Biotech gears up for the pandemic battle

The coronavirus has shone a light on the biotechnology industry. But can biotech firms strike the decisive blow against the pandemic?

Drawing on an impressive arsenal of new technologies and data, the biotech industry is in the frontline in the battle against the coronavirus.

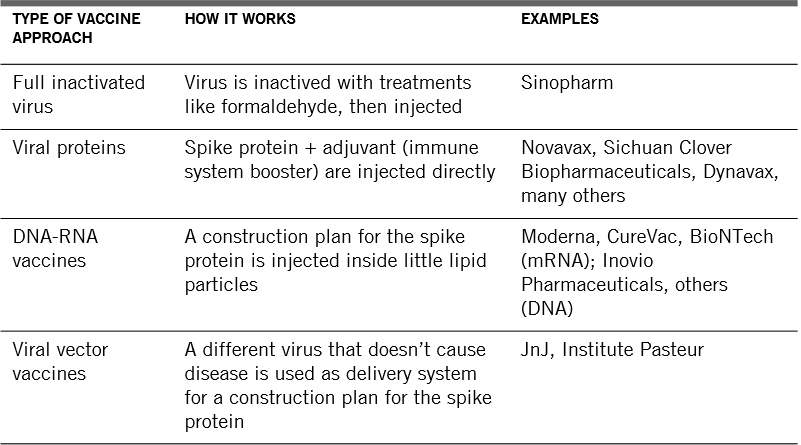

A vaccine would of course be the clearest route to victory. And here, there is some hope. Perhaps the most promising avenue for research is mRNA, in which the body is essentially used as a “bioreactor” to produce a vaccine. Under the process, cells are given the molecular template (messenger RNA) needed to build viral proteins. These proteins then serve as the trigger for the production of antibodies.

While mRNA is incredibly clever, it is also completely untested. The first hurdle is to create an antibody response that is powerful enough. This is what is currently being examined in a phase one study, which alone will take one year. More traditional vaccines may be developed more quickly, but even these could take at least 12 months.

A faster, if smaller scale, solution could come from therapeutics. Several biotechnology companies are working on creating lab-grown antibodies against the coronavirus. These antibodies are designed to be neutralisers, sticking to the surface of the virus like Velcro so that it cannot bind to cells and spread through the body. Once developed, these could then be given prophylactically to those most at risk. They could even be used to treat patients with the disease.

An alternative to creating antibodies is to harvest them from the blood plasma of people who have recovered from the coronavirus – a practice that met with some success during the SARS epidemic.

Targeting the virus and its consequences

Concurrently, scientists are developing or adapting a range of drugs to fight the pandemic. The immediate priority is antivirals, which stop or slow the replication of the virus in the body. One of the most advanced – in terms of development – is Gilead Science Inc’s Remdesivir* – an intravenous drug originally intended to combat Ebola, but which is now being trialled in early treatment of the coronavirus, with clinical test results due this month.

Tackling some of the more serious complications that occur during the later stages of the virus infection is another area of research.

If the disease is not caught early, or effectively fought off, the immune system can go into overdrive and start attacking the body. Suppressing this immune overreaction – by blocking the so-called IL-6 receptor – is the focus of drugs for treatment of the later stages of the disease, such as Regeneron Pharmaceuticals’ Kevzara.*

Risks and opportunities

All this is not to say the biotech industry can work at full capacity. It too is affected by efforts aimed at containing the pandemic. Conducting human clinical trials is much harder due to lockdowns, so many of these have been delayed. The commercialisation of new drugs has also slowed, as traditional face-to-face marketing is no longer possible. Production, meanwhile, is affected by the shuttering of factories and shortages of raw materials – some of the major manufacturing sites for ibuprofen, for example, are located in China’s Hubei province and Italy’s Lombardy region. Furthermore, the strain in financial markets will make it harder to raise new capital, which is particularly pertinent for younger, less established biotech companies.

Finally, even though coronavirus treatments will capture headlines and boost sentiment, the companies involved will feel obliged to keep pricing as low as possible, so they – rightly – will not be blockbusters for corporate profits.

As an investment, the biotech industry can be volatile – drugs can succeed or fail, patents can be granted or lost. However, the sector has historically held up well during times of market turbulence and recession (including during the global financial crisis in 2008-9). That’s because demand for medicine is not driven by economic cycles.

The Biotech strategy at Pictet AM focuses on high impact, essential therapies, using a proprietary scoring system that looks at each drug in terms of the severity of the disease it targets, its effectiveness, how affordable and accessible it is (including reimbursement by insurance policies) and the competitive position in terms of comparable drugs in existence or in development.

The portfolio includes companies which focus on the treatment of rare diseases, oncology and central nervous system problems, among others. In recent weeks, portfolio managers increased allocations to some large cap, profitable companies with ample cash buffers to weather the storm. However, we are also alert to new investment opportunities. As the 12-month price-to-earnings ratio shows, the sector is the cheapest it’s been in years both in nominal terms and relative to the wider market.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.