You are accessing the Individual investors website.

This content is only for the selected type of investor.

Institutional investors and consultants or Financial intermediaries?

Many managers talk about investing responsibly, but for us it has always been more than a tick-box exercise.

Since we launched our first sustainable strategy two decades ago, we’ve not only embedded it into how we invest, but in everything we do as a company.

Benefits of responsible investing

How to invest

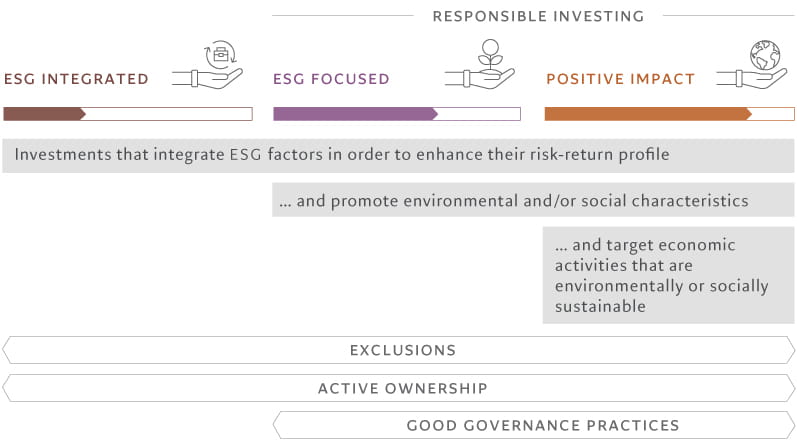

Integration of ESG factors and sustainability risk has become the norm in our investment processes.

Our ESG focused strategies promote environmental and/or social characteristics. For those investors aiming to achieve an impact, our positive impact strategies target economic activities that are environmentally and/or socially sustainable, such as providing solutions to climate change, energy transition or water scarcity.

ESG integrated is equivalent to an article 6 SFDR and may invest in securities with high sustainability risks. ESG focused is equivalent to an article 8 SFDR. Positive impact is equivalent to an article 8 or 9 SFDR.

SFDR: Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on Sustainability-related disclosures in the financial services sector.

Source: Pictet Asset Management, 31.12.2022.

What are the risks?

We believe that investing responsibly offers great potential for investors. There are risks however, and it’s therefore important to find an experienced manager to manage these.

Responsible investing strategies could invest in emerging markets, where investments can be higher risk and more volatile, or have investments denominated in a foreign currency meaning a change in exchange rates could affect their value.

Sustainability risks can also apply to some strategies. These are risks which arise from any environmental, social or governance events or conditions that, were they to occur, could cause a material negative impact on the value of the investment. Specific sustainability risks include but are not limited to climate transition risk, physical climate risk, environmental risk, social risk, governance risk.

Investments in fixed income may be subject to the default/credit risk of issuers, interest rate risk as bond prices move inversely to changes in interest rates, and liquidity risk. Investing in higher-yielding or non-investment grade bonds might mean the risk of the issuer defaulting on the capital repayment is higher.

Past performance is not a guide to future performance. The value and income of an investment can fall as well as rise and you may not get back the amount originally invested.

.jpg?w=800&hash=A762E63537733F0C4550DF27D87EBB16)

.jpg?w=800&hash=57E6B254DE9A32684096E8E9C4C55D4A)