since March 2020, with a broad weakening of momentum across developed markets, which dampens the outlook over the coming six to 12 months, though over the short term there’s the chance of a rebound.

Bond trends remain negative, though are starting to show signs of stabilising. Investor sentiment and positioning surveys show that appetite for risk remains at very depressed levels. Investors have raised cash to highest level in two decades, rotated further into defensives and turned underweight equities and tech as per a widely followed fund manager survey.