Asset allocation: re-opening remains on track

Riskier asset classes are trading at or close to all-time highs. There are good reasons for this.

Consumer and industrial demand is robust, supply bottlenecks look set to ease – potentially placing downward pressure on inflation – and corporate earnings and margins remain healthy.

This augurs well for equity markets over the near term.

And yet this positive picture needs to be balanced against a the emergence of a new threat to the economy. Though it had fallen right down the list of investors’ worries, the recently identified Omicron variant of Covid shows the pandemic hasn’t faded away. While pandemic-related developments can no longer dictate the economic cycle, they can certainly influence it.

December

Source: Pictet Asset Management

Markets were clearly spooked by the emergence of a new Covid variant classed as “very high” risk by the World Health Organization. While the unprecedented number of mutations in the strain suggests that the virus could evade current vaccines to some degree, this has yet to be established.

Also unclear is the severity of the disease the new strand causes, even if anecdotal evidence is encouraging.

For their part, governments aren't taking risks. Many have imposed travel restrictions, perhaps learning lessons from the dithering they were guilty of during the spread of the Delta variant earlier in the year.

But the picture is not universally negative.

Although Covid has caused distortions and supply bottlenecks, economies have by and large adapted remarkably well to the vagaries of the pandemic and are now are better prepared to withstand its effects.

Also, it appears that the vaccines that have been rolled out globally can be modified to target the new variant.

At the same time, we see no signs of 'froth' in the shares of companies that would have benefited from a full re-opening of the economy. Valuations for Covid-sensitive stocks suggest investors had been largely sceptical of the prospect of a smooth, hiccup-free reopening of the economy.

So, despite the heightened uncertainty, we believe the direction of travel is still towards the reopening and near-normalisation of economies worldwide.

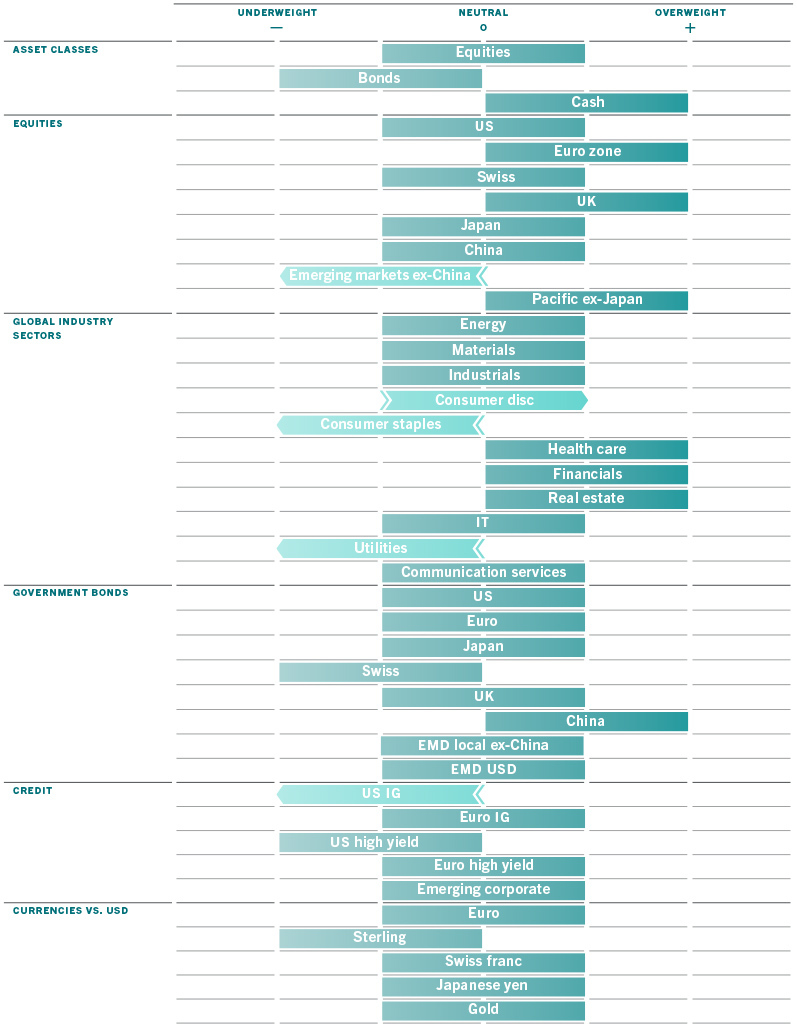

All of which leads us to maintain a neutral positioning on equities and remain negative on bonds.

