Asset allocation: a brisk bounce back

The head of steam building up behind the global economy is becoming ever more evident. As vaccination programmes allow Covid-related restrictions to be lifted, growth looks set to jump, with the economy likely to recover much of last year's losses.

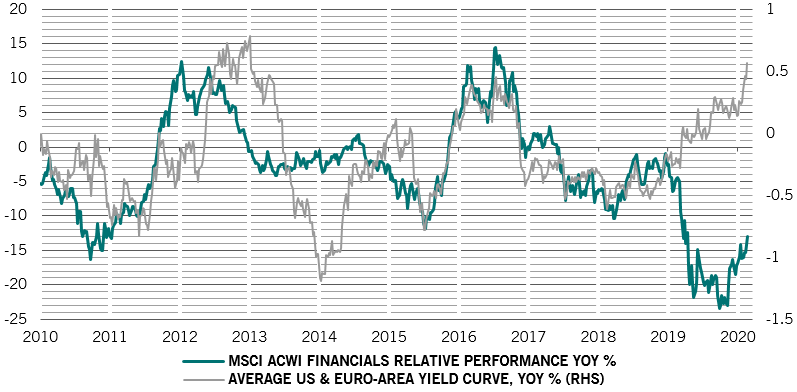

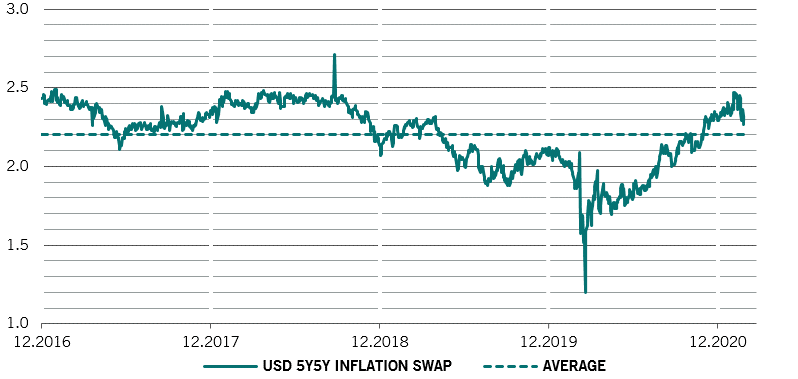

Bond yields have risen on doubts about central banks' ability and willingness to remain accommodative in the face of strong growth, the impact of President Joe Biden’s additional USD1.9 trillion stimulus package and because inflation expectations appear to be already broadly in line with official targets.

But we think these concerns are premature. Any overshooting of central bank's inflation objectives is likely to be only temporary, given large amounts of spare capacity in the economy. We don’t see underlying inflation picking up for at least the coming year. All of which leads us to maintain our overweight bias on equities and our neutral stance on bonds.

Our business cycle indicators show that momentum remains strong, prompting our economists to once again raise their real GDP growth forecasts for 2021 . We now expect the global economy to grow by a real 6.4 per cent this year against a market consensus of 5.1 per cent, with emerging economies, spearheaded by China and India (seen growing by a respective 9.5 per cent and 13.1 per cent) leading the way.1 But the US is also poised for a robust 6.5 per cent expansion, according to our forecasts, more than making up for last year’s 3.5 per cent contraction. That’s underpinned by a surge in retail sales – it looks like Americans are beginning to spend their stimulus cheques – and a robust response by industry to fill that demand.

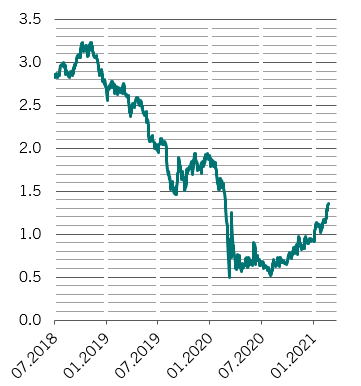

Base effects are likely to push inflation temporarily higher. It’s worth remembering that oil prices were briefly negative a year ago - now they’re roughly back to where they were before the Covid crisis. Meanwhile, as economies open up, we think the services sector will respond quickly to absorb pent-up demand and we’re likely to see few of the bottlenecks that typically give rise to underlying price pressures. In the US, any inflationary overshoot caused by excessive stimulus isn’t likely to appear until 2022/23, which should allow the US Federal Reserve to avoid tightening policy for the next 12 months or so.

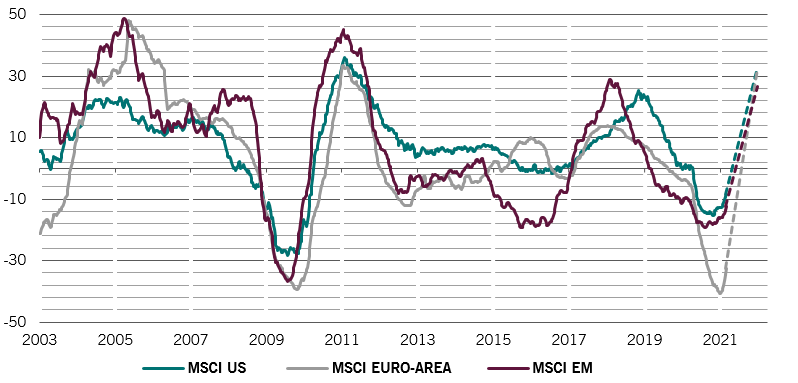

Our valuation indicators show most riskier asset classes trading at or near record highs. Valuations for stocks in the MSCI World index are at their most expensive since 2008 according to our models, with the market pricing in a return to pre-Covid rates of economic growth but with permanently lower interest rates.

We expect around a 20 per cent fall in the global price-to-earnings multiple as real yields start to rise and excess liquidity begins to dissipate. However, we also see a big jump in earnings per share growth (see equities section and Fig. 2) as both sales and profit margins benefit from a normalisation of economic conditions and generous fiscal support. The combined effect suggests around a 10 per cent upside for US equities from here.

As for fixed income, the recent rise in yields means that government bonds aren’t trading far away from their fair value for this stage of the economic cycle. For the first time since the pandemic struck, US 30-year real yields are in positive territory. But that rise in yields also makes equities look a little more expensive.

Technical indicators remain supportive for riskier assets, but they also flag up warnings that conditions are looking frothy. Seasonal factors are positive for equities. But investor sentiment is extremely bullish and fund manager cash levels are at 14-year lows and flows into the market are surging – at some USD180 billion, they’re at record year-to-date levels.