Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

China's radical experiment

China's attempts to boost lending are becoming bolder by the month.

China is throwing everything at its economic problems.

As weaker exports drag the country's growth to the slowest annual pace since 1990, the People’s Bank of China has implemented no fewer than 15 measures in the past four months alone to stabilise the economy. These include a series of reductions in banks’ reserve requirements, or the amount of cash that banks must hold as reserves against lending.

That’s still not enough, however. Credit is not quite flowing where it’s needed – Chinese lenders don’t have sufficient capital to lend to households and smaller companies - so the PBOC believes it needs another weapon.

This is why it has launched a new programme that will allow banks to issue a type of funding instrument popular in other countries – perpetual bonds. Such securities, which have no maturity date and rank lower in firm's capital structure than senior bonds, are a useful funding tool for banks as they count towards their non-core 1 tier capital, the gauge regulators use to measure a financial institution's health.

Through its Central bank Bills Swap (CBS) programme, the PBOC will allow primary dealers of perpetual bonds issued by banks to swap them for high-quality central bank bills. At the same time, perpetual bonds sold by banks with a rating equal or higher than AA will also become eligible collateral for the PBOC's broad suite of funding facilities.

It’s a bold move. While the PBOC is not quite engaging in quantitative easing, it is essentially re-capitalising the banking system by taking riskier subordinated debt onto its balance sheet.

Its calculation is that this should help unclog the credit transmission channel and spur lending in the private sector, which contributes more than 60 percent to national output.

Banks are sure to take up the PBOC's offer. A few days before the CBS programme was launched, the Bank of China, a state-owned commercial lender, announced plans to issue as much as RMB40 billion in perpetual bonds, the first of its kind issued by a Chinese bank.

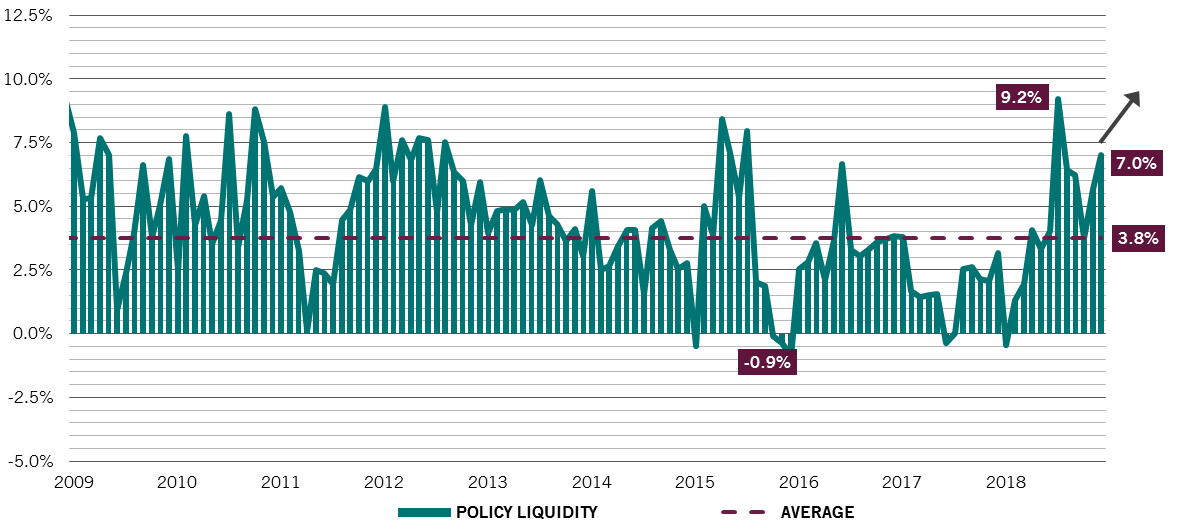

The sheer scale of the PBOC's stimulus could have a major bearing on the global economy. Tallying up its various monetary measures, including asset purchases and its regular open market operations, China now accounts for more than half of the liquidity being pumped into the global financial system, compared with less than fifth a decade ago.1 According to our calculations, the supply of liquidity from the PBOC will have reached a record high in January (see chart).

But we don’t think the central bank will stop here. At the very least, we expect the PBOC to cut banks’ reserve requirement ratios by a further 150-200 basis points this year.

If the Chinese backstop succeeds in arresting a domestic and global slowdown, the old investment adage of “Don’t fight the Fed” might have to be supplanted by “Don’t fight the PBOC”.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.