Overall, our business cycle indicators show the economy continuing to recover from the pandemic. Notwithstanding concerns about short-term risks to European growth, largely related to fresh lockdowns and a new surge in Covid cases, we are more confident on how economic conditions are shaping up in the developed world.

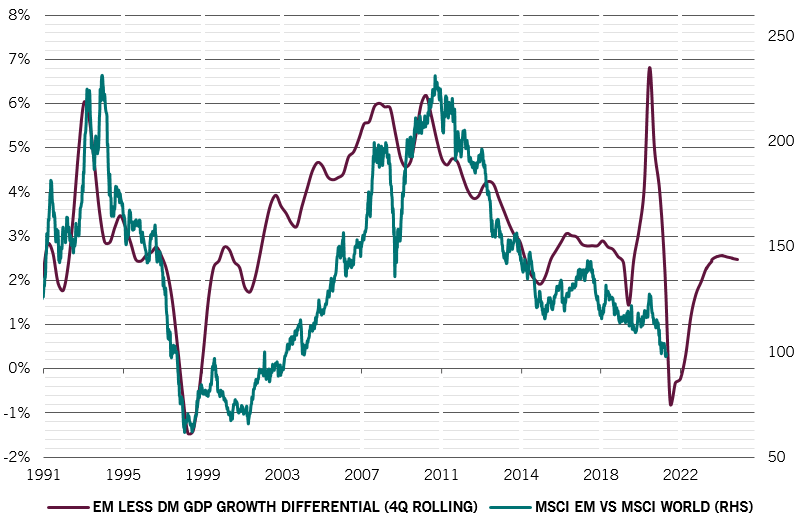

US growth can be expected to remain very strong in both real and nominal terms (see Fig. 2). Worldwide, we expect services industries to gain momentum. Under normal conditions, services sectors would typically follow the lead of manufacturing – which has shown some softening lately. However we believe the next phase of the recovery will be powered by services as the reopening of economies should remains by and large on track (albeit with the added uncertainty due to the spread of the Omnicron variant).

We forecast a sequential re-acceleration in growth through to the first half of 2022. The pace of global economic expansion should remain above-trend for the foreseeable future – our forecast of 4.8 per cent GDP growth next year remains above consensus.

