Asset allocation: shifting to neutral on equities

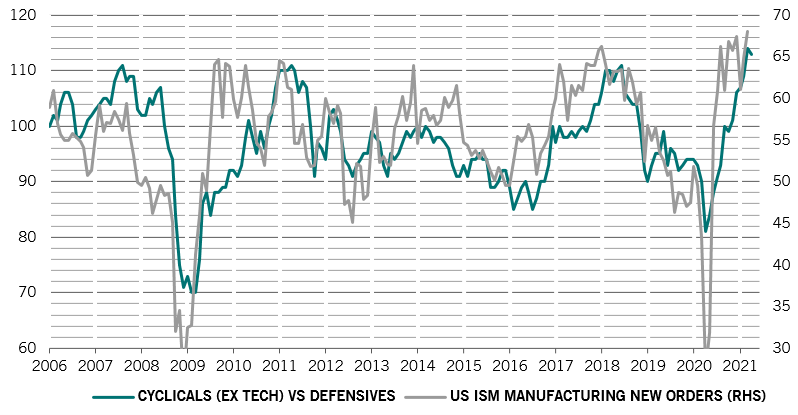

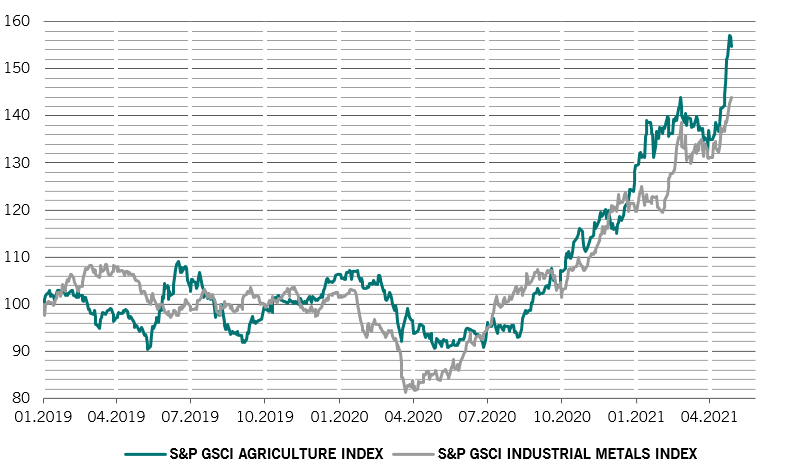

Just four months into 2021, global equity markets have already hit our targets for the year (returns of 10 per cent). That and tentative signs that economic and corporate earnings growth may be peaking has led us to take some profits. We therefore downgrade equities to neutral, and trim our exposure to cyclical stocks.

Our business cycle indicators suggest the global economy is recovering well from the pandemic, but growth momentum has slowed slightly. That’s particularly true in China, where weaker-than-expected first quarter data has prompted us to trim our 2021 GDP growth forecast there to 10.0 per cent from 10.5 per cent. This slowdown is partly due to a cooling in credit growth. China’s credit impulse, our own measure of credit flowing through the economy, has dropped off sharply since October is now broadly in-line with its long-term average of 6.5 per cent of GDP.1 This is in keeping with the view that China will stick to its promise of maintaining continuity and stability in economic policies.

In the euro zone, the recovery is not self-sustaining yet and is fully conditional on successful control of the pandemic, the vaccination campaign and on the persistence of accommodative monetary and fiscal policies. Economic activity in the US, meanwhile, continues to beat expectations – for now. We expect growth to peak in the current quarter, before slowing into the year-end as the fiscal boost starts to fade. Reinforcing our view, a New York Fed survey shows US households plan to spend just 25 per cent of the their stimulus cheques; 34 per cent of the cash will be used to pay down debt and the balance saved.

May 2021

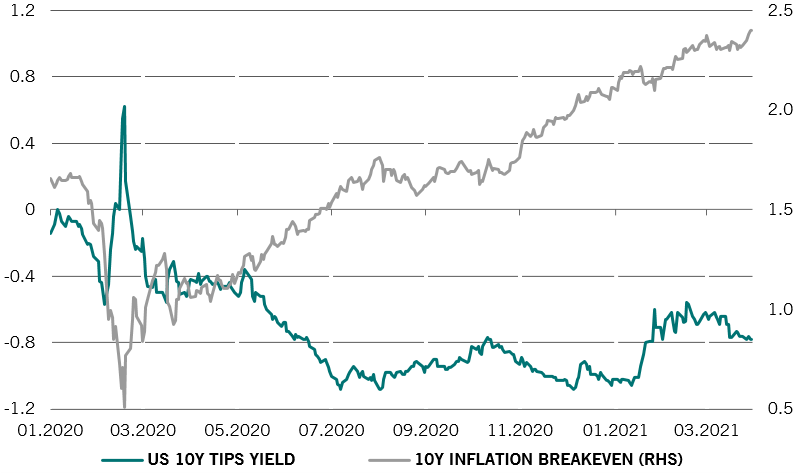

Globally, stocks’ earnings multiples should come under further pressure in the coming months as monetary stimulus fades. Any further upside for equities will thus have to come from corporate earnings growth. This could indeed continue to surprise on the upside for a while longer, but with investor positioning in – and sentiment towards – stocks already at very bullish levels, any positive market reaction to news of stronger profits is likely to be muted, while weaker-than-expected results could be severely punished.

Technical indicators suggest we are about to enter a three-month long period of negative seasonality for equities (the period running from May to July tends to be associated with weak stock market performance). While investment flows into equities remain strong, the momentum is slowing even if our indicators do not yet suggest stocks are 'overbought'. For bonds, the overall technical signal remains negative.