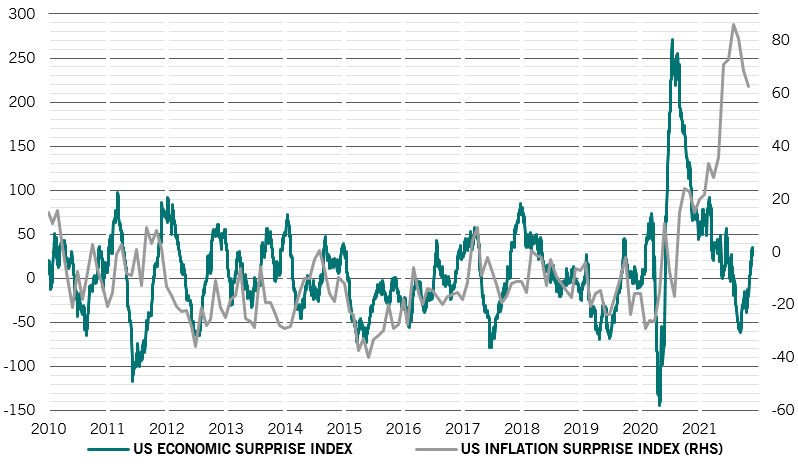

US economic surprise vs. inflation surprise indices

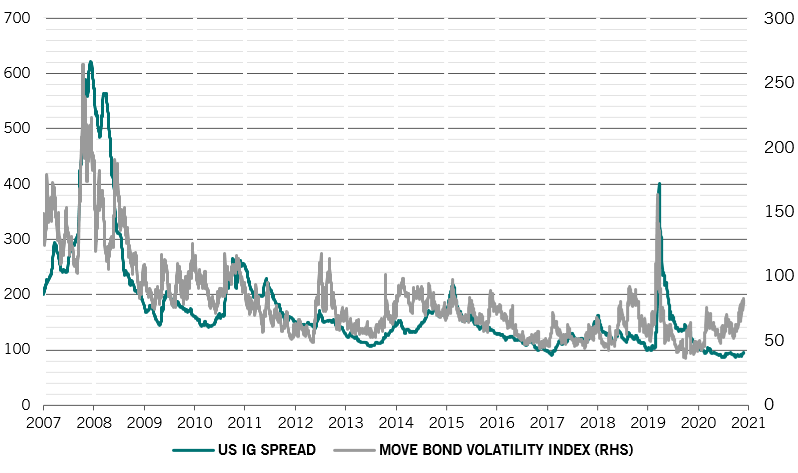

Our liquidity indicators show a significant contraction in credit supply this quarter, thanks to a sharp withdrawal of central bank stimulus. More positively, however, there are signs of credit supply growing in the private sector, particularly in the US, while the Chinese authorities are also starting to relax their stance.

The pickup in private borrowing has historically put upward pressure on interest rates, as it allows central banks to tighten even faster.

Our valuation indicators show that all major asset classes remain expensive by historical standards, with equities hovering at all-time highs. One exception is Latin America, whose equity markets are now cheap even in absolute terms. In relative terms, the UK is also good value.

US stocks are the most richly priced. And consumer discretionary stocks are beginning to look as expensive as technology shares. Meanwhile, cyclical stocks have outperformed their defensive counterparts as inflation expectations have increased; this has taken cyclical stocks’ premium over defensives back close to cycle highs of 16 per cent.

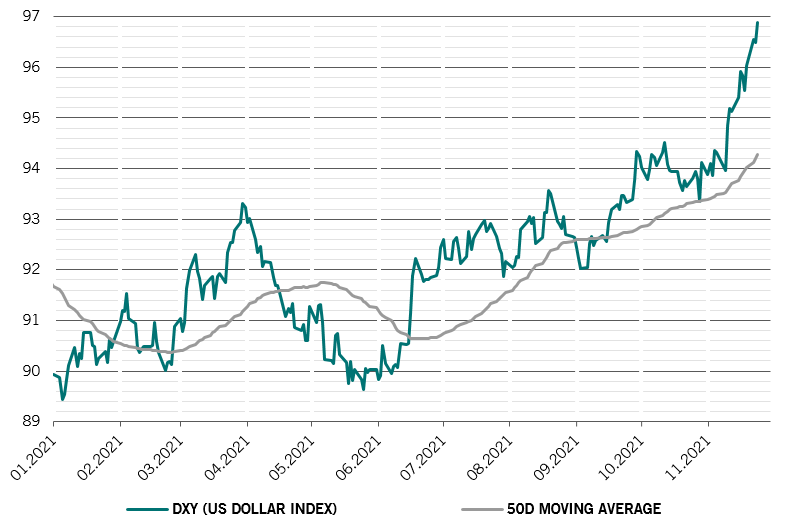

A decline in liquidity and upward pressure on real yields will reduce stocks’ price-earnings ratios, though about half the contraction we envisaged earlier this year has already occurred. Meanwhile, though the a surge in profit growth looks to be easing, we still expect corporate earnings to rise 16 per cent for the coming year.

Within fixed income, the signal on Chinese government bonds is neutral while US investment grade bonds appear expensive. Surging inflation has triggered a flight into US inflation-linked bonds, leaving them with yields below -1.0 per cent and the second most overbought asset class in our models.

Our technical indicators show that positive trends for global equities intensified, compensating for an absence of positive seasonal factors. Technical readings for bonds were negative although surveys show investor positioning in fixed income appears excessively bearish, which would normally be a ‘buy’ signal.